What a HUGE Day for NIA’s Top Silver Picks

Yesterday morning, NIA made something very clear: If cost were no object... and we could…

NIA Silver Stock Update: Highlander to Close on Bear Creek Next Week

It was just announced this morning that Bear Creek shareholders have overwhelmingly approved Highlander Silver…

OSS Gains 26.23% to $10.54, Up 387.96% Since NIA’s Suggestion

This morning, NIA sent out an alert about how its #1 overall stock suggestion for…

NevGold Soars, Lahontan Breakout, OSS Signs U.S. Navy Contract

NevGold (TSXV: NAU) gained 8.49% yesterday to $1.15 per share on huge volume of 3.11…

One of NIA’s Biggest Days Ever Is Ahead

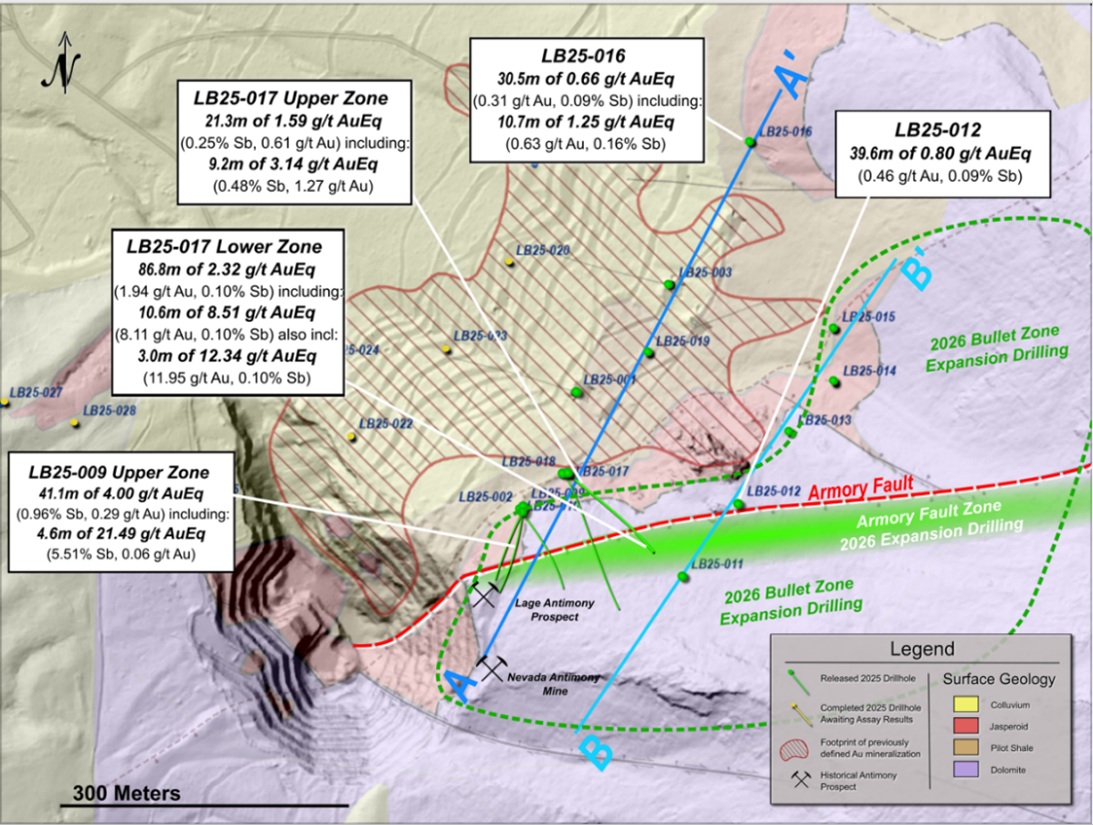

NevGold (TSXV: NAU) just announced this morning that it discovered a high-grade oxide gold-antimony “Armory…

NevGold Discovers High-Grade “Armory Fault”

NEVGOLD DRILLS 8.51 G/T OXIDE AUEQ OVER 10.6 METERS (8.11 G/T AU AND 0.10% ANTIMONY)…

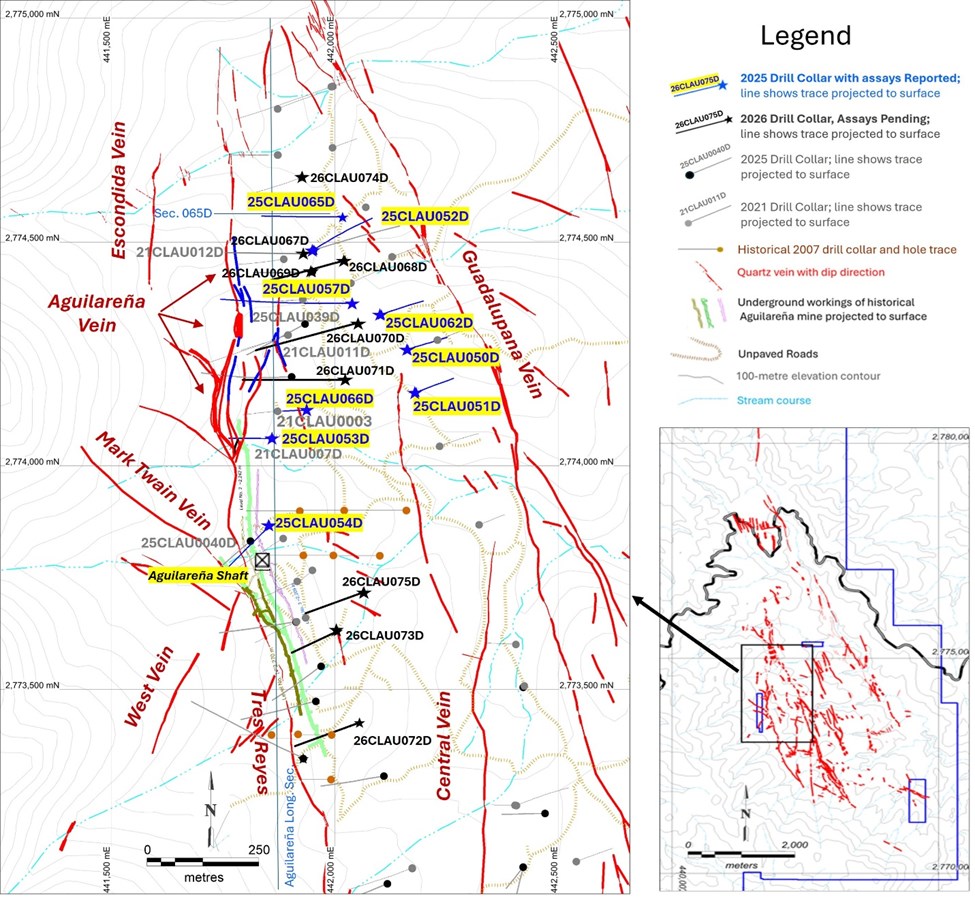

PSIL Delivers 2,074 g/t AgEq Intercept at Claudia

Pacifica Silver Reports Additional Drill Results at Claudia with Multiple High-Grade Silver-Gold Intercepts at the…

QIMC Drill Now Turning at West Advocate

QIMC Reports Diamond Drilling Underway at West Advocate Hydrogen Project, Nova Scotia Montreal, Quebec —…

NIA Warned About GSVR and GRSL One Week Ago

One week ago, NIA published an alert entitled, 'Vizsla Silver Smart to Diversify into Pacifica…

Pacifica Silver (CSE: PSIL) Could Be Best Opportunity in Market

Over the last ten years, the world's #1 largest gaining producing copper miner has been…