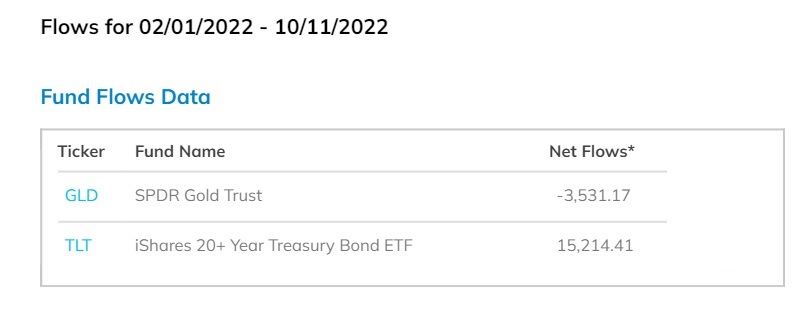

Since February 1st, the iShares 20 Plus Year Treasury Bond ETF (TLT) has seen a record $15.214 billion in inflows vs. SPDR Gold Trust (GLD) seeing $3.531 billion in outflows.

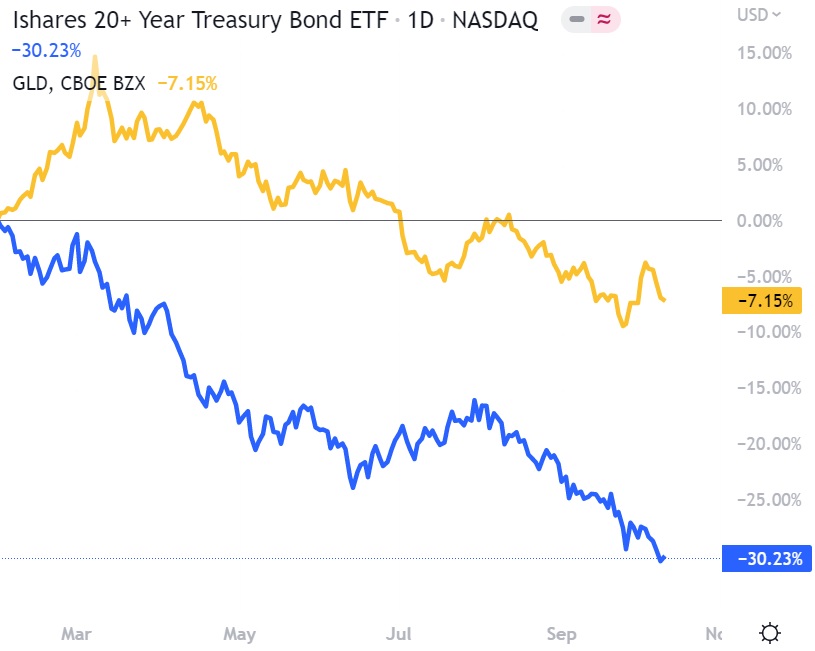

Investors who bought TLT believing that U.S. Treasuries are a better safe haven than gold made a major mistake!

TLT since February 1st has declined by 30.23% vs. GLD declining by only 7.15%.

Gold is up big during this time period when priced in the Euro, British Pound, Japanese Yen, Australian Dollar, and even the Canadian Dollar!

Gold has been outperforming nearly all other assets! The GLD/TLT ratio is fast approaching its all-time high!

Augusta Gold (TSX: G) will soon be trading in the $5-$10 per share range.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 174,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.