QIMC Sparks Massive 6,700-Claim Rush in Nova Scotia Hydrogen Corridor

NIA Commentary: QIMC has just triggered one of the largest staking rushes we’ve ever seen…

The Chart That Proved Bitcoin’s Peak

It genuinely makes us cringe every time we hear Michael Saylor encouraging his followers to…

Trio-Tech (TRT) Gains 10.14% to $8.47, Will Be #1 Largest Gaining AI Stock of 2026

NIA's #2 favorite overall stock suggestion for 2026, Trio-Tech International (TRT) gained by 10.14% today…

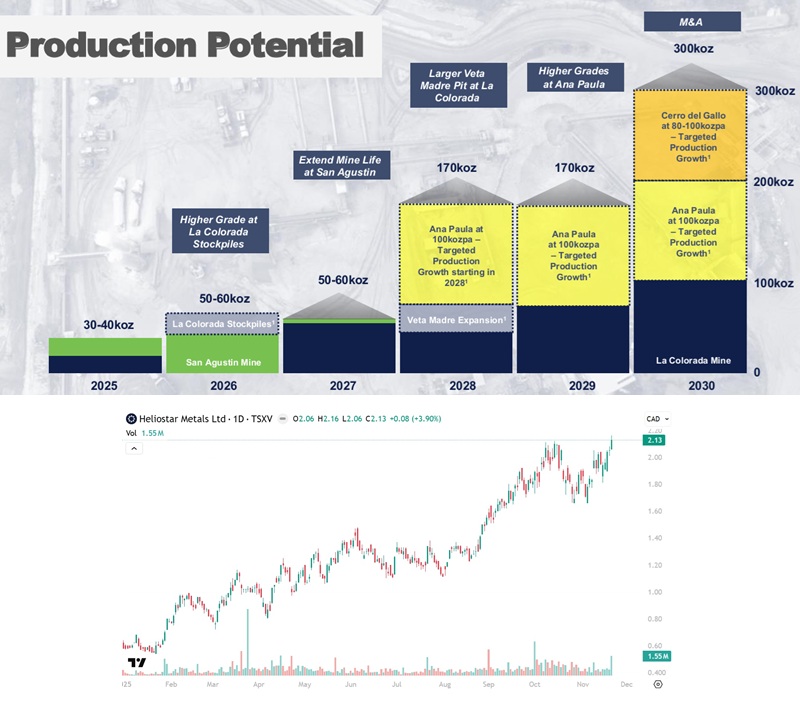

Heliostar Surges to New All-Time High as Q3 Cash Flow Jumps to $14.2M

Heliostar Metals (TSXV: HSTR) gained 3.90% today to a new all-time high of $2.13 per…

Important NIA Thursday Morning Update

NIA's #1 favorite overall stock suggestion for 2026, Titan Mining (TSX: TI), is expected to…

First Mining Secures Frank Giustra Partnership to Accelerate Cameron Gold Project

First Mining Announces New Partnership to Advance Cameron Gold Project VANCOUVER, BC, Nov. 20, 2025…

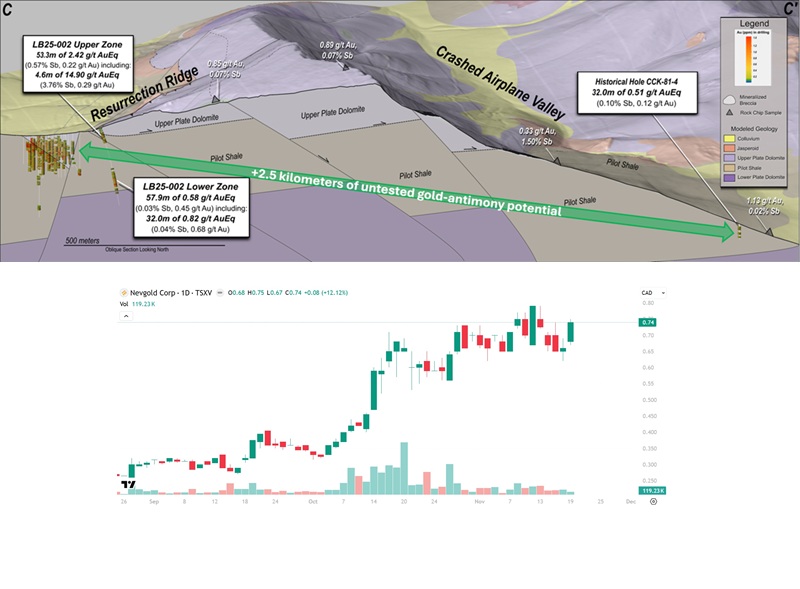

NevGold Gains 12.12% to $0.74: One of America’s Most Advanced Antimony/Gold Discoveries

NIA's second to latest brand-new stock suggestion NevGold (TSXV: NAU) gained by 12.12% today to…

Contango Launches Lucky Shot Underground Drill Program to Complete Feasibility Study

Contango Announces Start of Lucky Shot Underground Drill Program to Complete Feasibility Study Nov 19,…

NevGold Secures $10M as Perpetua Hits $4.2B: The Two Critical U.S. Antimony Companies

On November 2nd, NIA released one of our most important alerts of 2025: “Massive Antimony…

TRT: Fastest-Growing AI Stock at Lowest EV/Rev?

NIA’s #2 favorite overall stock suggestion for 2026, Trio-Tech International (TRT), gained by 6.04% today…