Most Silver Stocks Are Extremely Overvalued

Most silver stocks are extremely overvalued relative to gold stocks.

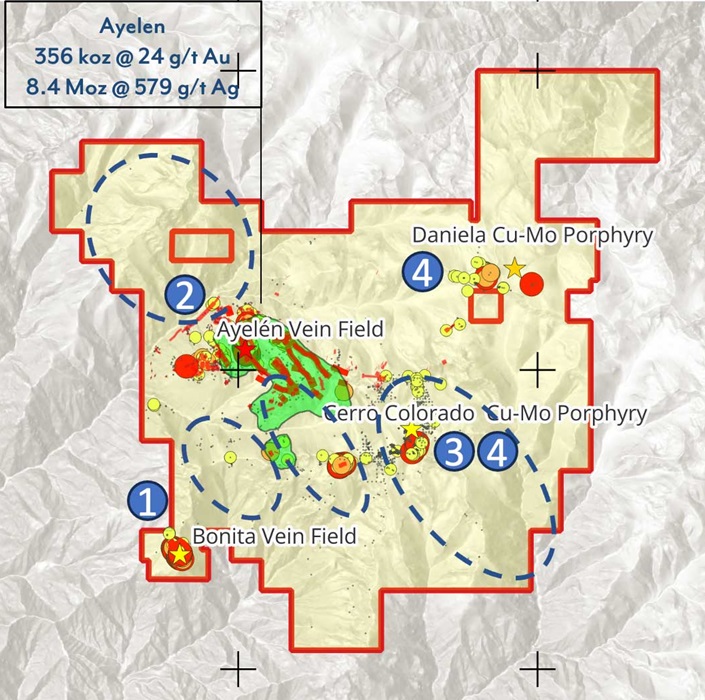

Highlander Silver (TSX: HSLV) we own because it is primarily a gold stock, not a silver stock… and it is perfectly positioned to rapidly rise up the left side of the Lassonde Curve for new bonanza grade discoveries. HSLV’s CEO Daniel Earle was previously the CEO of Solaris Resources (TSX: SLS) and took it up by 1,144% within 18 months of its mid-2020 listing.

Augusta Gold (TSX: G) dipped by 1.44% today because silver is breaking out, and HSLV is perceived as a silver stock so investors have FOMO and believe it will outperform G.

HSLV is the only stock we know of with a legit chance to go from a $300M market cap today up to a $3B market cap before year-end, but a $300M market cap is the highest market cap stock we have ever owned where no initial drilling results have been released yet. New Found Gold (TSXV: NFG) is in our opinion worth zero so if it has a $500M market cap it is a safe bet HSLV will easily surpass NFG’s market cap this month.

Please just keep in mind: expectations for Highlander Silver (TSX: HSLV) are very high vs. expectations for Augusta Gold (TSX: G) very low.

No matter what Augusta Gold (TSX: G) does next, even if AngloGold Ashanti (AU) doesn’t acquire G until a year from now… and even if the EXIM loan from Trump doesn’t close for several more months… literally ANY press releases from G that are more positive sounding than always the same thing of “debt being extended for five more months” will result in G rapidly rising to new all-time highs of above $3.60 per share.

Augusta Gold (TSX: G) is one of only a select handful of stocks that we wake up every morning feeling extremely excited about because we understand the value of their assets and how their management is the hardest working in the industry. The amount of knowledge Richard Warke has about literally EVERYTHING taking place in the industry means that if some type of acquisition opportunity comes across his desk… Augusta’s current assets that we think about 24/7 could actually become an afterthought similar to how we loved Discovery Silver (TSX: DSV)’s Mexican silver assets previously owned by NIA’s Levon Resources, but after Tony’s brilliant deal with Newmont where they stole some of Newmont’s best assets for pennies on the dollar… DSV is suddenly a $2.57B market cap company by simply doing a transaction and acquiring an Ontario gold mine (their Mexican silver assets are now small in comparison).

It is entirely possible that Augusta Gold (TSX: G) becomes a $3B+ market cap company within 6-12 months for reasons that are unpredictable today. Yes, we think Equinox will sell the Pan Mine and/or Castle Mountain Mine to G if Richard Warke wants to acquire them, similar to how DSV acquired Newmont’s Porcupine… but we don’t have enough knowledge to know if they are worth acquiring. Maybe Richard Warke has something MUCH BIGGER planned… like perhaps a gold mine that got shut down due to an environmental disaster and he was waiting for a government to finish cleaning it up before acquiring it? We won’t mention the gold mine by name except to say we know for a fact that its government wants a strong financial backer to become its new owner.

For HSLV there is a risk that they release strong initial drilling results averaging 5 g/t gold equivalent, but maybe the market expects to immediately see intercepts of 20-30 g/t gold equivalent. In this scenario, there is SERIOUS RISK of HSLV crashing by 10%-20% prior to its market cap rising to $500M-$1B.

Minaurum (TSXV: MGG) is the #1 best high-grade silver play, period, because it is fully permitted for production just like Augusta Gold (TSX: G)’s Reward Gold Project in Beatty, Nevada! MGG’s maiden resource estimate will be released next month. Silvercrest was just acquired for $1.7B and MGG has hired key executives who were on their management team to handle MGG’s resource estimate and imminent drilling program to rapidly expand its high-grade silver resource!

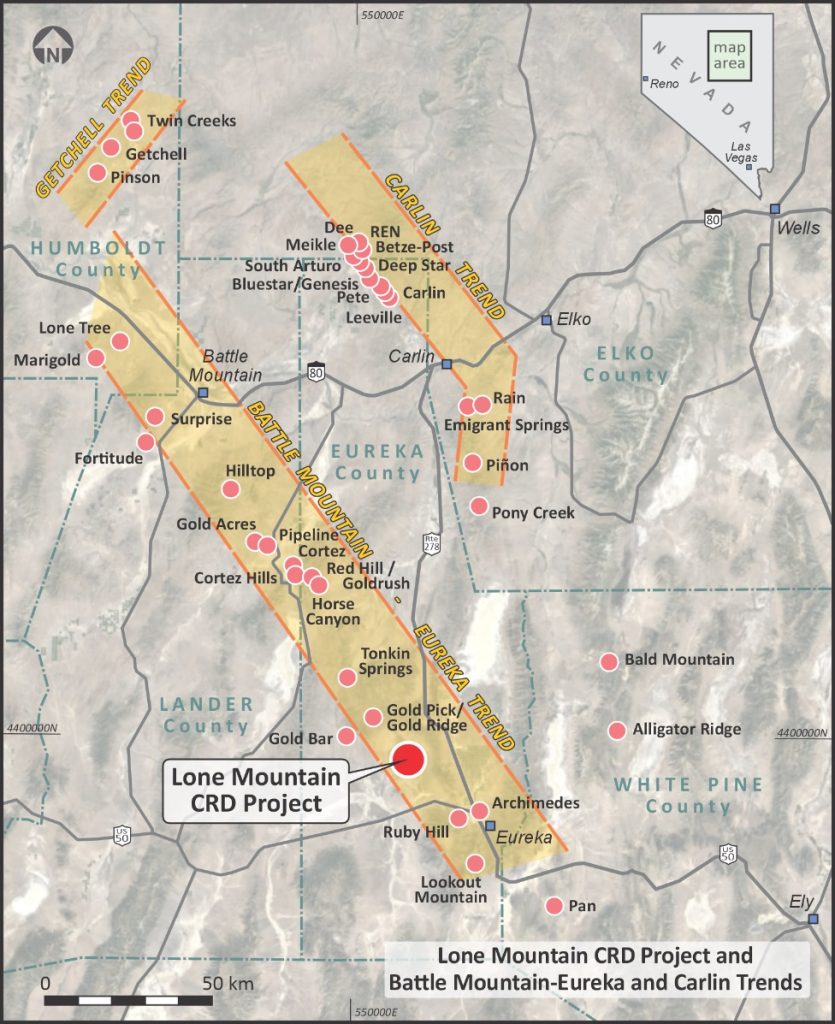

MGG is another stock that could eventually be worth $1B+ for reasons unrelated to their Alamos Silver Project. MGG’s latest brand-new acquisition of the Lone Mountain CRD Project is perhaps the most brilliant new acquisition any company has made in 2025!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 232,200 shares of G and may purchase more shares. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.