Viva Gold (TSXV: VAU) Already Up 26.47% in Four Days

On early Thursday morning at 9:29AM ET, NIA announced that its President purchased 100,000 shares of Viva Gold (TSXV: VAU) on Wednesday at $0.085 per share.

On Thursday, Viva Gold (TSXV: VAU) bounced by 5.88% to $0.09 per share on volume of 831,843 shares or 223% above its average daily volume!

On Friday, Viva Gold (TSXV: VAU) bounced by 11.11% to $0.10 per share on volume of 818,700 shares or 218% above its average daily volume!

On Monday, Viva Gold (TSXV: VAU) bounced by 5% to $0.105 per share on volume of 405,430 shares or 57.5% above its average daily volume!

On Tuesday, Viva Gold (TSXV: VAU) bounced by 2.38% to $0.1075 per share on volume of 723,140 shares or 181.12% above its average daily volume!

Viva Gold (TSXV: VAU) has so far bounced by 26.47% in four trading days! VAU has a 200-day moving average of $0.15 per share, which is its most important long-term key breakout point!

Viva's CEO James Hesketh is the executive who did the early work at the Reward Gold Project in the Beatty Gold District of Nevada over a decade prior to Augusta Gold (TSX: G) acquiring control of the property. He is the one who actually completed the permitting process for the Reward Gold Mine, which is why AngloGold Ashanti (AU) desperately needed to acquire NIA's Augusta Gold (TSX: G) at a massive premium!

From 2019 through 2025, VAU conducted seven private placements raising a total of $10,619,213 at prices ranging from $0.12 per share up to $0.30 per share with an average share issuance price of $0.17 per share or double the price where NIA's President purchased a small initial stake on Wednesday:

| Date / Period (Final Close) | Amount Raised (CAD) | Shares/Units Issued | Price per Unit (CAD) |

|---|---|---|---|

| Aug 6, 2019 | $1,018,650 | 3,395,502 | $0.30 |

| Dec 2019–Feb 2020 | $705,235 | 2,938,480 | $0.24 |

| May–Jun 2021 | $4,000,000 | 19,047,619 | $0.21 |

| Dec 21, 2023 | $1,399,567 | 11,663,061 | $0.12 |

| Jul 9, 2024 | $667,750 | 4,451,667 | $0.15 |

| Post–Jul 31, 2024 | $1,193,004 | 7,953,359 | $0.15 |

| Apr 3, 2025 | $1,635,007 | 12,576,974 | $0.13 |

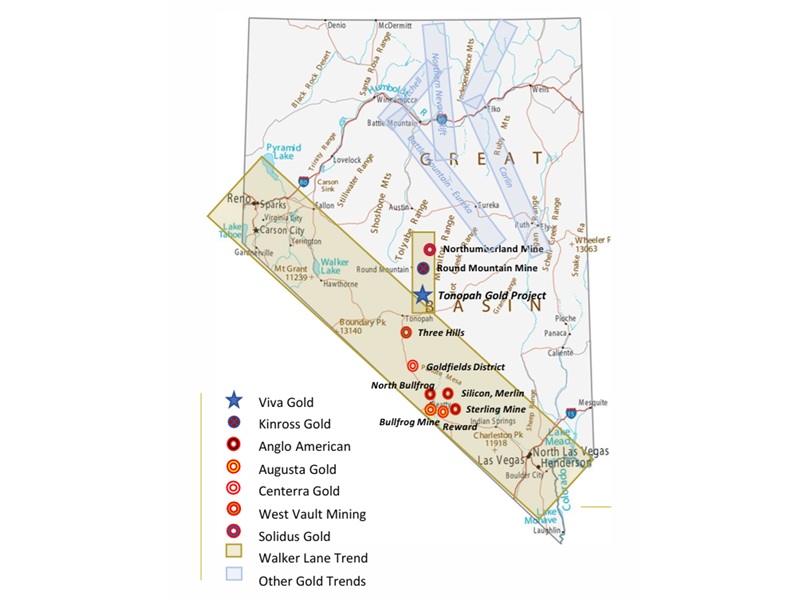

Viva Gold's Tonopah is located directly south of Kinross Gold (KGC)'s Round Mountain, which is Nevada's #1 largest producing gold mine not owned by Newmont/Barrick's Nevada Gold Mines! However, Round Mountain is running out of ore and no longer operating at full capacity! By 2030, Round Mountain's gold reserves will be depleted! Dundee Corporation (TSX: DC.A) the original seed investor behind KGC knows this and that is why they own 20% of Viva Gold (TSXV: VAU)!

Viva Gold's Tonopah is located directly north of Centerra Gold (TSX: CG)'s Goldfield Project. CG acquired Goldfield in 2022 at a cost of US$206.5 million and has spent US$45 million doing additional drilling over the last three years for a total investment of US$251.5 million. CG has established a gold resource at Goldfield of 794,000 oz measured & indicated grading 0.67 g/t plus 23,000 oz inferred grading 0.33 g/t for a total resource of 817,000 oz. CG has spent US$307.83 per oz of gold resources, which are spread between four open pit deposits on the property.

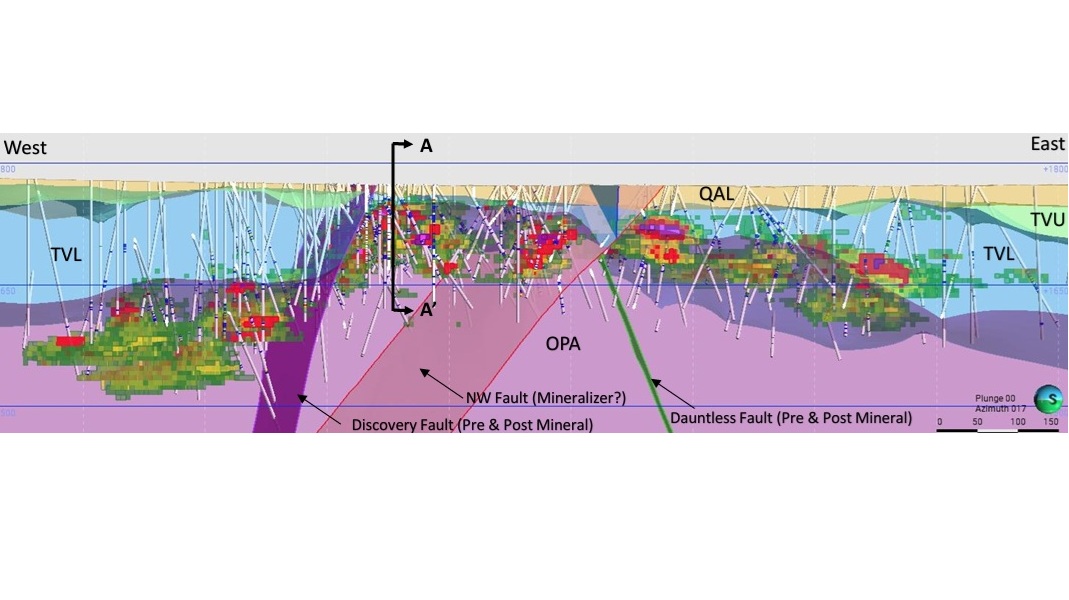

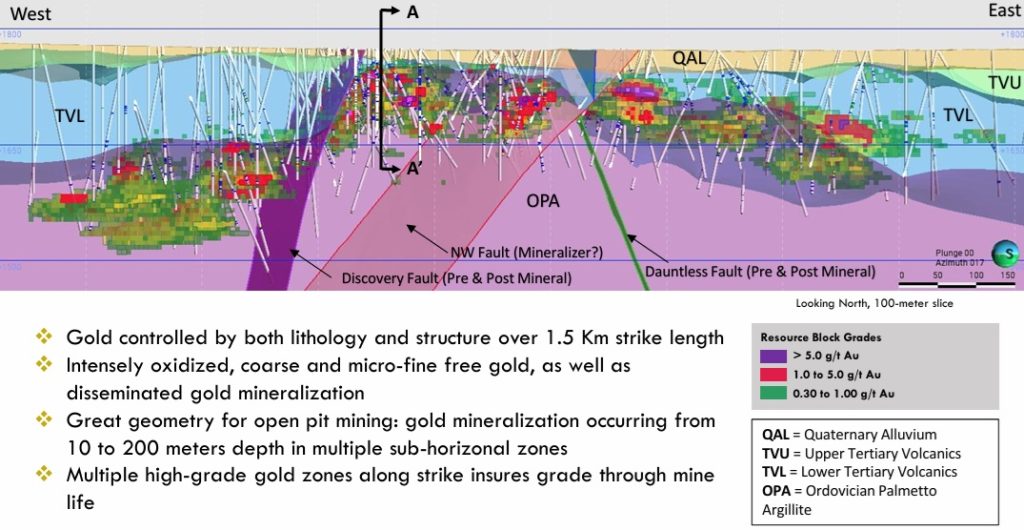

Viva Gold's Tonopah gold resources are in a single open pit deposit across a 1.5 km strike containing both near-surface oxide gold for low-cost heap leaching and high-grade sulfide gold!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 100,000 shares of VAU in the open market and can buy or sell shares at any time. This message is meant for informational and educational purposes only and does not provide investment advice.