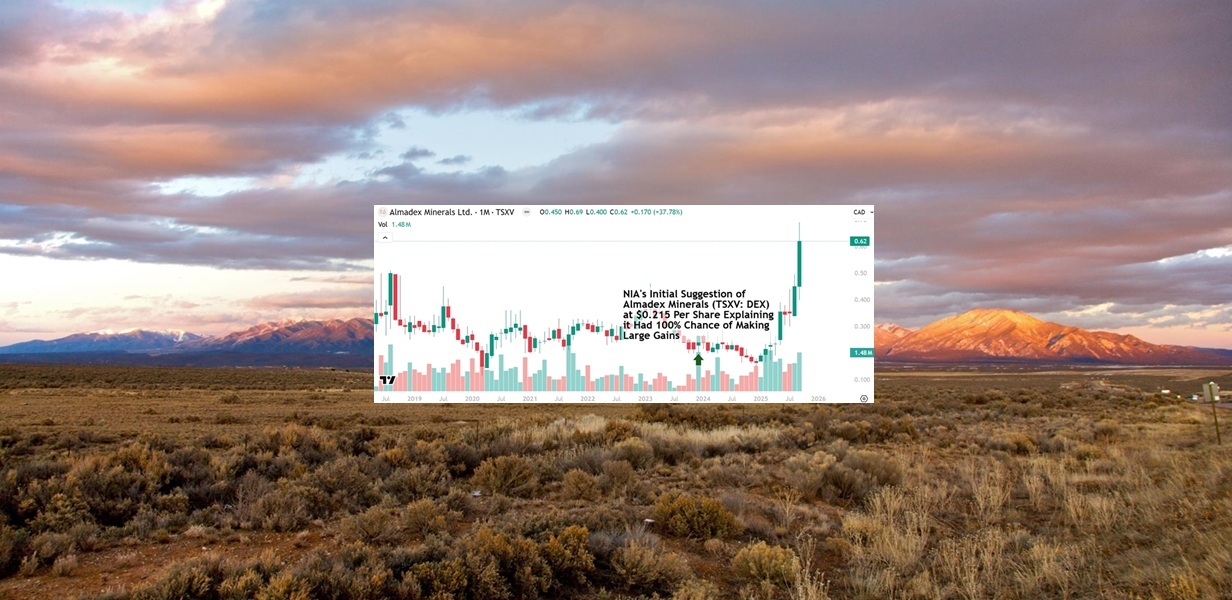

NIA’s 100% Sure Thing Winner Almadex (TSXV: DEX) Hit New All-Time High Last Week Up 220.93%

On December 19, 2023, NIA announced Almadex Minerals (TSXV: DEX) as its favorite brand-new stock suggestion at $0.215 per share explaining it was the only stock in the market besides Augusta Gold (TSX: G) that had a 100% chance of making large gains. DEX hit a new all-time high last week of $0.69 per share for a gain of 220.93% from NIA’s suggestion price and finished the week at $0.62 per share. Rick Rule who we highly respect also suggested DEX about a year after NIA.

Today, Contango ORE (CTGO) is definitely the safest gold miner in the market with the highest odds of becoming a huge winner from its current share price of $22.22 per share mainly because it will generate $300 million or more in free cash flow over the next three years, which exceeds its current market cap and enterprise value.

Discovery Silver (TSX: DSV) which made one of the most brilliant acquisitions we have ever seen of the Porcupine Complex in Ontario for US$425 million has a market cap right now of US$2.88 billion, but what is the point of owning DSV at this point? In Discovery’s first quarter of operating the Porcupine Complex post-acquisition they reported free cash flow of US$27.3 million. So, at this rate it will take 26.37 years of operations to cover DSV’s market cap?

If Newmont didn’t want Porcupine and was willing to sell it for US$425 million, what are the odds it is still operating in 26 years? Newmont did a PEA before selling it (not a feasibility study) and even the PEA said it will only operate for 22 years. If a feasibility study was done, maybe the mine life would only be 10 years.

Contango ORE (CTGO) doesn’t have a big-name investor like Eric Sprott behind the company, so it remains undiscovered… but CTGO’s CEO Rick Van Nieuwenhuyse previously founded NovaGold (NG) and discovered Donlin, and NovaGold’s largest shareholder is billionaire John Paulson who recently purchased a 40% direct stake in Donlin in addition to becoming NG’s largest shareholder (NG owns 60% of Donlin). On an overall basis (directly and indirectly through NG), billionaire John Paulson owns the majority of Donlin, which was discovered by CTGO’s CEO Rick Van Nieuwenhuyse and is the largest undeveloped gold project in the United States that has a realistic chance of future development… although Donlin’s initial CAPEX is extremely high. If John Paulson is successful on this bet, he is likely to profit many billions.

We believe CTGO is the bigger opportunity because it is already generating massive free cash flow today and won’t have any dilution. In 2020 during the last mini gold boom, CTGO’s Johnson Tract development project was owned by a company HighGold Mining, which soared from $0.57 up to $3.14 for a gain of 450.87% in six months:

CTGO with impeccable timing… swooped in and acquired HighGold Mining in July 2024 for $0.52 per share. At HighGold’s September 2020 high the company was worth C$185.422 million or US$139.1 million. With gold hitting much higher new all-time highs since then we are sure if CTGO didn’t acquire HighGold near its all-time low, HighGold would be worth at least US$200 million today, but if we use the US$139.1 million figure to value Johnson Tract and subtract it from CTGO’s enterprise value of $275.85 million, CTGO’s stake in Manh Choh one of the world’s highest grade open pit gold mines is currently being valued at only $136.75 million or 1.3675x CTGO’s estimated 2025 full year free cash flow of US$100 million.

QuestCorp Mining (CSE: QQQ) if it makes a CRD intercept at any one of its four targets at La Union could become our largest gainer of 2025, but it is also the riskiest stock we have suggested in years, so it also has a chance of becoming our only loser of the year. From last week’s description of what they found at the first two targets our confidence in QQQ has gone way up, but nobody knows anything until the assay results are announced later this year.

North Peak Resources (TSXV: NPR) is another low market cap, high risk stock with potential for huge upside… with an amazing CRD project that is similar to QQQ, and NPR already achieved high-grade gold intercepts at the Prospect Mountain Mine Complex last year when nobody was paying attention. This caused NPR to complete the full acquisition of 100% of the Prospect Mountain Mine Complex.

NPR’s Executive Chairman Harry Dobson is equally as successful as Frank Giustra, but Dobson is low profile preferring to race his horses vs. Giustra being high profile with his donations to the Clinton Foundation. There is absolutely no premium priced into NPR like you see with Frank Giustra’s Argenta Silver (TSXV: AGAG) a stock that will gap up again tomorrow followed by another collapse in the days that follow. If all of the hype for gold and silver suddenly went away (we are very early in the bull market, but we always think in terms of a worst-case scenario) it is unlikely to matter for NPR, which initially gained by 800% within one year of NIA’s March 2021 suggestion during a bear market for gold stocks. AGAG needs a hyped-up bull market just to avoid crashing by 80%.

Barrick could have owned 70% of AGAG’s only silver project El Quevar if they only spent $4 million more on the property, but they gave it back to Golden Minerals (AUMN) last year after determining the poor recoveries would make El Quevar uneconomical. AGAG only had to pay $3.5 million to AUMN for 100% ownership of El Quevar and didn’t even need to issue a royalty because AUMN knew the property was practically worthless. If Barrick determined El Quevar wasn’t even worth $4 million, what are the odds of anybody acquiring AGAG in the future for above its current market cap? Zero.

NIA is extremely confident silver will soon rise to $70-$100 per oz and $50 per oz will become its new long-term support level and if so Minaurum Gold (TSXV: MGG) has the only new fully permitted high-grade polymetallic silver project in all of Mexico along with a large portfolio of non-core projects that could be spun-off in the future such as J David Lowell’s Santa Marta and the Lone Mountain CRD Project located in close proximity to North Peak Resources (TSXV: NPR)’s Prospect Mountain Mine Complex one of the highest grade new gold discoveries in all of Nevada.

MGG has the same type of high-grade polymetallic silver vein system that the majors have recently been spending billions to acquire. Research Coeur’s newly acquired Las Chispas and First Majestic’s newly acquired Los Gatos and compare them both to MGG’s Alamos Silver Project. MGG co-founder Dr. Peter Megaw previously discovered Mexico’s Juanicipio silver project and founded MAG Silver, which was just acquired by Pan American Silver for $2.1 billion.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from QQQ of US$30,000 cash for a three-month marketing contract. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.