Why NIA Is Very Concerned About Gold Mining Stocks

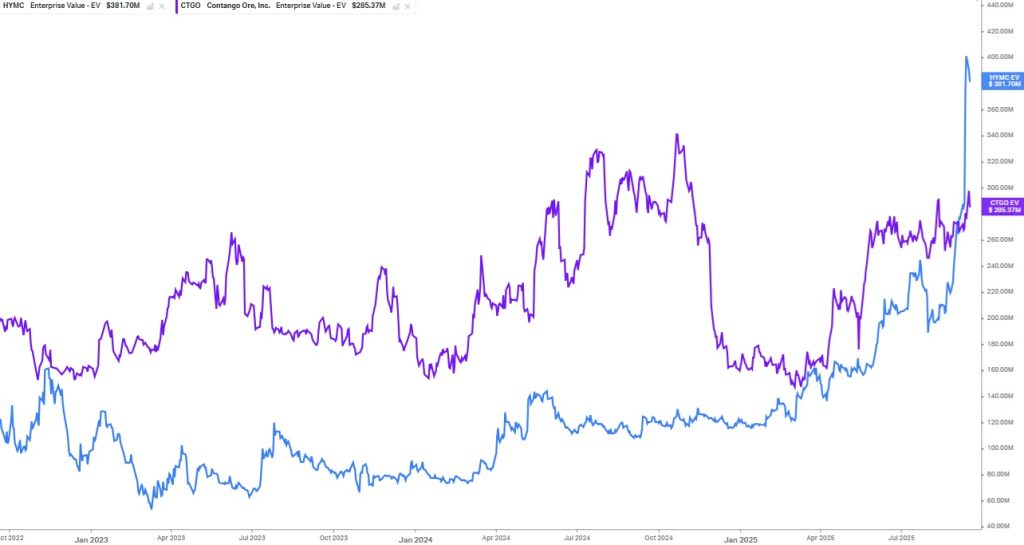

Here is a good example of why NIA is very concerned about gold mining stocks. Probably the worst managed gold miner of all is Hycroft Mining (HYMC) the company Eric Sprott brilliantly tricked AMC CEO Adam Aron into investing $27.9 million into in March 2022. In 2023, HYMC had an enterprise value of $53.19 million. Today, HYMC is suddenly worth $381.7 million and has surpassed Contango ORE (CTGO)'s enterprise value of $285.37 million:

CTGO's CEO Rick Van Nieuwenhuyse previously founded NovaGold (NG) and as CEO built its market cap from $7 million in 1999 up to $4 billion in 2010, using cash flow from sand and gravel sales to acquire the Donlin Creek and Galore Creek projects and then discovering a 40-million-ounce gold deposit at Donlin, while simultaneously establishing Galore Creek as one of the largest undeveloped copper–gold–silver porphyry deposits in the world (today owned by a 50/50 JV between Newmont/Teck Resources), and also doing a spin-off to NG shareholders of Trilogy Metals (TMQ) a company that he led as CEO until 2019 when he stepped down to allow Jim Gowans who was CEO of NIA's largest gaining silver stock in history Arizona Mining to takeover for the purpose of establishing a joint venture with South32 the same company that acquired Arizona Mining for $2.1 billion or 1,576% above NIA's suggestion price. South32 was later granted FAST-41 status for expedited permitting of the Hermosa Project/Taylor Deposit, which is now being developed. CTGO's Johnson Tract is the only critical metals mining project in Alaska ready for permitting and may be considered for FAST-41 priority permitting!

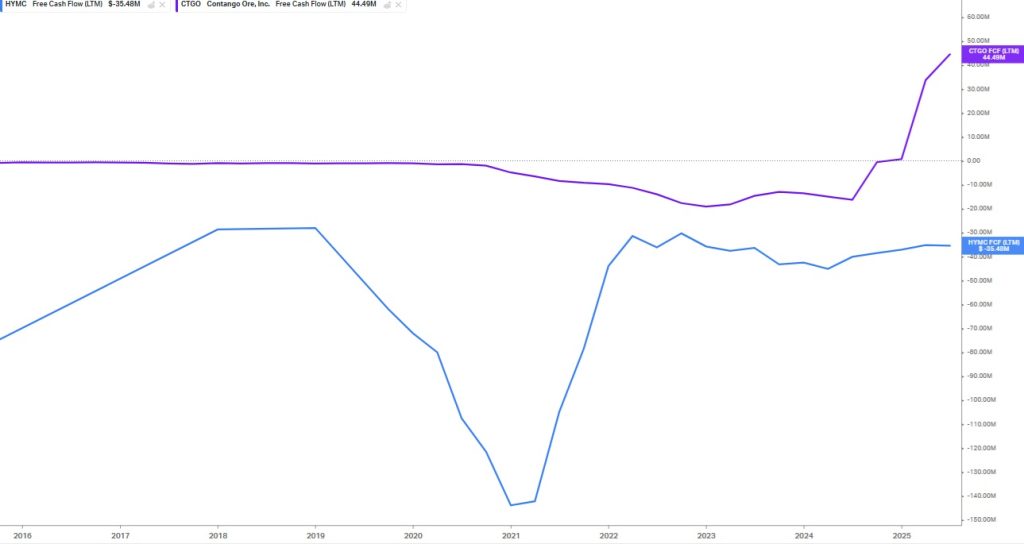

CTGO's CEO is the most experienced and successful in all of Alaska, but regardless… take a look at the trailing twelve-month free cash flow of HYMC vs. CTGO:

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.