Will NIA Regret Not Making Total Metals (TSXV: TT) #1 Overall Pick for 2026?

Exactly one week ago, NIA sent out an alert (click here to read) saying, "As of this moment we would probably make Titan Mining (TSX: TI) our #1 top pick for 2026, but maybe we will find something better before year-end. Titan is the stock with the highest potential for a rerating to a significantly higher enterprise value/revenue multiple especially after Titan lists on the NYSE American exchange where UAMY is traded."

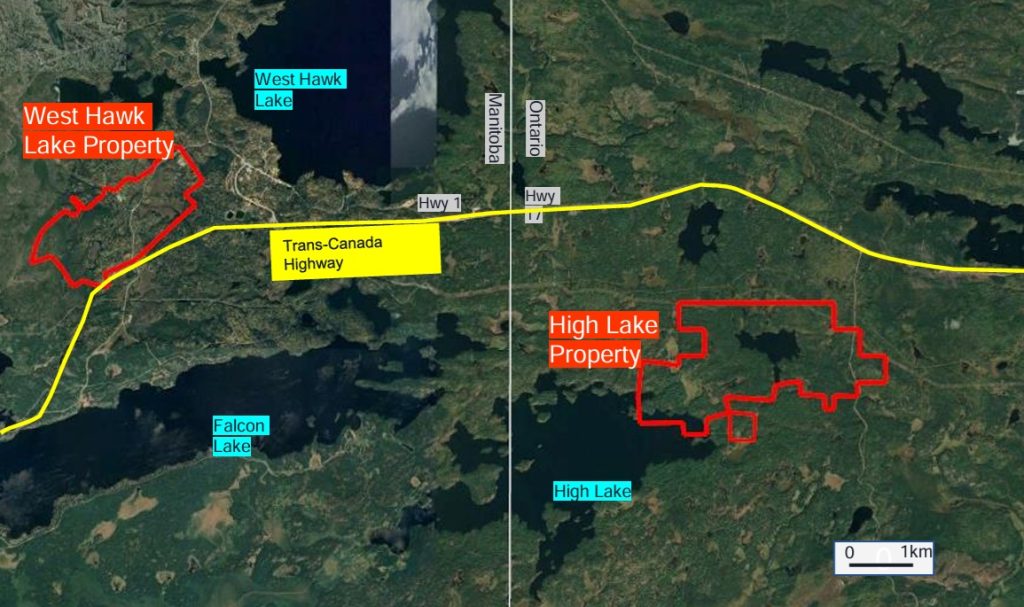

Obviously, when we said find something better, we already knew about Total Metals (TSXV: TT) and that was the company on our minds where it could be the only bigger opportunity mainly because it's a brand-new ground floor situation with only 29.7 million shares outstanding and about to acquire two of the highest grade gold projects in all of Canada, both adjacent to each other on opposite sides of the Manitoba/Ontario border. The average American has no idea Manitoba even exists, let alone that it hosts high-grade gold deposits like West Hawk Lake.

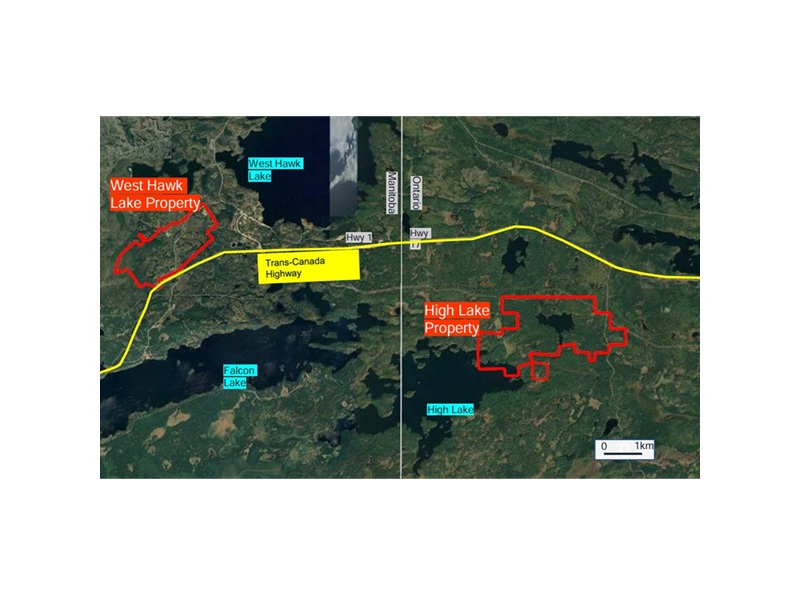

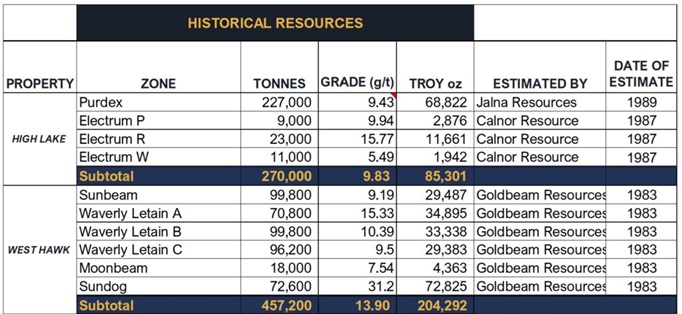

At least with Saskatchewan, the average American knows that Brock Lesnar lives there, and it has uranium mines, but for Manitoba… Americans know nothing about it. Think about the synergies if both High Lake and West Hawk Lake were to be developed together… they are both located right off of the Trans-Canada Highway!

The geological continuity between High Lake and West Hawk Lake, located approximately 10 kilometers apart, suggests they may be part of a larger mineralizing system. This proximity creates potential synergies for development, including the possibility of a centralized processing facility that could service both high-grade gold properties, thereby improving project economics through shared infrastructure and operational costs. The geological similarities between the properties also suggest that exploration techniques and understanding developed at one property could be directly applicable to the other, creating operational efficiencies and reducing exploration risk.

The High Lake and West Hawk Lake projects have consistently delivered some of the highest-grade gold intersections reported in recent Canadian exploration, placing them among the elite tier of global gold discoveries. The exceptional grades encountered at these properties significantly exceed industry benchmarks for both open-pit and underground mining scenarios, creating compelling economics even in challenging market conditions… but we are in the early innings of the most epic gold secular bull market in history, and it will last for equally as long as the recent technology bull market!

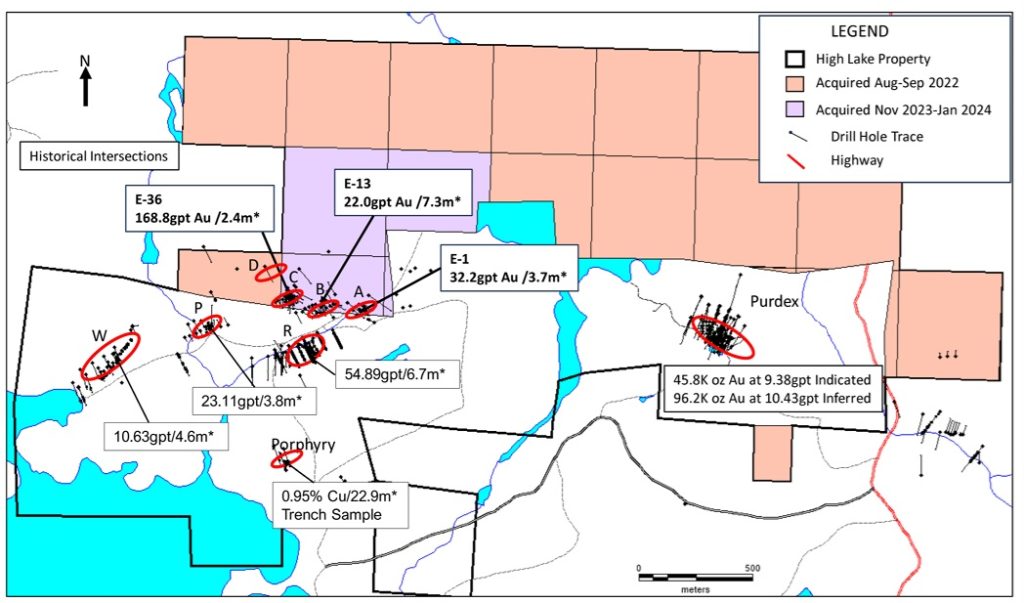

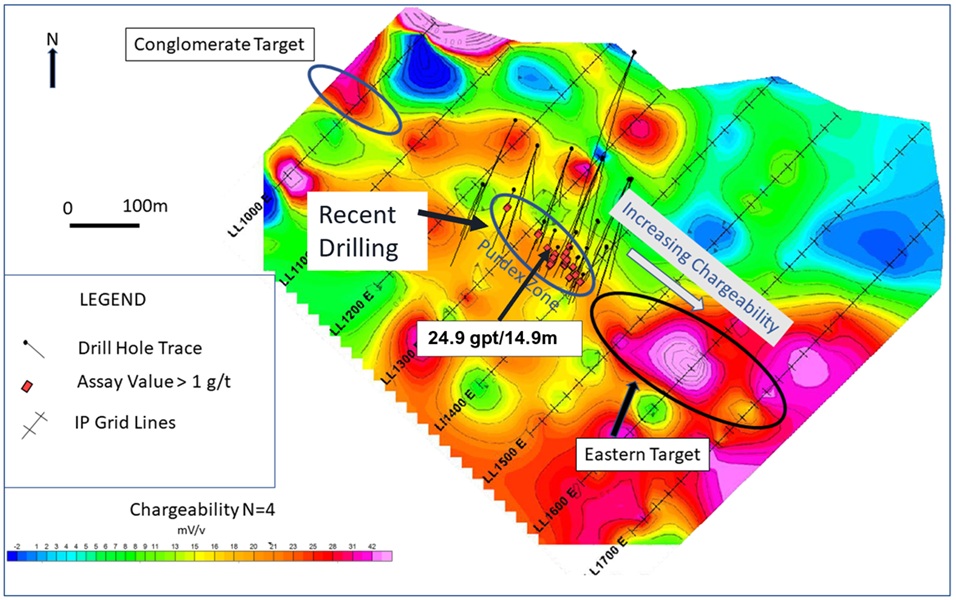

The discovery of near-surface high-grade mineralization at High Lake represents a particularly significant development for the project’s economics. A high-grade gold pod within 20 to 30 meters of surface has been identified, which opens the potential for a sizable bulk sample using low-cost open-pit mining methods. This near-surface mineralization, including intersections of 9.82 g/t gold over 9.75 meters within 20 meters from surface, creates opportunities for early revenue generation through low-cost extraction methods.

Unlike $834 million market cap New Found Gold (TSXV: NFG), which has poor geological continuity… the consistency of high-grade results at High Lake is particularly noteworthy, with multiple drill holes returning grades exceeding 10 g/t gold over significant widths. Recent highlights include intersections of 13.52 g/t gold over 6.5 meters at 229 meters from surface, 6.14 g/t gold over 24.55 meters within 15 meters from surface, and 9.2 g/t gold over 26.4 meters from 280 meters downhole. These results demonstrate that high-grade mineralization extends from surface to depth and maintains consistent grades throughout the deposit, a characteristic that significantly enhances mining economics and operational flexibility.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from TT of US$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.