NIA Gold Bull Investors Up 211.55% on BOGO, How Much Upside Remains?

Borealis Mining (TSXV: BOGO) closed Friday at a new all-time high of $1.34 per share which for investors in NIA’s Gold Bull Resources (acquired by BOGO) who received 0.93x BOGO shares is equivalent to $1.2462 per share for a gain of 211.55% since NIA’s Gold Bull Resources suggestion at $0.40 per share.

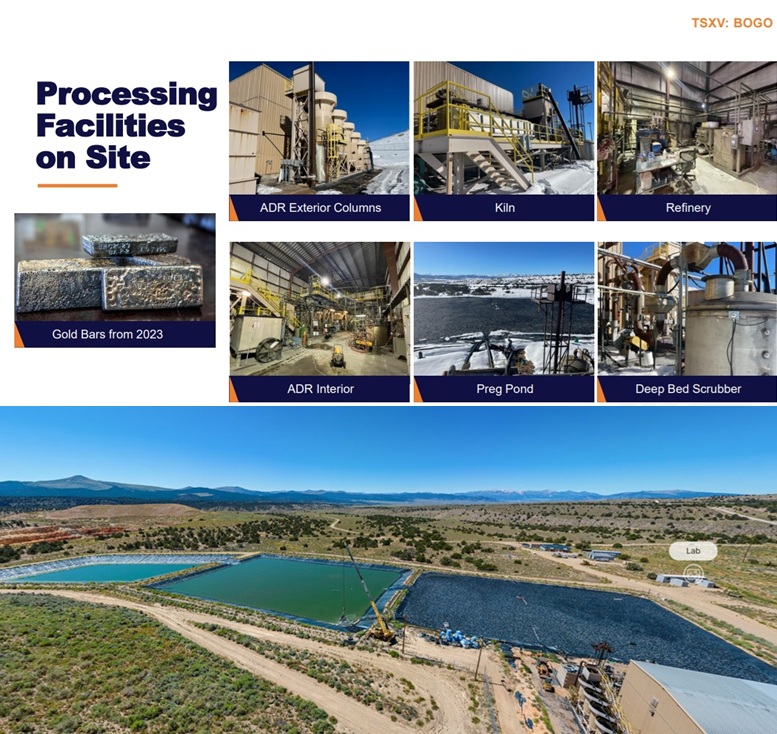

Gold Bull Resources had a market cap of CAD$4 million when we suggested it and would easily be worth CAD$40 million today and BOGO’s existing infrastructure at the Borealis mine is worth an estimated CAD$125.25 million based on the initial CAPEX to construct Augusta Gold’s Reward Gold Project in their feasibility study.

We know BOGO has a historical non-43-101 resource of approximately 2 million oz but most of it is contained in the Graben sulfide deposit. We don’t know how much oxide gold still exists at the Borealis mine, but they have intercepted significant oxide gold in multiple drill holes.

Click here for our Borealis Mining (TSXV: BOGO) report.

BOGO seems undervalued at a CAD$154.636 million market cap but does it have as much upside as Total Metals (TSXV: TT)?

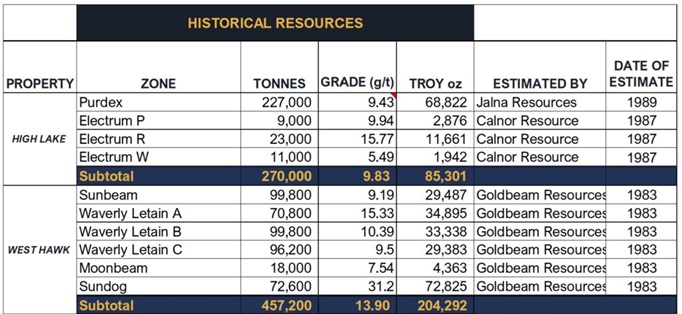

When Total Metals (TSXV: TT) completes its acquisition of the High Lake and West Hawk Lake gold projects it will have approximately 49.7 million shares outstanding and about $4 million in cash leftover to start work on their flagship polymetallic copper, zinc, gold, silver Electrolode project. At its current price of $0.92 per share we are talking about a market cap of only CAD$45.72 million or USD$32.79 million when Total Metals is going to own two of the highest-grade gold projects in all of Canada.

Click here for our mini report on Total Metals we will have a full report published post-acquisition.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA previously received compensation from BOGO of US$100,000 cash for a twelve-month marketing contract which has expired but NIA could receive additional compensation for additional contracts in the future. NIA has received compensation from TT of US$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.