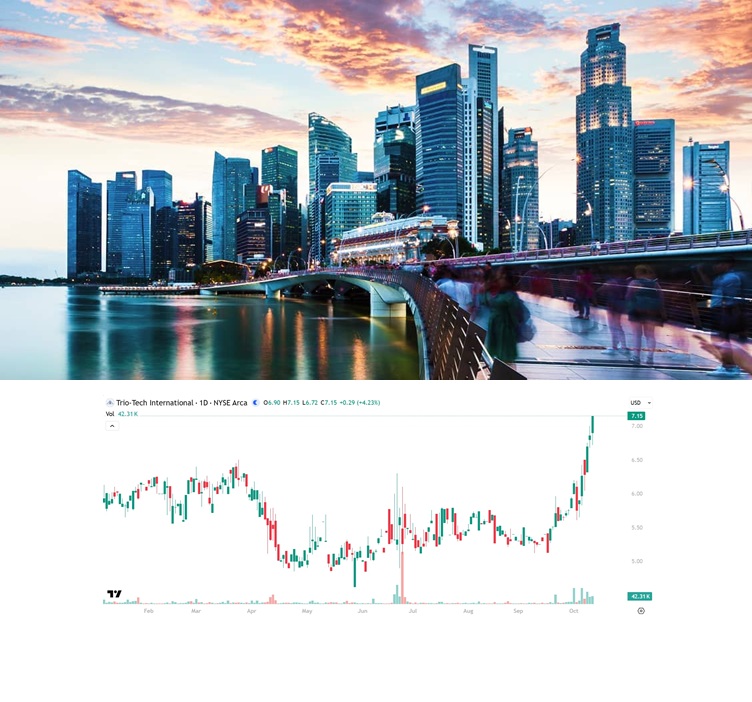

Trio-Tech International (TRT) Gains 4.23% to New 2025 High of $7.15!

Trio-Tech International (TRT) gained by 4.23% today to a new 2025 high of $7.15 per share. TRT is already up by 19.17% since NIA's Monday afternoon suggestion at $6 per share.

We already know that AMD is "Customer A" the second largest AI GPU company after Nvidia (NVDA). If the S&P 500 or NASDAQ were to collapse, there is a chance it could take Bitcoin down with it and gold is high enough now where it could also dip temporarily. Trio-Tech International (TRT) rises big under all scenarios!

Historically, when the U.S. dollar weakens as it has over the last twelve months, U.S. technology companies see their growth disappear and all of the growth moves to Asia. When Asian stocks were last in play between July 2005 and July 2007, TRT gained by 589.42% from $3.59 per share up to $24.75 per share. Similar to how VanEck Gold Miners ETF (GDX) has blown past its 2011 highs we expect Trio-Tech International (TRT) to blow past its July 2007 high of $24.75 per share.

The rally for foreign stocks in countries like Singapore, Malaysia, Thailand, etc… where Trio-Tech International (TRT) is positioned favorably hasn't yet begun.

TRT with its tiny float means when it finally gets discovered it could run to $50 per share extremely fast.

But even if we are wrong… it is almost guaranteed that TRT will rise to an enterprise value of at least 1x revenue in an absolute worst-case scenario, which would equal $12.97 per share. If it gets to 1x revenue or $12.97 per share it would have surpassed its key breakout point of $11.70 per share and by then everybody will be jumping into the momentum and driving it to new all-time highs of above $25 per share and then maybe it becomes a bubble and goes to $50-$100 per share.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.