Massive Antimony Re-Rating Potential: NevGold (TSXV: NAU)

Massive Antimony Re-Rating Potential: NevGold (TSXV: NAU)

In recent months, Nova Minerals (NVA) became one of the most talked-about critical-minerals stocks in North America after reporting a series of high-grade surface rock samples containing up to 54.1% antimony (Sb) from its early-stage projects in Alaska. Despite not yet drilling a single hole for antimony or publishing a compliant resource, NVA shares exploded by as much as 1,771%—surging from $0.87 in August 2024 to a high of $16.28 in October 2025. That rally briefly pushed Nova to a market capitalization exceeding US$457 million, entirely on the strength of surface samples and the narrative of future government-backed antimony production in the United States.

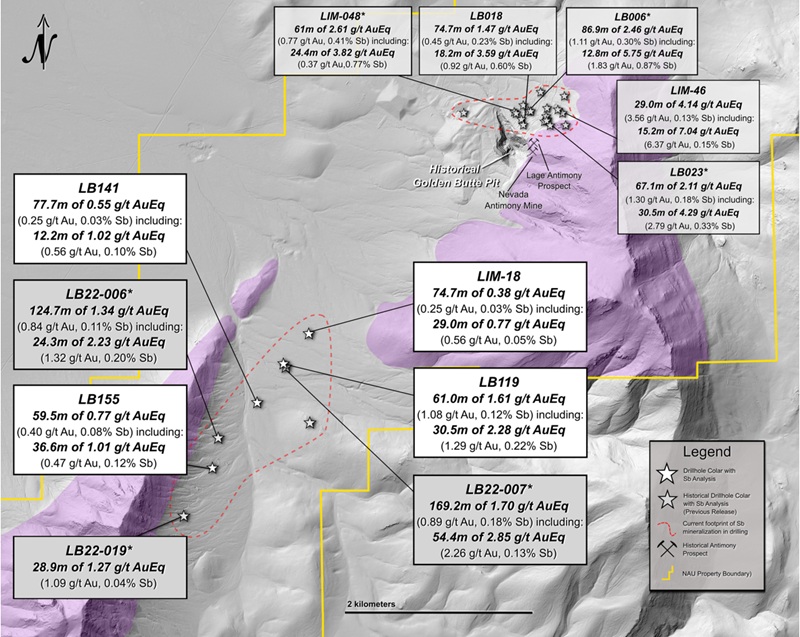

By contrast, NevGold (TSXV: NAU) already has dozens of drilled intercepts confirming a continuous, near-surface antimony/gold system at its Limousine Butte Project in Nevada—where grades have reached up to 14.90 g/t AuEq (including 3.76% Sb) over 4.6m. NevGold's maiden antimony/gold Mineral Resource Estimate (MRE) is scheduled within months, representing a major milestone that NVA has not yet achieved. Yet despite being far more advanced technically and located in one of the most infrastructure-rich mining jurisdictions in the U.S., NevGold’s market cap remains only a fraction of Nova’s.

If Nova Minerals (NVA) a company with no antimony drilling or resource data can reach a valuation of US$458 million solely from surface sampling and narrative momentum, the upside potential for NevGold (TSXV: NAU)—with verified high-grade drill results, an imminent resource estimate, and strong geological continuity—appears many times greater. As of today, Perpetua Resources (PPTA)'s Stibnite in Idaho is the only U.S. based project with a compliant antimony/gold resource estimate, and its market cap is $2.93 billion.

NevGold (TSXV: NAU)'s upcoming MRE, targeted for this winter… will mark a pivotal moment not only for NevGold but for the entire North American antimony supply chain! Through a systematic 2025 re-assay campaign of over 50 historical drill holes… followed by the launch of an aggressive new 2025 drilling program targeting an entirely new oxide gold-antimony Bullet Zone from surface… NevGold has demonstrated that Limousine Butte hosts a district-scale Carlin-type Au–Sb system with extensive near-surface oxide zones amenable to rapid economic assessment. Preliminary metallurgical testwork achieved up to 92% antimony recovery via acid leach and 78% via sulfidized flotation, with gold recoveries remaining unaffected—an exceptional technical outcome that underscores the project’s viability.

Regional Context: Surrounded by Billion-Dollar Majors

NevGold (TSXV: NAU)’s Limousine Butte Project is located in one of the most strategic and under-recognized mineral belts in the western United States. It is surrounded by a remarkable concentration of multi-billion-dollar mining majors actively operating or earning in on large-scale discoveries across eastern Nevada:

- Freeport-McMoRan (NYSE: FCX) controls the nearby Butte Valley and Falcon Butte copper-gold systems under an earn-in arrangement targeting porphyry-style mineralization.

- South32 Ltd. (ASX: S32) has partnered with Ridgeline Minerals (TSXV: RDG) to advance the Selena Project, a high-grade silver-lead-zinc CRD/skarn system only a short distance southwest of Limousine Butte.

- Centerra Gold (TSX: CG) recently entered a significant earn-in with Viscount Mining on the Cherry Creek Project to the northeast, seeking sediment-hosted and vein-style gold systems similar in geologic character to those being drilled by NevGold.

The presence of these Tier-1 operators underscores the emerging district-scale potential of the entire region. Each major is targeting mineralization related to Devonian-age carbonate host rocks and thrusted dolomite structures—the same stratigraphic and structural setting that hosts NevGold’s Carlin-type gold-antimony system at Resurrection Ridge and Cadillac Valley.

This growing cluster of activity by the world’s largest base- and precious-metal producers confirms the strategic significance of Limousine Butte within Nevada’s next-generation discovery corridor. With Freeport advancing porphyry copper, South32 delineating silver-lead-zinc CRD zones, and Centerra seeking bulk-tonnage gold systems, NevGold holds a central position bridging all three deposit styles—a position that enhances optionality, potential for joint ventures, and long-term acquisition appeal.

Limousine Butte is not an isolated exploration play; it is the focal point of a billion-dollar neighborhood, surrounded by industry leaders whose footprints validate the geological and economic relevance of NevGold’s ground.

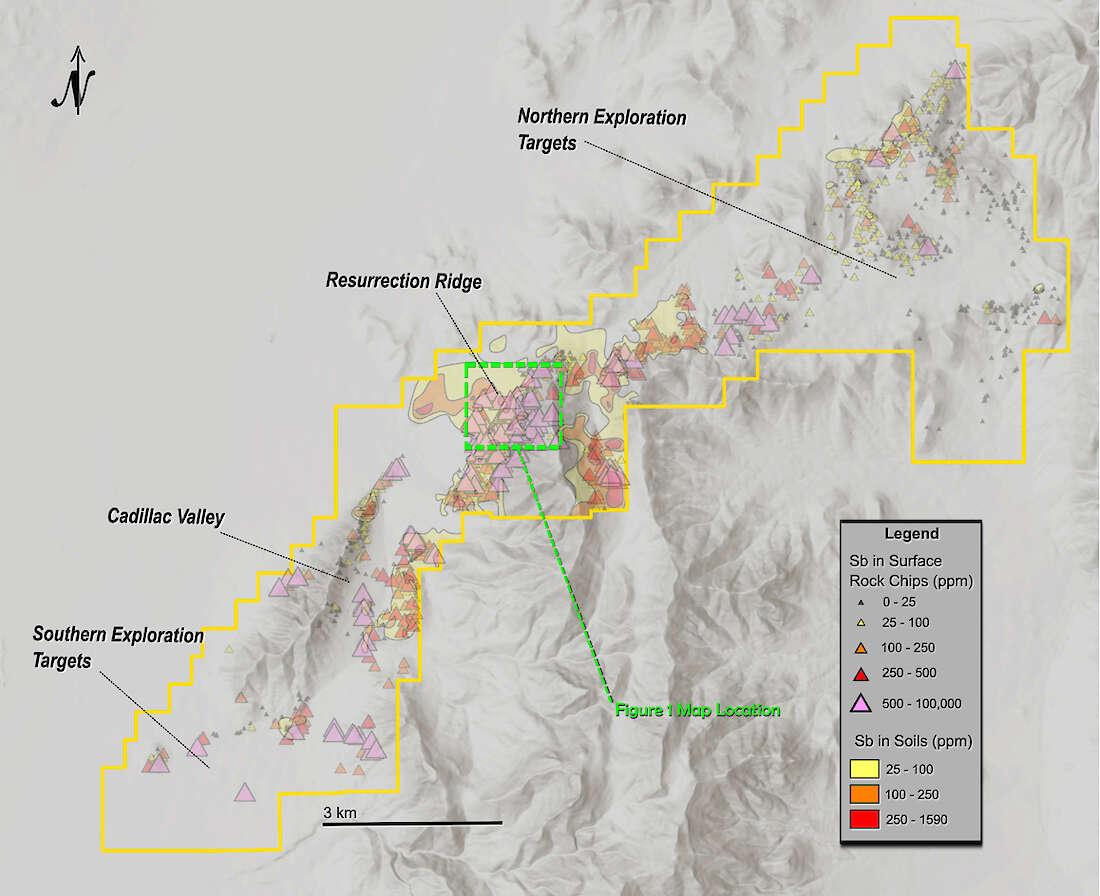

District-Scale Antimony–Gold System: A North American Discovery of Exceptional Importance

The extraordinary scale and continuity of antimony (Sb) mineralization across NevGold’s 100%-owned Limousine Butte Project in Nevada is unmatched anywhere else in the state and arguably across the entire United States. The Sb-in-soils and Sb-in-rock-chips dataset reveals an uninterrupted corridor more than 10 kilometers long, with exceptionally high surface values exceeding 1% Sb in multiple zones and coincident gold anomalies throughout.

The scale and consistency of this geochemical footprint elevate Limousine Butte to one of the largest undeveloped antimony–gold systems ever identified in North America. Unlike many gold projects that show only trace antimony or narrow Sb halos, Limousine Butte demonstrates a fully integrated Carlin-type Au–Sb system with both metals occurring in large concentrations near surface—a combination previously best exemplified by Perpetua Resources (PPTA)’s Stibnite Project in Idaho.

- Oxide, open-pittable mineralization confirmed across several kilometers of strike.

- High-grade Sb zones exceeding 2–3% Sb at surface and in drilling, paired with strong gold values.

- Metallurgical recoveries up to 92% Sb and 80–85% Au, demonstrating practical extraction potential.

- Full alignment with the U.S. Defense Production Act (2025) focus on rebuilding domestic antimony supply.

With over 5 kilometers of confirmed mineralized strike already drilled and unexplored targets stretching twice that length, Limousine Butte is emerging as the premier Carlin-type Au–Sb discovery in the United States—a potential complement and rival to Perpetua’s Stibnite in both scale and strategic significance.

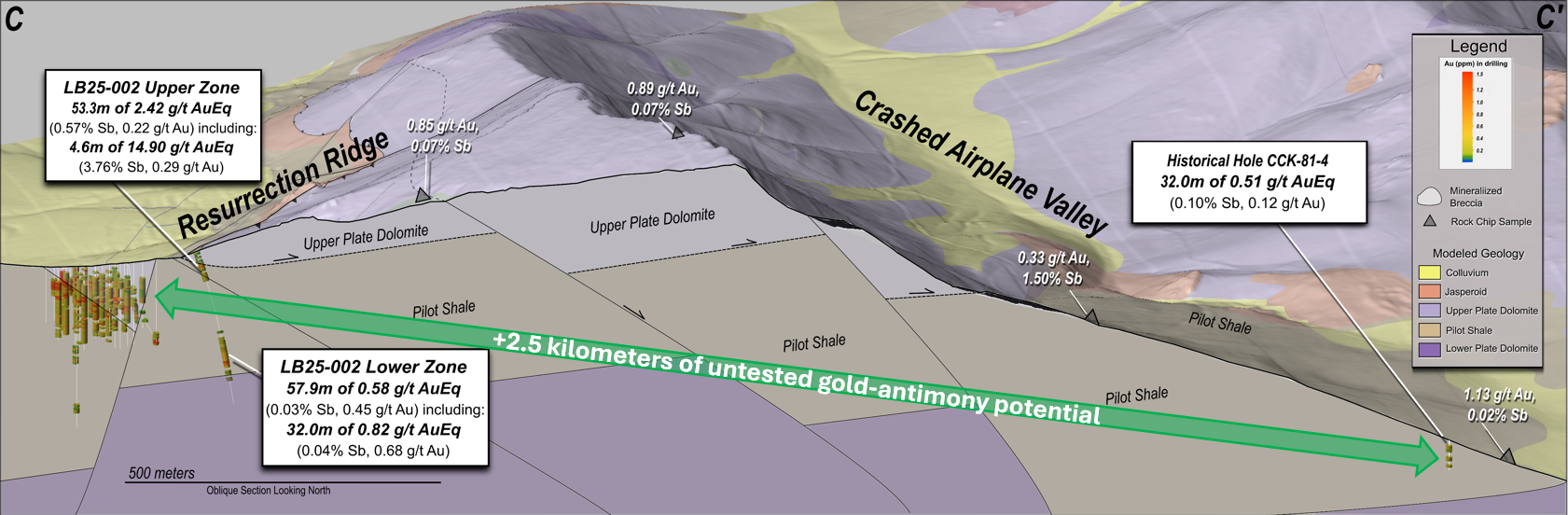

Transformational Discovery at Resurrection Ridge

Last month marked a true turning point for NevGold when the company announced results from its first new drill hole targeting the deeper section beneath Resurrection Ridge. The intercept from hole LB25-002 completely transformed the geological model of the Limousine Butte Project, proving that the high-grade antimony/gold system extends far below the previously defined oxide horizon. What had been interpreted as a shallow, surface-constrained deposit has now evolved into a major Carlin-type Au–Sb system with significant vertical and lateral continuity.

This discovery not only expanded the known mineralized envelope but also confirmed the existence of a high-grade feeder zone grading up to 14.90 g/t AuEq (3.76% Sb) over 4.6 metres within a broader 53.3-metre zone averaging 2.42 g/t AuEq. The updated model shown below highlights how dramatically the system opens up beneath the dolomite thrust contact, exposing a new, highly prospective corridor of mineralization that remains largely untested.

In short, the first hole into this new section has changed everything: Limousine Butte has transitioned from a near-surface oxide-gold discovery into a district-scale, multi-horizon Carlin-type system—one capable of rivaling the early discovery stages of Perpetua’s Stibnite Project in both scale and strategic critical-mineral significance.

The new model not only redefined the geometry of Resurrection Ridge, but it reframed the entire district. When viewed in three-dimensional context, the Limousine Butte system reveals a continuous, mineralized corridor extending more than five kilometres from the high-grade zones at Resurrection Ridge through Cadillac Valley and toward the largely untested Crashed Airplane Valley trend. This continuity confirms that NevGold is not simply delineating a single deposit but unlocking a multi-centered Carlin-type system that shares the same structural controls and host sequence across the district.

The broader interpretation shows how the newly discovered feeder beneath the dolomite thrust may connect into multiple horizons of oxide mineralization along strike. What were once considered isolated targets are now recognized as parts of a unified, district-scale hydrothermal system with the potential to support several open-pittable resource centers. This realization elevates Limousine Butte from a project into a true emerging mining camp.

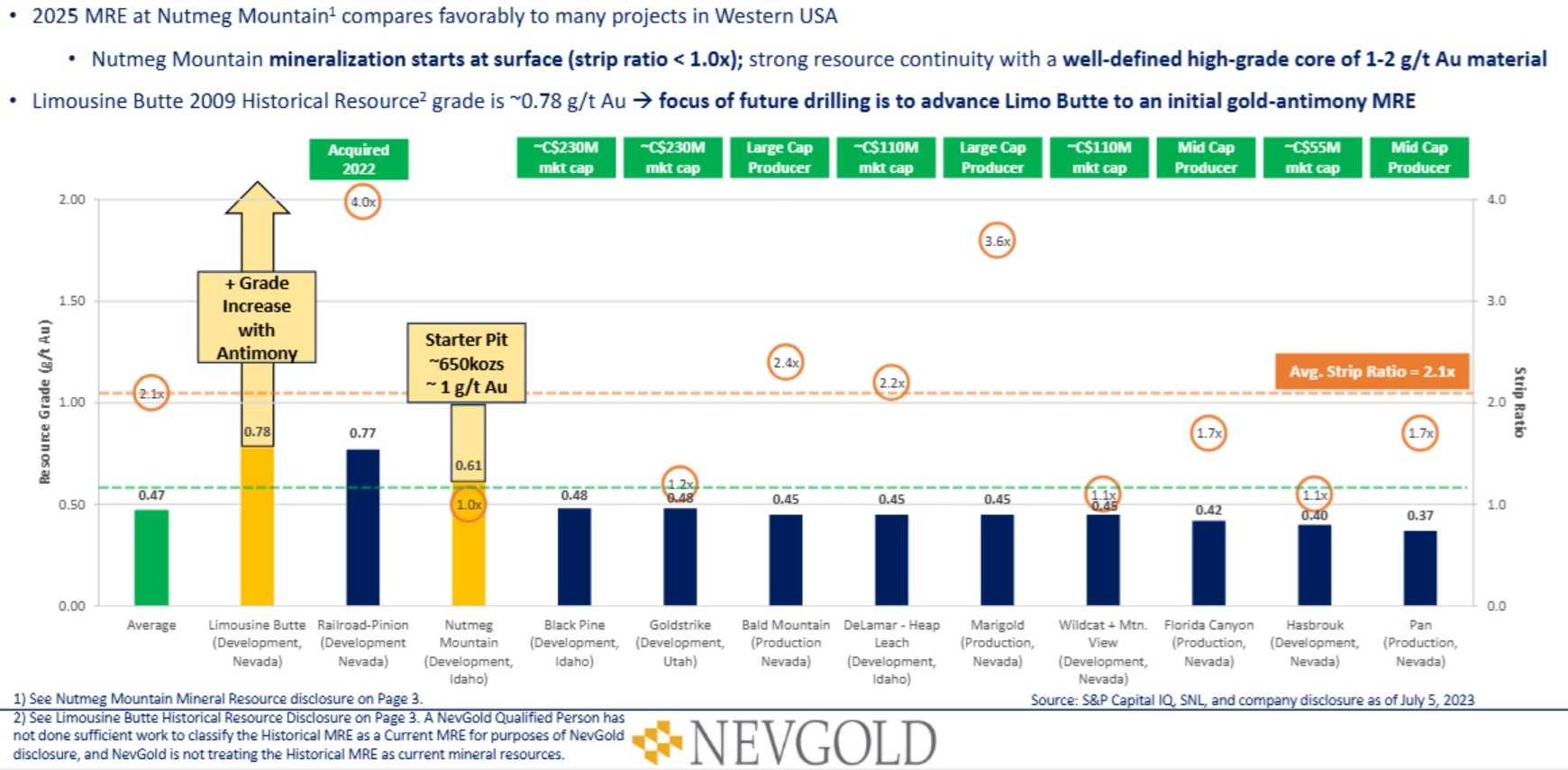

Transformative Grade Increase Driven by Antimony Discovery

The 2009 historical resource at Limousine Butte averaged approximately 0.78 g/t gold—a solid oxide grade for Nevada. However, NevGold’s 2025 re-assay program revealed that many of these same intervals contain substantial antimony enrichment, dramatically changing the project’s metal profile. Based on the strong gold–antimony correlation now evident across Resurrection Ridge and Cadillac Valley, the company believes gold-equivalent grades could exceed 2.0 g/t AuEq in the forthcoming resource model.

This represents a step-change in value and strategic importance. What was once viewed as a typical oxide-gold system is emerging as a dual-metal discovery—one that combines near-surface oxide gold amenable to heap leaching with critical-mineral antimony suitable for downstream recovery. The integration of both metals positions Limousine Butte as one of the most unique undeveloped deposits in the U.S. and a potential cornerstone for domestic antimony supply.

With ten drill holes currently pending assays and a maiden gold–antimony resource estimate (MRE) expected within months, NevGold is entering a pivotal period. The upcoming results are expected to quantify the full impact of the antimony component on grade, tonnage, and overall project economics—potentially redefining the scale of Limousine Butte’s discovery.

Limousine Butte’s historical oxide gold grade of 0.78 g/t Au could exceed 2.0 g/t AuEq once antimony is incorporated — a transformational shift now being tested by ten pending drill holes and an upcoming maiden resource estimate.

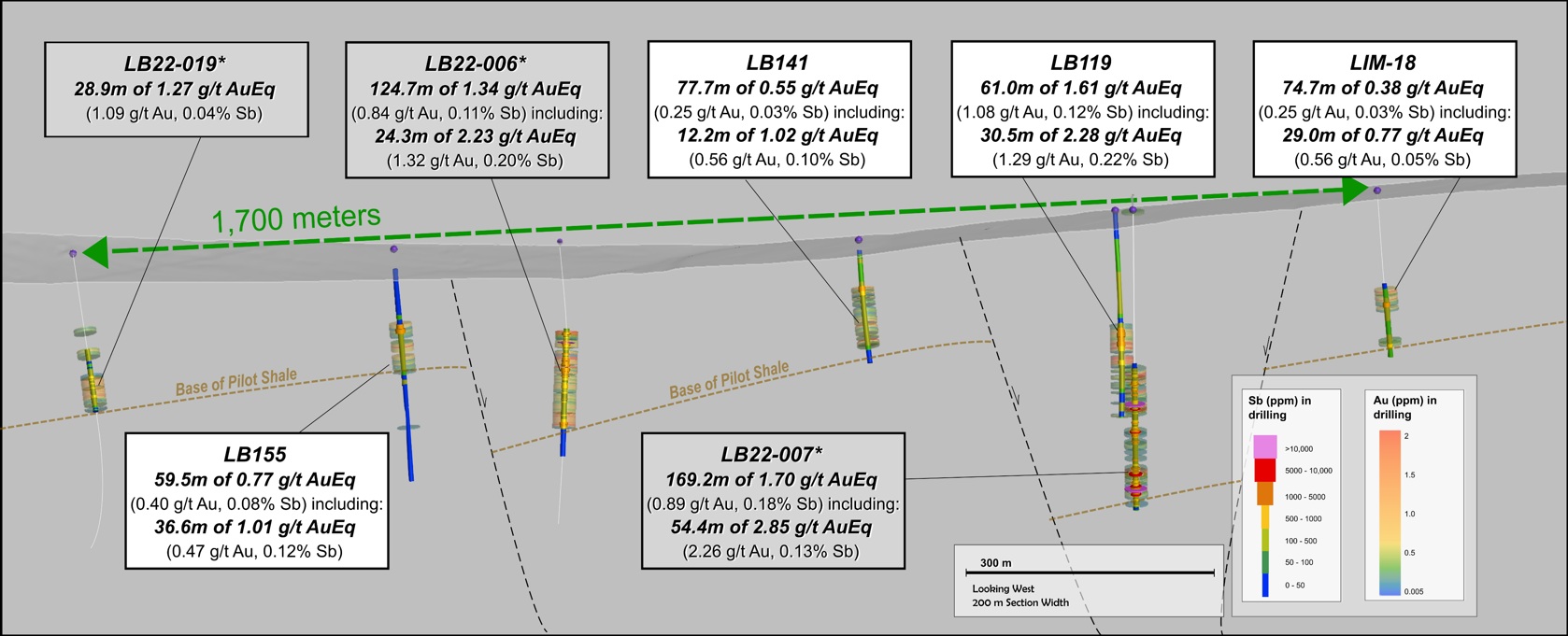

Re-Assays Reveal Hidden Antimony Across the District

Before drilling a single new hole, NevGold re-examined decades of historical drill data at Limousine Butte. The company discovered that many legacy holes—originally assayed only for gold—contained previously unrecognized high-grade antimony. Re-sampling and re-analysis confirmed that Limousine Butte hosts a district-scale antimony/gold system extending between Resurrection Ridge and Cadillac Valley.

The re-assay program produced standout intercepts including 4.07 g/t AuEq over 54.9 m (LIM-40) and 2.46 g/t AuEq over 86.9 m (LB-006), demonstrating that many of the so-called “low-grade oxide gold” zones were actually strongly enriched in antimony. This gold–antimony correlation, mapped across more than 1.7 kilometres of strike, revealed a continuous, structurally controlled system and became the foundation for NevGold’s new 3-D geological model uniting Resurrection Ridge and Cadillac Valley into a single Carlin-type Au–Sb corridor.

This reinterpretation work, completed between February and July 2025, laid the groundwork for NevGold’s first entirely new drill test of the deeper structural model—hole LB25-002—which was announced in October 2025 and marked a transformational discovery for the project.

⟶ Feb–Jul 2025 | Re-assays & Model Building • Oct 2025 | First New Discovery (LB25-002)

Valuation Perspective: Market Ignoring NevGold’s Dual-Asset Potential

Despite the scale of its Nevada discovery, NevGold (TSXV: NAU) remains valued by the market almost entirely on its Nutmeg Mountain Project in Idaho—while effectively assigning zero value to Limousine Butte, the company’s primary focus and near-term catalyst. This disconnect represents a rare opportunity for investors as NevGold advances toward additional assays and a maiden oxide gold–antimony resource estimate at Limousine Butte.

NevGold’s Nutmeg Mountain: Among America’s Most Attractive Undeveloped Oxide Gold Deposits

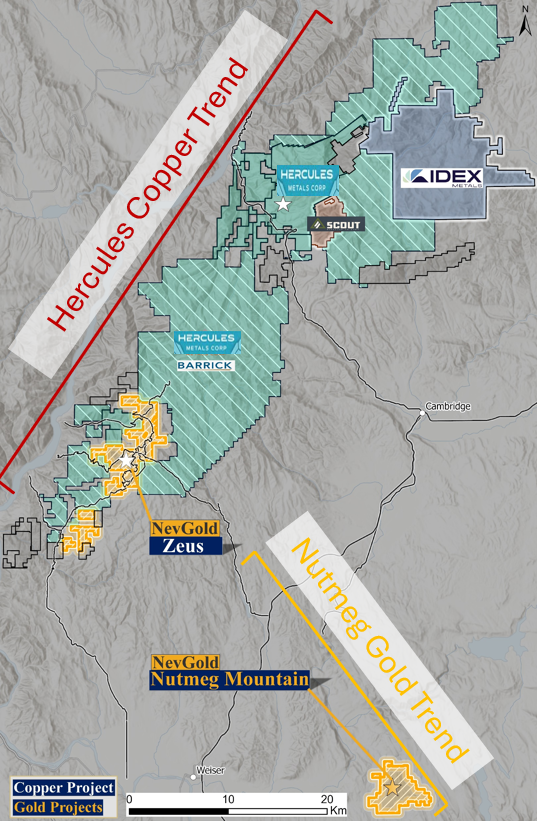

Only a handful of small-cap public companies control oxide gold resources larger than NevGold Corp. (TSXV: NAU)—and few can match the quality and economics of its Nutmeg Mountain Project in Idaho. Located approximately 80 km north-northwest of Boise and 20 km east of Weiser, Nutmeg benefits from excellent road, power, and water infrastructure and sits within a rapidly emerging mining district that includes the Hercules Copper Trend to the northwest.

NevGold’s Western U.S. Project Portfolio showing 100%-owned Nutmeg Mountain (Idaho) and Limousine Butte (Nevada) – two oxide gold projects with district-scale potential.

Nutmeg Mountain positioned along the Nutmeg Gold Trend and near the emerging Hercules Copper Trend — an underexplored precious and base-metal district in western Idaho.

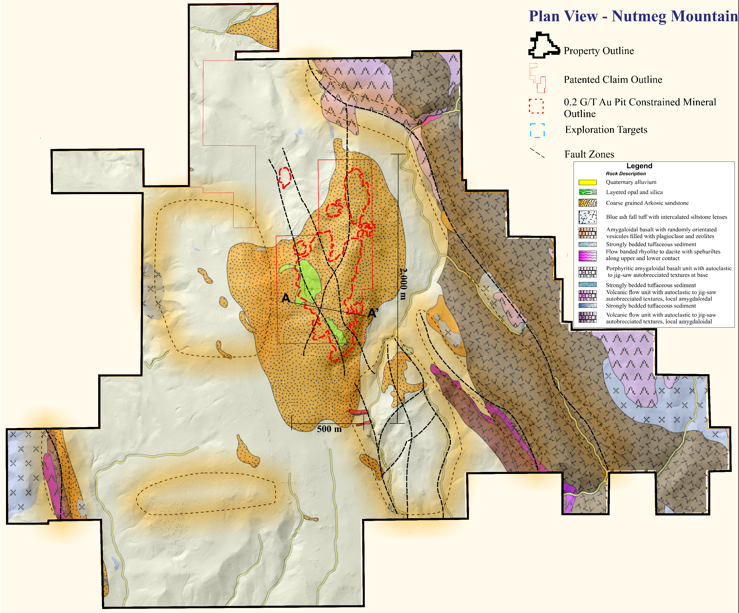

Nutmeg hosts a near-surface, low-sulphidation epithermal gold system that has seen over 70,000 meters of historical drilling in 934 holes. The deposit remains open in all directions, and the average historical drill depth of less than 75 meters leaves the high-grade feeder structures typical of these systems virtually untested. With mineralization beginning at surface and extending through multiple zones, Nutmeg provides exceptional leverage to both grade expansion and resource growth.

Most of the gold identified to date occurs within a north-trending graben bounded by fault zones that control hydrothermal brecciation, veining, and silicification. The Main Zone hosts the majority of mineralization—extending over 1.2 km north–south, 250–500 meters wide, and up to 180 meters thick—while the North Zone, Stinking Water, and Cove Creek zones remain under-drilled and highly prospective.

Plan view of Nutmeg Mountain’s updated 2025 resource footprint showing multiple near-surface oxide zones and untested exploration targets.

2025 Mineral Resource Estimate (MRE)

NevGold’s 2025 updated Mineral Resource Estimate confirmed 1.738 million ounces of oxide gold at a 0.20 g/t Au cut-off, representing an 18% increase in Indicated tonnage and a doubling of Inferred resources since 2023. Importantly, higher-grade subsets include 560,000 ounces grading 0.92 g/t Au at a 0.60 g/t cut-off, demonstrating the potential for a future starter-pit scenario with robust early cash flow potential.

| Classification | Cut-off (g/t Au) | Tonnes (M) | Grade (g/t Au) | Gold Ounces (koz) |

|---|---|---|---|---|

| Indicated | 0.20 | 74.2 | 0.50 | 1,186 |

| Inferred | 0.20 | 49.7 | 0.34 | 548 |

| Indicated | 0.60 | 19.0 | 0.92 | 560 |

| Inferred | 0.60 | 3.0 | 0.87 | 85 |

Source: NevGold Corp. (Sept 18, 2025 MRE Update)

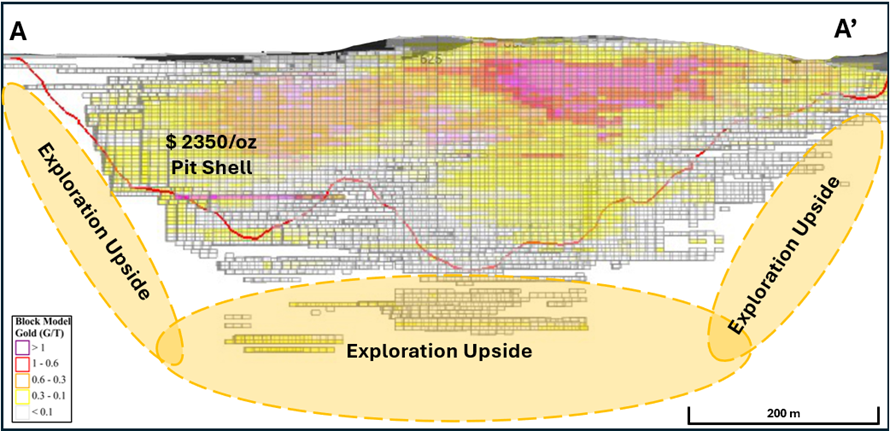

The strip ratio of the project based on conceptual pit shells is estimated at less than 1:1—an exceptionally low figure for an open-pit, oxide, heap-leach gold project. With 80% gold recovery assumptions and mineralization starting at surface, Nutmeg stands among the most mining-efficient oxide deposits in the United States.

Cross-section of Nutmeg Mountain’s updated 2025 resource model showing mineralization from surface and significant upside below the US$2,350/oz pit shell.

Ongoing Growth and Exploration Potential

NevGold continues to drill new high-priority targets outside the main resource shell with the goal of expanding the 2025 MRE laterally and at depth. Historical drilling rarely exceeded 75 meters—leaving the high-grade feeder veins typically seen in epithermal systems completely untested. The company has also initiated detailed metallurgical studies and baseline permitting to support a forthcoming Preliminary Economic Assessment (PEA).

Given these fundamentals, Nutmeg Mountain alone supports a valuation several times NevGold’s current market capitalization. Yet the market continues to assign virtually no value to Limousine Butte—the company’s Nevada flagship and near-term news driver—with additional assays and a maiden gold–antimony resource estimate expected in the months ahead.

Peer Comparisons: Oxide Gold Leaders Across the U.S.

- Liberty Gold (TSX: LGD) controls one of America’s largest undeveloped oxide gold resources at Black Pine (Idaho), totaling 4.875 million oz. However, grades are significantly lower—an Indicated resource of 4.163 Moz @ 0.32 g/t Au and Inferred of 712 koz @ 0.23 g/t Au. Despite its size, Liberty’s strip ratio of 1.3 and weaker grades result in less favorable mining economics. At $0.78/share and a market cap of US$282.9M, Liberty trades at US$58/oz—77% higher than NevGold’s valuation.

- Dakota Gold (NYSE American: DC) holds one of the largest undeveloped oxide deposits at Richmond Hill (South Dakota), containing approximately 5.06 million oz. Grades are similar to NevGold’s but its strip ratio of 2.3 is more than double. At $4.08/share and a US$458M market cap, Dakota trades at US$90.6/oz—nearly triple NevGold’s valuation.

- Orla Mining (TSX: ORLA) acquired the South Railroad Project (Nevada) in 2022 for roughly US$190M, gaining 2.024 million oz of oxide gold resources. However, its strip ratio of 4.1 offsets slightly higher grades. Orla effectively paid US$93.9/oz—and with gold prices now nearly double since acquisition, the implied valuation today likely exceeds US$180/oz.

At only US$32.84 per ounce of oxide gold, NevGold’s Nutmeg Mountain stands out as one of the most undervalued and strategically attractive oxide gold projects in the United States. Its near-surface mineralization, higher grades, and ultra-low strip ratio deliver a clear economic edge over much larger peers. With Limousine Butte’s upcoming results and MRE, investors are effectively receiving that Nevada discovery for free.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from NAU of US$100,000 cash for a twelve-month marketing contract. This message is for informational and educational purposes only and does not provide investment advice.