Bloomberg Confirms Power Problem That QIMC Is Built to Solve

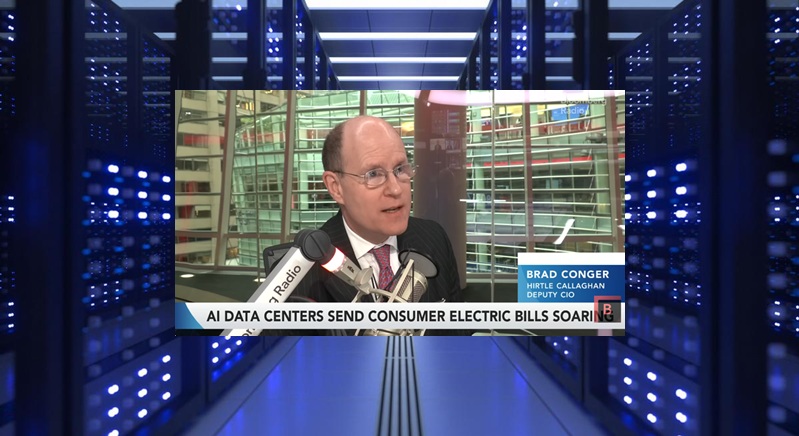

Bloomberg Intelligence warned this week that AI data center energy use is set to explode — doubling or even tripling to over 100 GW of power demand within five years, consuming 13–15% of all U.S. electricity. The discussion made it clear: “They have the chips, but they don’t have the power.”

While hyperscalers scramble for new energy sources, QI Materials (CSE: QIMC) just unveiled a Strategic Advisory Board designed specifically to link natural hydrogen exploration with clean-energy infrastructure and off-grid AI data centers.

⚡ Bloomberg’s Warnings → QIMC’s Opportunity

| Bloomberg Theme | QIMC’s Response |

|---|---|

| Data centers will consume 13–15% of U.S. power; grid strain causing backlash. | QIMC’s white hydrogen projects aim to power off-grid data centers, bypassing the overloaded grid. |

| Hyperscalers are seeking “our own electricity, our own power.” | QIMC’s model connects geology to modular hydrogen-powered AI infrastructure — an independent clean-energy solution. |

| Delays in gas turbines and small modular reactors are constraining growth. | Natural hydrogen offers a scalable, lower-cost, near-term clean energy source that can be developed faster than SMRs. |

| The AI buildout may mirror past infrastructure bubbles but will leave lasting assets. | QIMC’s integrated model ensures the long-term use of its hydrogen and silica assets for sustainable, future data systems. |

🌍 Strategic Advisory Board = Energy + AI Expertise

QIMC’s newly appointed Advisory Board gives the company an edge as it bridges the geological and digital worlds:

- Eric Chouinard, founder of iWeb Technologies, brings data center operational experience directly relevant to AI infrastructure.

- Sylvain Boucher adds scaling and commercialization expertise from the tech and health sectors.

- Peter Wong ensures Indigenous and community collaboration across the Québec–Ontario hydrogen corridor.

Together, they align with Bloomberg’s conclusion that AI’s next phase will depend not on chips — but on who controls the cleanest, cheapest, and most reliable power.

⛏️ Next Milestone: Nova Scotia Mining Conference (Nov 12–13, 2025)

QIMC will present its first drill targets and strategic outlook for its Nova Scotia hydrogen properties. With the region’s subsurface gas seeps and proximity to Atlantic power hubs, QIMC is positioning itself as the first public company in Canada to directly connect natural hydrogen resources to the AI data center boom.

🪙 NIA Commentary

Bloomberg’s segment underscored what NIA has been saying for months: AI’s limiting factor isn’t silicon — it’s energy. QIMC is one of the few early-stage companies planning for both. Their vertical model — from natural hydrogen geology to off-grid AI compute — could become the blueprint for sustainable data infrastructure in the post-grid era.

Energy always sits at the top of value creation. Every major industrial revolution began with an energy breakthrough:

- Coal → Industrial Revolution

- Oil → Transportation revolution

- Silicon chips + electricity → Digital revolution

- Natural White Hydrogen → AI + Clean Energy revolution

Graphene, despite its remarkable physics, is a dependent technology — it enhances batteries, semiconductors, or composites. Hydrogen is an enabling technology that everything else depends on. Once a natural hydrogen well proves commercially viable, it can produce energy for decades with no mining, refining, or grid hookup.

Graphene hype peaked around 2015–2018 with tiny prototype markets — conductive inks, tennis rackets, coatings. Global demand today is still under $100 million annually.

By contrast:

- The hydrogen economy is already a multi-hundred-billion-dollar policy and investment target (U.S. DOE, EU, Japan, and Canada all have hydrogen roadmaps).

- Natural hydrogen is a potential low-cost subset of that — no electrolysis, no methane reforming, no CO₂ footprint.

Even one successful discovery well could be worth more than the entire global graphene market.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from QIMC of US$50,000 cash for a six-month marketing contract. This message is for informational and educational purposes only and does not provide investment advice.