Drilling at North Peak’s Industry Targets Underway. Follow-up Channel Sampling at Dean Cave Yielded up to 90.4 g/t Au

Drilling at North Peak’s Industry Targets Underway.

Follow-up Channel Sampling at Dean Cave Complex Stopes Yielded Further High-Grade Gold up to 90.4 g/t

November 03, 2025 8:22 AM EST | Source: North Peak Resources Ltd.

Calgary, Alberta–(Newsfile Corp. – November 3, 2025) – North Peak Resources Ltd. (TSXV: NPR) (OTCQB: NPRLF) (the “Company” or “North Peak”) announces RC drilling has moved onto the Industry tunnel target area, having completed nearly 1,000 feet in the Wabash /Williams area, along with further results from follow-up sampling within the Dean Cave complex at their Prospect Mountain property in Eureka, Nevada (the “Property”).

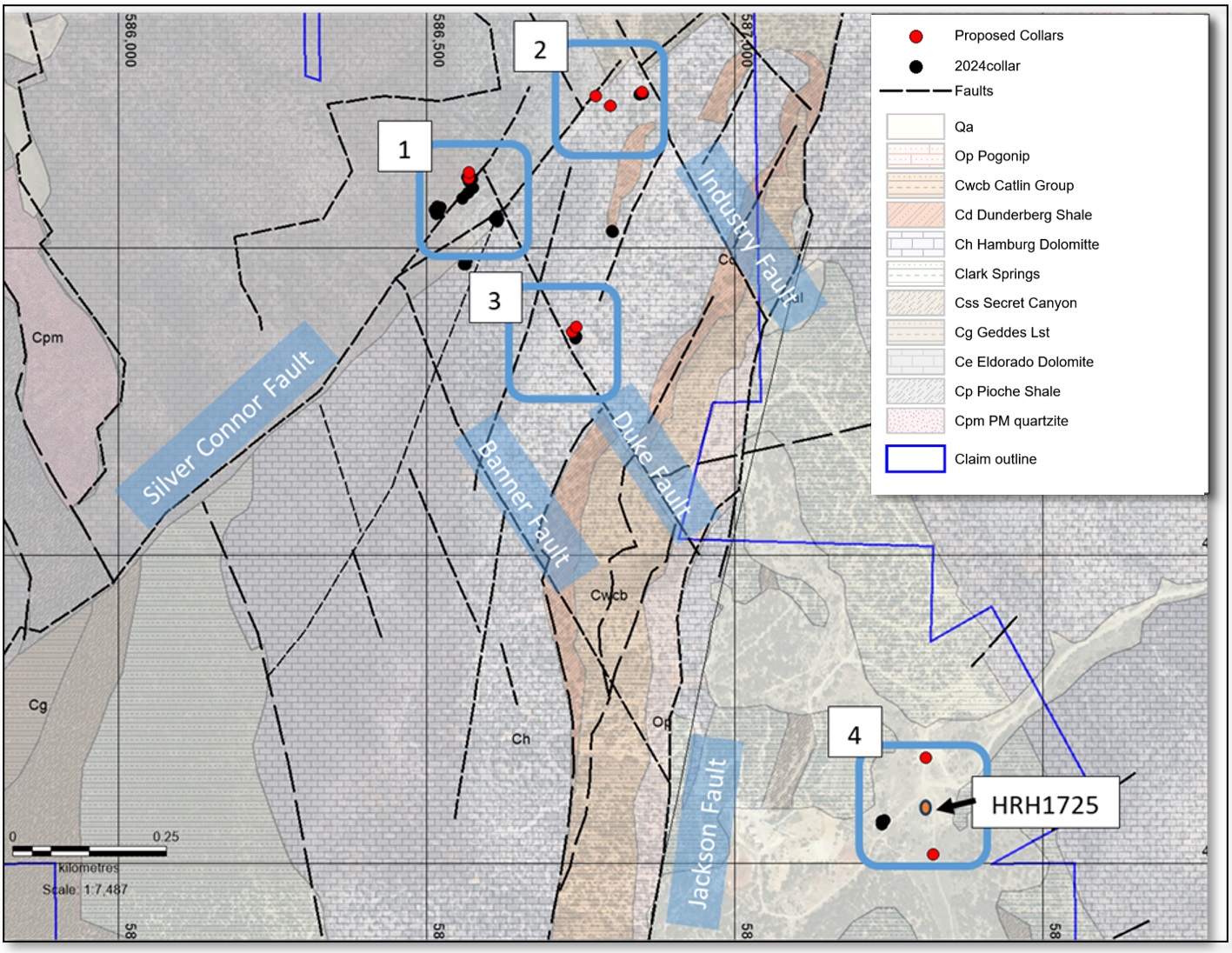

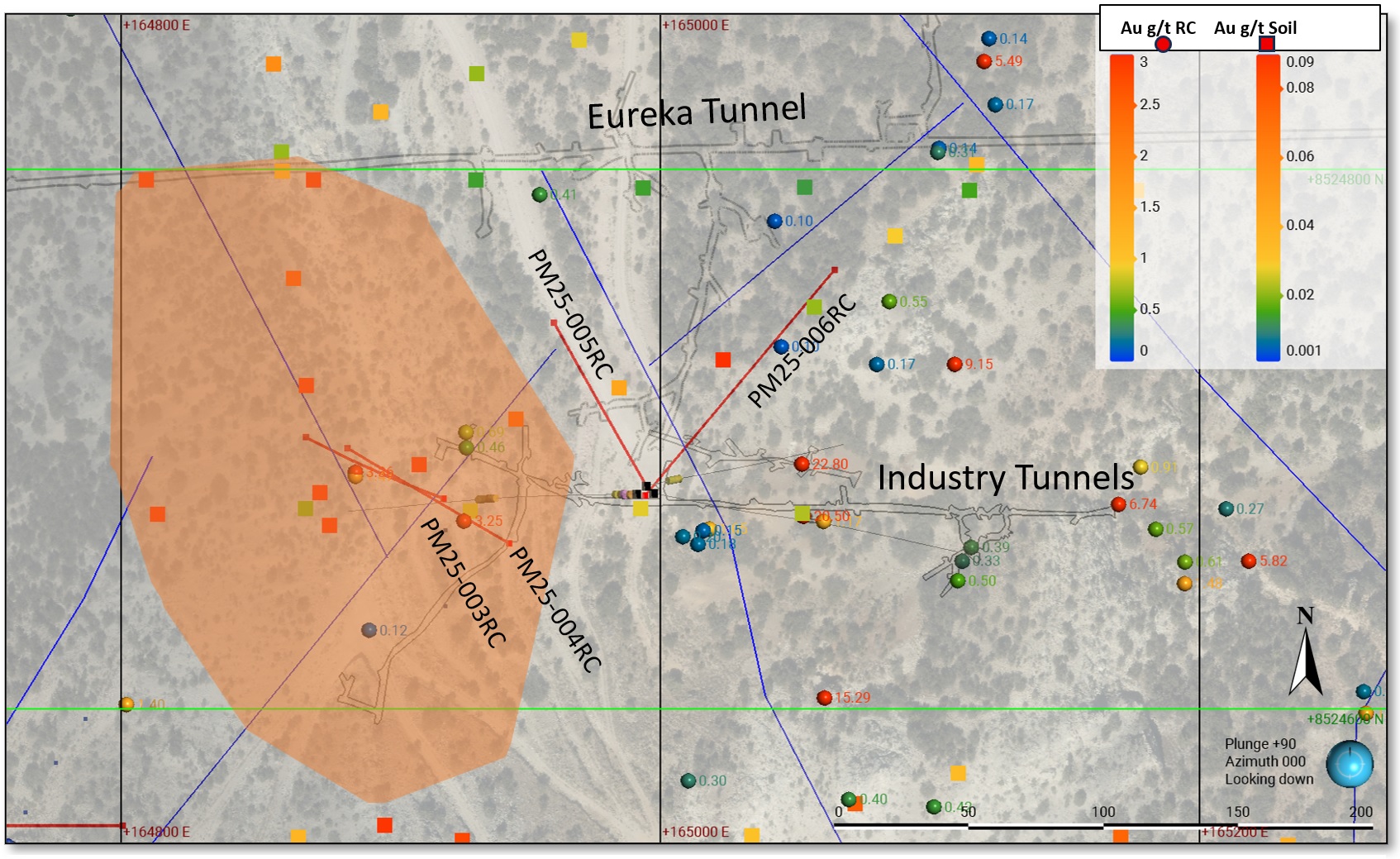

Drilling at the Industry target is following up on a 10,000m2 area of >0.1 g/t Au in soil anomaly in the Eldorado dolomite between the Eureka and Industry tunnel systems. The target area (See area 2 in Figure 1) includes previously unreported grab samples from stopes within the Industry tunnels (see Figure 2) and the surrounding dumps ranging up to 22.8 g/t Au and 87 g/t Ag. Note grab samples are selective in nature and should not be interpreted as representative of the economic potential of the area.

No grades were recorded from historical production of the Industry tunnel from 1873-1888, however excise figures from historical smelter returns record Industry tunnel as containing some of the more valuable ores, paying $79.2 USD/short ton, with a gold equivalence value of 3.83 oz/short ton in 1888 gold prices (USGS Professional Paper 406, The Eureka Mining District, Nevada, 1962). Payables were based on recoverable Au, Ag and Pb values.

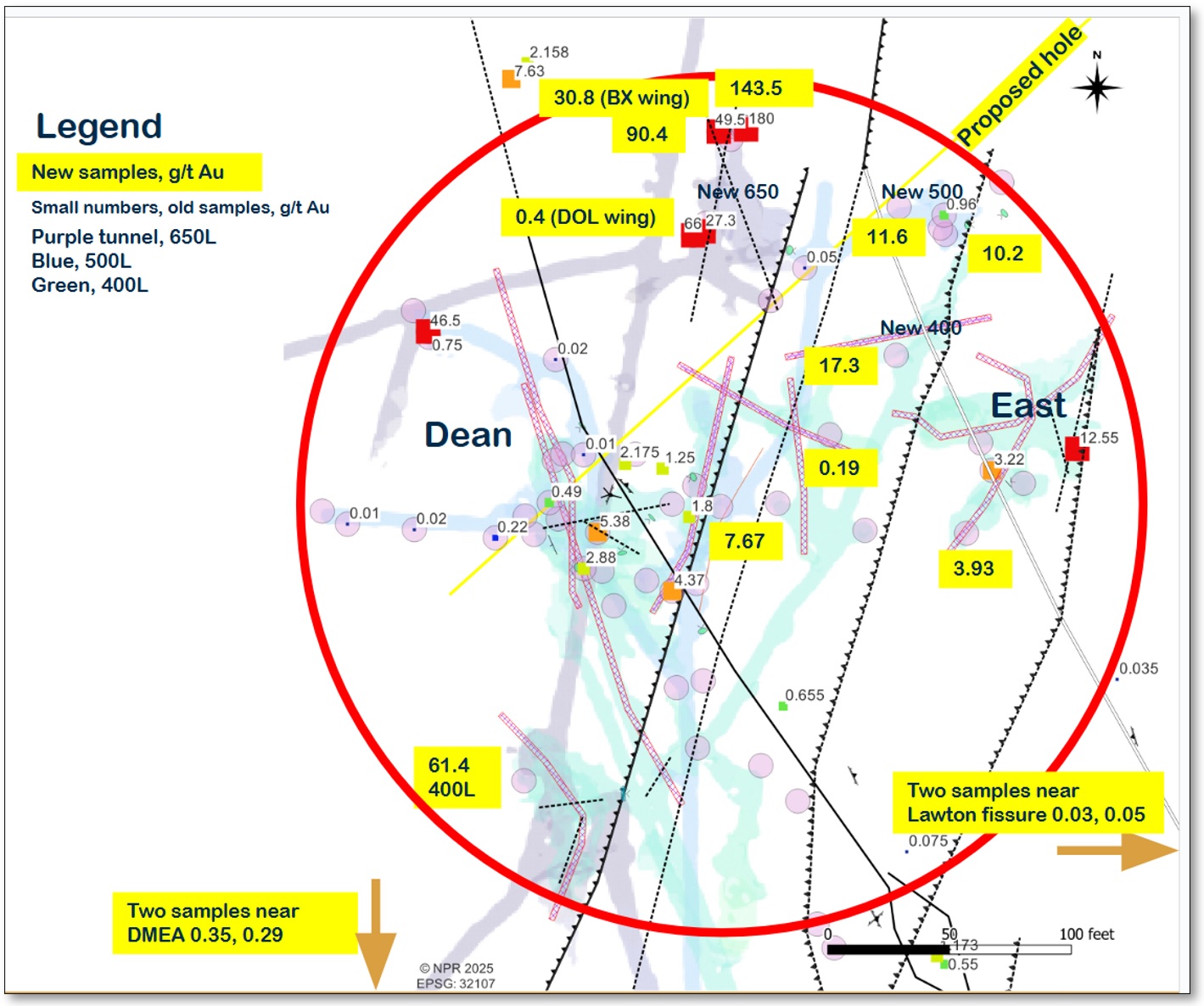

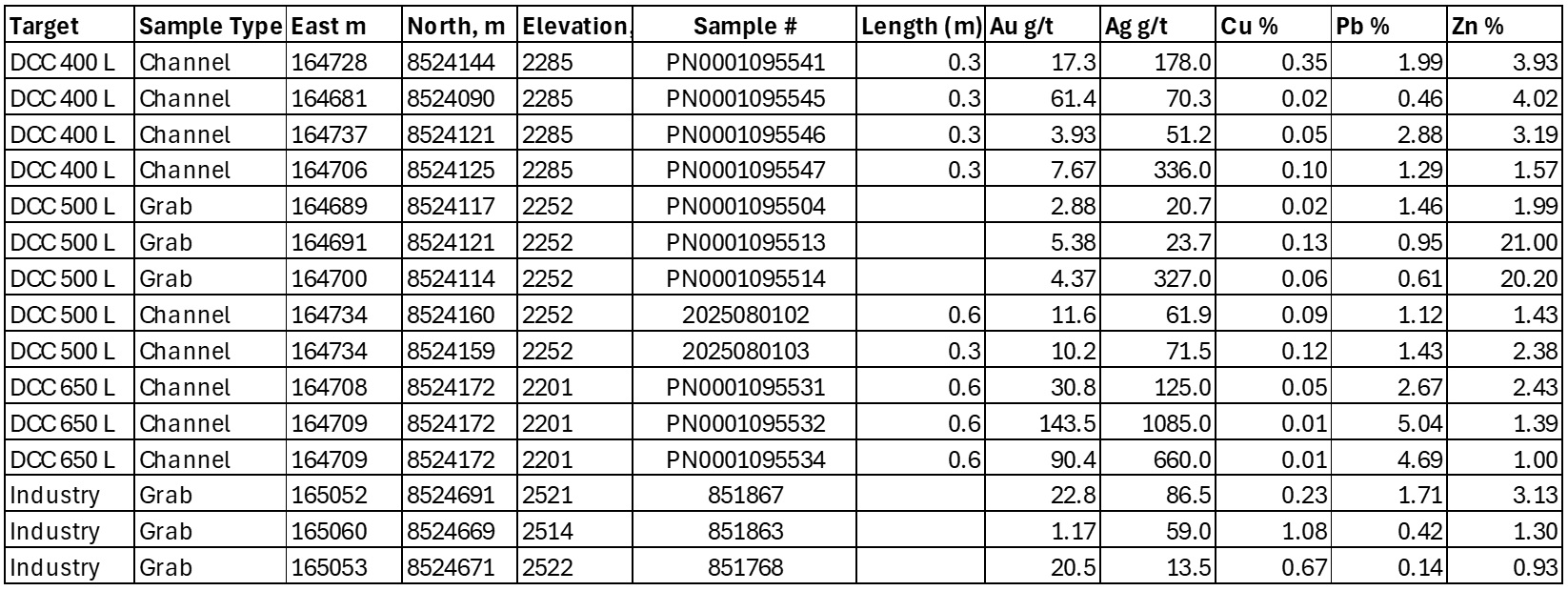

Further representative channel sampling across gossans on the 400-650 levels of the Dean Cave complex yielded best results of:

| 17.3 g/t Au, 178 g/t Ag, 1.99% Pb, 3.93% Zn over 0.3m (420 L) |

| 61.4 g/t Au, 70.3 g/t Ag, 0.46% Pb, 4.02% Zn over 0.3m (420 L) |

| 11.6 g/t Au, 61.9 g/t Ag, 1.12% Pb, 1.43% Zn over 0.6m (520 L) |

| 10.2 g/t Au, 71.5 g/t Ag, 1.43% Pb, 2.38% Zn over 0.3m (520 L) |

| 90.4 g/t Au, 660 g/t Ag, 4.69% Pb, 1.00% Zn over 0.6m (650 L) |

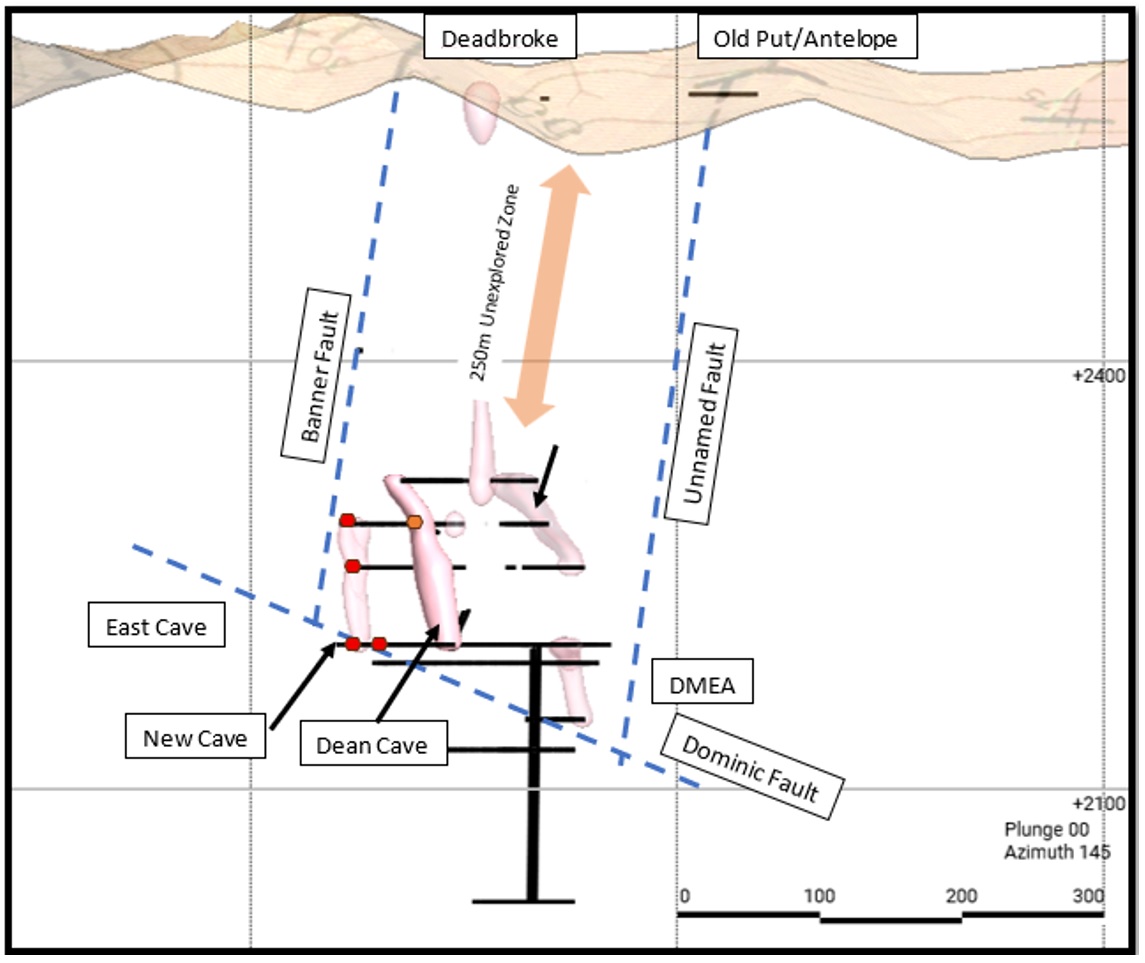

These results highlight the eastern area of the Dean Cave complex as a high priority zone for high-grade oxide ore. A network of intermittently mined old stopes plunge to the NW at 40–50 degrees and roughly follow the intersection of the Domonic and Banner faults, giving a clear drillable exploration target. Other stope systems appear to follow parallel faults. Drilling from Area 3 will target the unexplored area above these stopes and the drill will move here after the Industry targets.

There is a clear zoning in Zn/Pb ratios in the samples which correlate well with increasing grade. Values >20% Zinc are recorded with Zn/Pb ratios >10:1; gold is typically 0.1–10 g/t in these areas. As Zn/Pb ratios approach 1:1, gold grades increase proportionally, providing a useful exploration guide for the coming drilling.

Rupert Williams, CEO commented, “Drilling is progressing well with over 600m drilled so far. The geology team’s mapping and field work continues to support exciting drilling target areas.”

Background to the Areas

The Dean Cave complex was one of the last areas to be mined in the Historic Diamond Mine, with sporadic activity continuing into the 1980s. The ore in Carbonate Replacement Deposits often occurs in vertical chimneys and layer-parallel mantos. The Dean Cave area includes the DMEA/Deadbroke chimney and the East Cave chimney, extending to depths of at least 400–650m. Chimney zones occur along ENE fracture zones parallel to the Silver Connor Fault near the intersection with NW fault zones (Banner McIntosh system), representing underground oxide exploration targets with high potential for further mineralization.

The Dean Cave stopes for which production records exist averaged 0.229 oz/t (7.8 g/t) Au and 5.83 oz/t (200 g/t) Ag from 291 ore cars (Silver Viking Corp., 1980, map DM0-08 – Note: Historical and not verified).

The DMEA refers to the area briefly mined in 1954 following a loan from the Defense Minerals Exploration Administration, averaging 0.69 oz/t Au, 50.5 oz/t Ag, and 29.4% Pb.

The Industry tunnel area lies at the junction of another NW fault system and the Silver Connor fault. It hosts three historical mines (Industry, Industry Upper, Eureka Tunnel) at different levels, though production is believed modest based on dump sizes.

Review by Qualified Person, Quality Control and Reports

Mr. David Pym, CGeol., Consulting Geologist to the Company, is the Qualified Person under NI 43-101 who reviewed and approved the technical disclosure in this release. Samples were sent to ALS Global, Elko, Nevada, with QA/QC protocols including 1 blank, 1 standard, and 1 duplicate per 20 samples (15% QA/QC rate). Six CDN standards ranging 0.433–7.34 ppm Au were used. Samples were assayed via 30g fire assay and 44-element ICP-MS suite, with overlimit re-assays for Au, Ag, Pb, Zn, Cu.

About Prospect Mountain

The Property lies within the Battle Mountain–Eureka trend, hosting Carlin-style, Carbonate Replacement (CRD), and Porphyry-related Skarn mineralization. At Prospect Mountain, CRD mineralization is heavily oxidized to depths of 610m (2,000ft). A Plan of Operations covering 181 acres permits surface exploration, underground mining up to 365,000 tons annually, and includes water extraction and containment authorization.

A complete description of Prospect Mountain geology can be found in the NI 43-101 Technical Report (effective April 10, 2023) filed on SEDAR+.

About North Peak

North Peak Resources Ltd. is a Canadian-based gold exploration and development company listed on the TSX Venture Exchange (NPR) and OTCQB (NPRLF). Founded by the team behind Kirkland Lake Gold and Rupert Resources, the Company specializes in acquiring mining assets, applying modern exploration techniques, and advancing them toward production.

The Company cautions investors that its exploration properties are early stage and speculative in nature.

For Further Information

Rupert Williams, CEO

Phone: +1-647-424-2305

Email: info@northpeakresources.com

Website: www.northpeakresources.com

Chelsea Hayes, Director

Phone: +1-647-424-2305

Email: info@northpeakresources.com

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.