Why Titan Mining (TII) and Trio-Tech (TRT) Are NIA’s Top 2 Picks for 2026

Many NIA members are asking why we made Titan Mining (TII) and Trio-Tech International (TRT) our top 2 favorite overall stock suggestions for 2026 if QI Materials (CSE: QIMC) and NevGold (TSXV: NAU) could potentially outperform them. Why not just make QIMC and NAU our top two picks?

There is a total of 5,539 publicly traded companies listed on the Big 3 U.S. exchanges: NYSE, NYSE American, and NASDAQ.

If we exclude banks and financial related companies including insurance, biotech and other healthcare related companies including pharmaceuticals, and REITs: there are 3,265 remaining companies on the Big 3 U.S. exchanges in industries we would consider investing in. After excluding companies based in China there are only 3,062 remaining companies.

If we screen these 3,062 publicly traded companies for… 1) revenue growth of 50% or more in most recent quarter, 2) positive net income over trailing twelve months, 3) positive free cash flow over trailing twelve months, and 4) little or no dilution over trailing twelve months with shares outstanding increasing by 5% or less: it eliminates 99.12% of all companies!

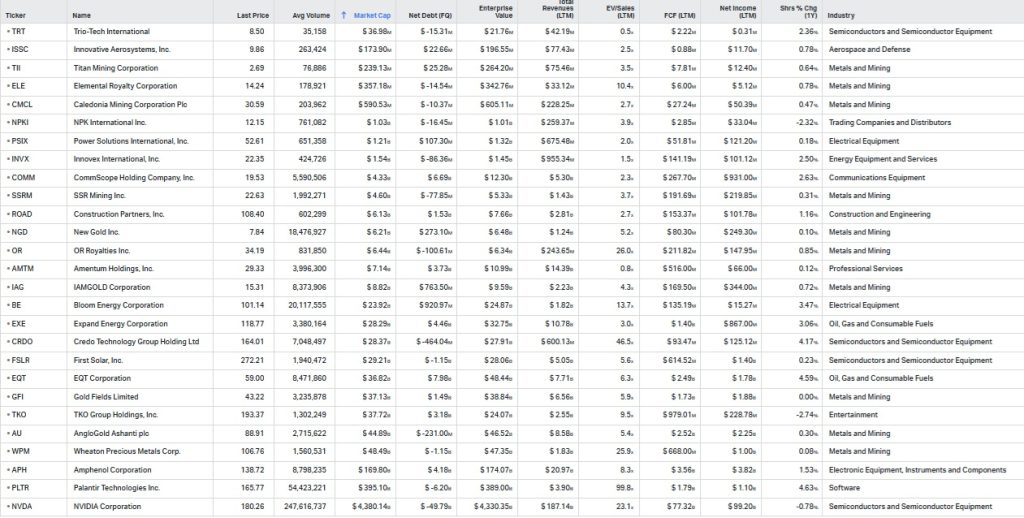

These are the 27 remaining companies starting from the lowest market cap to the highest:

Of the 27 profitable, cash flow positive, rapidly growing U.S. listed companies with little/no dilution:

Trio-Tech International (TRT) has the lowest market cap.

Titan Mining (TII) has the third lowest market cap.

TRT reported revenue growth of 58% last quarter, and nobody has noticed yet. AMD's new Malaysian AI chip facility was only open for 1/2 of the quarter!

TII was listed on the NYSE American exchange less than one week ago and is poised to become the #1 fastest growing U.S. listed mining company as zinc production ramps up and graphite production comes online!

Obviously, with Bezos/Gates backed Koloma staking thousands of claims in recent days directly adjacent to QI Materials (CSE: QIMC) in Nova Scotia, it feels like the type of speculative play that can blow up to a billion-dollar market cap very quickly, and NevGold (TSXV: NAU) has similar potential with its U.S. antimony resource estimate coming soon and Jamie Dimon recently having JP Morgan make a massive investment into Perpetua Resources (PPTA) the only company that currently has a U.S. antimony resource!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from QIMC of US$50,000 cash for a six-month marketing contract. NIA has received compensation from NAU of US$100,000 cash for a twelve-month marketing contract. This message is for informational and educational purposes only and does not provide investment advice.