New NIA Pick: Strategic Copper/Gold/Silver Project Next to Highland Valley

In recent days, we have been telling you about how the McLeod's are silver’s most powerful family and how we are acquiring both of their silver companies. NIA's Highlander Silver (TSX: HSLV) is acquiring Bear Creek Mining (TSXV: BCM), chaired by Catherine McLeod-Seltzer, and NIA's Contango ORE (CTGO) is making a move to acquire Dolly Varden Silver (TSXV: DV), founded by Robert McLeod.

Now, don’t feel bad for Bear Creek Chairwoman Catherine McLeod-Seltzer. Not only was she once the business partner of J. David Lowell, the legendary geologist and original financial backer of NIA's Minaurum Silver (TSXV: MGG), but just this past April she was appointed to the board of $20+ billion market cap Teck Resources (TECK), the owner of Canada’s largest producing copper mine, the Highland Valley Copper Mine.

We now have a brand-new stock suggestion for you: GSP Resource Corp (TSXV: GSPR), currently $0.10 per share.

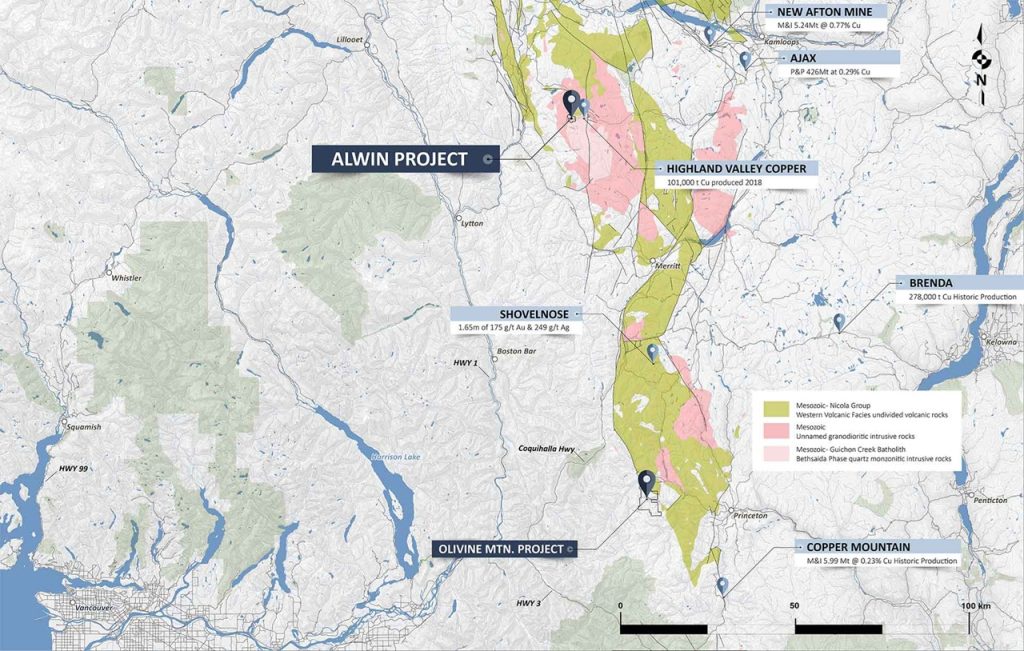

You won’t believe this, but GSPR controls the Alwin Mine Project, a past-producing high-grade copper/gold/silver mine located directly adjacent to Teck’s Highland Valley Copper Mine. This is one of the most strategically located brownfield exploration projects in Canada, and almost nobody is paying attention yet. Despite its location, GSPR trades at a market capitalization of only ~CAD$5 million, a valuation disconnect we rarely see at this stage.

Importantly, in 2024, GSPR drilled into multiple zones of ultra high-grade copper/gold/silver mineralization, including:

- 2.41% Cu, 35 g/t Ag, and 0.68 g/t Au over 17.4 metres

- Including a higher-grade core of 4.11% Cu, 60 g/t Ag, and 0.95 g/t Au over 8.4 metres

- Plus a brand-new discovery of 5.04 g/t Au and 1.01% Cu over 7.90 metres, located outside the current pit shell

This isn’t a greenfield concept. It is a de-risked brownfield project beside Teck’s mine, with historical production, infrastructure already in place, and 50,000+ metres of historic drilling that would cost approximately US$20 million to replicate today at $400 per metre.

GSPR already has a published NI 43-101 compliant resource of 1.46 million tonnes, averaging 1.08% copper, containing 34.6 million pounds of copper. With a market capitalization of only ~CAD$5 million, GSPR is trading at less than 10 cents (USD) per pound of copper in the ground, even before assigning any value to its gold and silver.

GSP Resource’s (TSXV: GSPR) Alwin Mine Project is located far closer to Teck Resources’ Highland Valley Copper Mine than the Shovelnose Project. And just this morning, Dundee Corporation, the 20% owner of NIA’s Viva Gold (TSXV: VAU), announced a massive $85 million earn-in agreement on the Shovelnose Project.

If Dundee is willing to commit $85 million to a project that is farther away from the Highland Valley Copper Mine, imagine the strategic value of GSPR’s Alwin Mine Project, which literally sits next door.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA’s President has purchased 100,000 shares of VAU in the open market and can buy or sell shares at any time. NIA’s President has purchased 5,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. NIA has received compensation from GSPR of US$60,000 cash for a six-month marketing contract. This message is for informational and educational purposes only.