Sending Kids to Quality Learing Center vs. Investing into Graphene Company with Model Mayhem CEO

Look, you have the right to invest your hard-earned money into Hydrograph (CSE: HG) whose CEO’s main experience is doing Model Mayhem, just like you have the right to send your kids to the Quality Learing Center. It is your choice. We simply offered a better alternative in Graphene Manufacturing Group (TSXV: GMG), a company with real products that are revolutionizing the world, like its 6-minute charging graphene battery being used by Rio Tinto.

Do we believe GMG will gain as much as Trio-Tech International (TRT) this year? Of course not… TRT is an international AI conglomerate with a 2-for-1 forward split taking place after the close tomorrow!

We are bringing you literally the highest quality, most undiscovered small-cap companies in the world with the largest upside potential.

Nobody has a clue that Energy Transition Minerals (ASX: ETM) has just hired Jefferies as investment banker for a U.S. listing. When the NASDAQ listing takes place later this year, ETM will instantly become a $1 billion+ market cap company — that is a 100% fact.

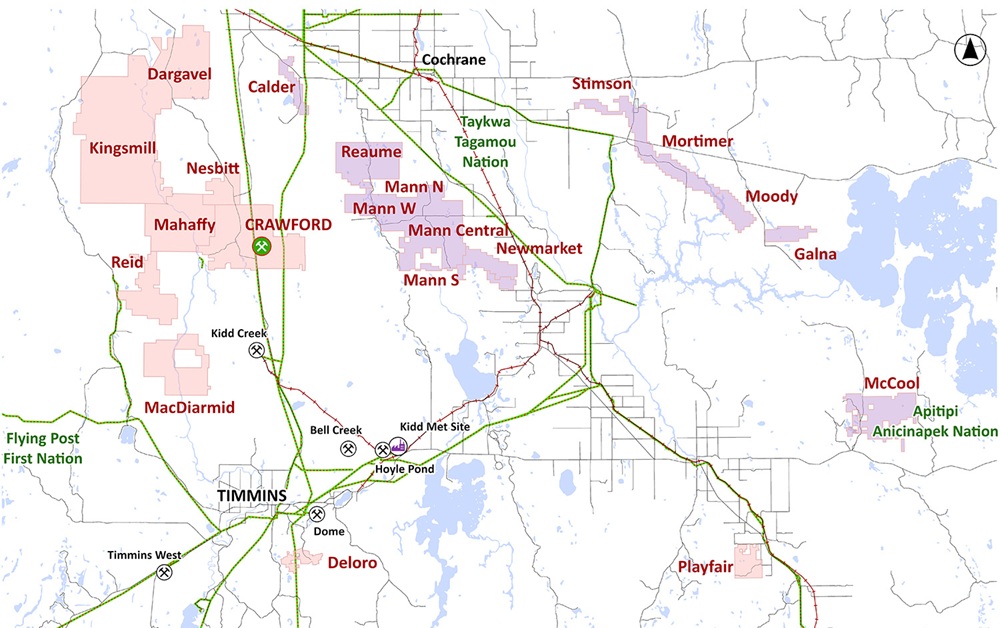

Canada Nickel Company (TSXV: CNC)’s Crawford is already the second largest nickel sulfide resource in the world, but Crawford is likely to be surpassed in 2026 by the Mann West/Mann Central nickel sulfide projects owned by East Timmins Nickel, a joint venture between Noble Mineral Exploration (TSXV: NOB) and CNC. NOB also owns a 2% NSR royalty in MacDiarmid, where CNC made a huge nickel discovery last summer. Take a look at the map below — MacDiarmid is adjacent to Kidd Creek, the world’s deepest base metal mine:

NOB also owns a 2% NSR royalty in Mahaffy, which is directly adjacent to Crawford. Plus, NOB owns many CNC shares and is the largest Homeland Nickel (TSXV: SHL) shareholder, the company that owns all of Oregon’s best nickel projects.

On Wednesday morning, NIA sent out an alert saying, “We will probably find out within the next 24 hours that Dundee has increased its stake in Viva Gold (TSXV: VAU).” NIA was right as usual. A SEDI filing came out Wednesday evening disclosing that Dundee Corporation purchased 5,240,956 shares of Viva at $0.16 per share. Click here to read NIA’s August 7th alert about NIA’s President buying Viva shares at $0.085 per share, timing its bottom perfectly!

NIA is aware of the recent price action and unusual trading patterns in Celtic plc (LSE: CCP). At this time, NIA is not issuing an update and will not speculate on ownership, trading activity, or potential outcomes. As always, we only discuss positions and outlooks within the context of a formal alert or disclosure-driven event. We have nothing new to disclose beyond what has already been stated historically.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 800,000 shares of ETM and can buy or sell shares at any time. NIA’s President has purchased 100,000 shares of VAU and can buy or sell shares at any time. NIA is receiving compensation from NOB of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.