Articles

AI Datacenters, antimony, copper, ETM, gold, GSPR, HSLV, MGG, Natural Hydrogen, NAU, nickel, NOB, QIMC, rare earth elements, silver, technology, TRT

0 Comments

NIA’s Performance vs. Rest of Market

When you consider the performance of NIA’s stock suggestions compared to the rest of the market and how NIA consistently outperforms most Wall Street Analysts, Hedge Fund Managers, FinTwit Gurus, YouTube Influencers, etc., you would think we would have millions of members by now. But NIA members are selfish and like to keep us to themselves — and that’s perfectly understandable.

If Richard Warke did an interview similar to Eric Sprott where he talked about how he was inspired by the “greatest of all time” mine finder J. David Lowell and how companies like Arizona Mining, Ventana Gold, Augusta Gold, Augusta Resource Corp., etc. get acquired at massive premiums, it wouldn’t be possible to research Highlander Silver (TSX: HSLV) and Minaurum Silver (TSXV: MGG) at these dirt-cheap prices anymore.

If everybody knew about NIA, it wouldn’t be possible to research any of our stock suggestions at dirt-cheap prices!

Ever since NIA’s October 6th suggestion of Trio-Tech International (TRT), it has strongly outperformed Aehr Test Systems (AEHR), the S&P 500, and the NASDAQ Composite:

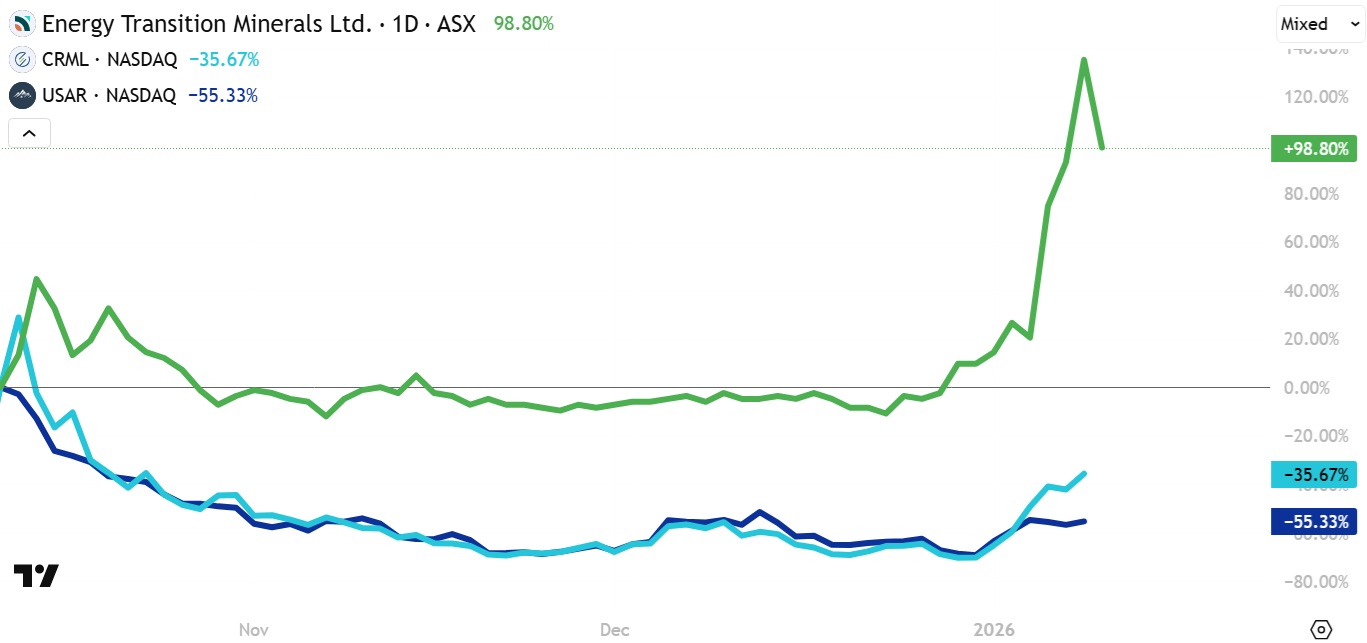

Ever since NIA’s October 13th suggestion of Energy Transition Minerals (ASX: ETM), it has strongly outperformed Critical Metals (CRML) and USA Rare Earth (USAR):

Ever since NIA’s October 28th suggestion of NevGold (TSXV: NAU), it has strongly outperformed United States Antimony (UAMY), Perpetua Resources (TSX: PPTA), Americas Gold and Silver (TSX: USA), the TSX Venture Composite Index, and the S&P 500:

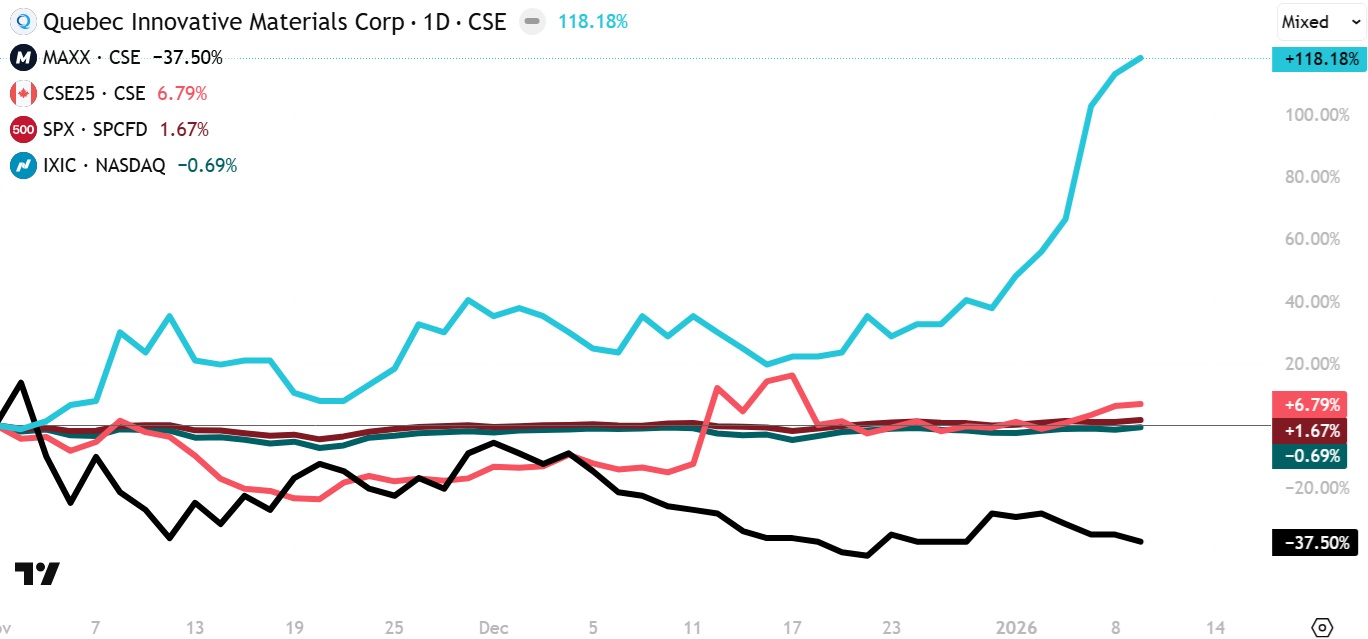

Ever since NIA’s November 4th suggestion of QI Materials (CSE: QIMC), it has strongly outperformed Max Power Mining (CSE: MAXX), the CSE25 Index, the S&P 500, and the NASDAQ Composite:

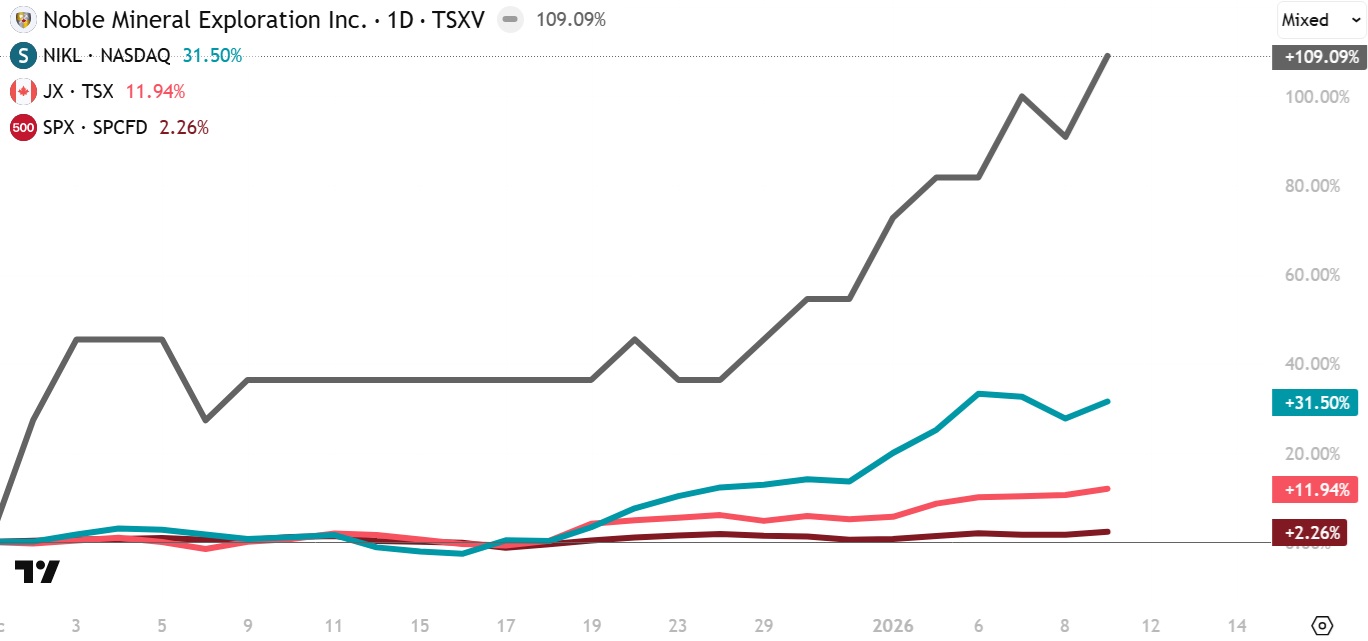

Ever since NIA’s December 2nd suggestion of Noble Mineral Exploration (TSXV: NOB), it has strongly outperformed Sprott Nickel Miners ETF (NIKL), the TSX Venture Composite Index, and the S&P 500:

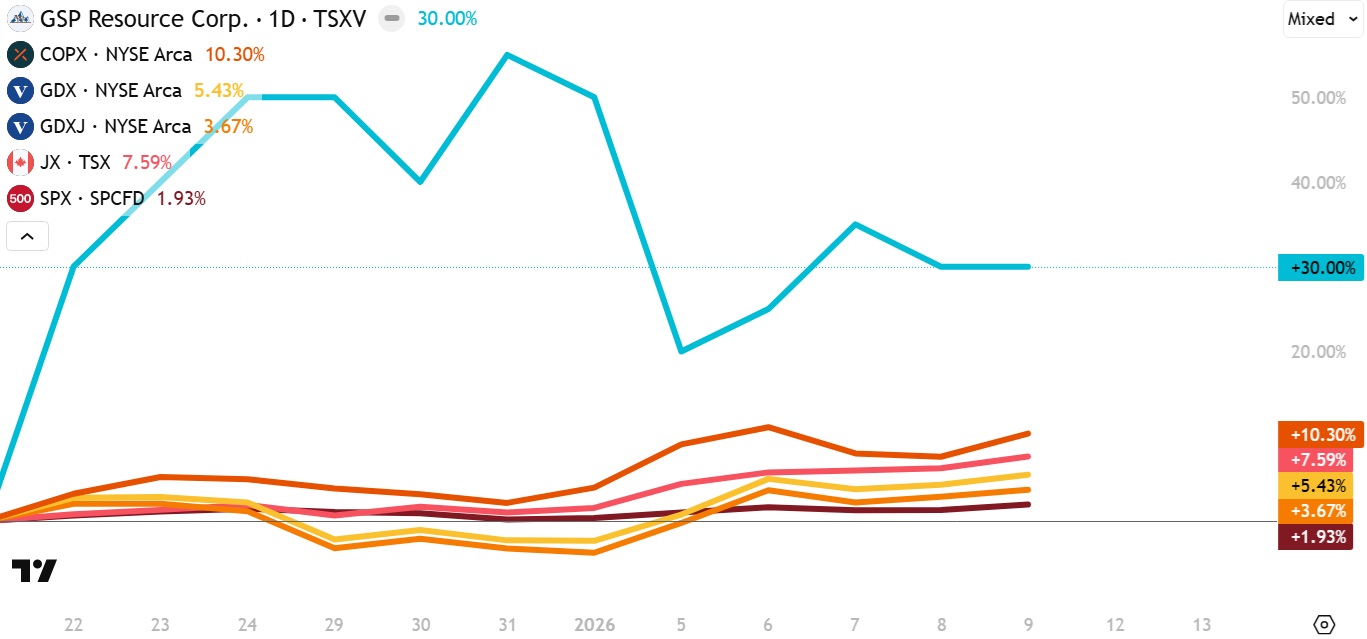

Ever since NIA’s December 22nd suggestion of GSP Resource (TSXV: GSPR), it has strongly outperformed Global X Copper Miners ETF (COPX), VanEck Gold Miners ETF (GDX), VanEck Junior Gold Miners ETF (GDXJ), the TSX Venture Composite Index, and the S&P 500:

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 125,000 shares of HSLV and may buy or sell shares at any time. NIA’s President has purchased 1,200,000 shares of ETM and can buy or sell shares at any time. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. NIA has received compensation from NAU of US$100,000 cash for a twelve-month marketing contract. NIA has received compensation from QIMC of US$50,000 cash for a six-month marketing contract. NIA is receiving compensation from NOB of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. NIA has received compensation from GSPR of US$60,000 cash for a six-month marketing contract. This message is for informational and educational purposes only and does not provide investment advice.