Super Copper Rips Higher on Billionaire-Backed AI Thesis

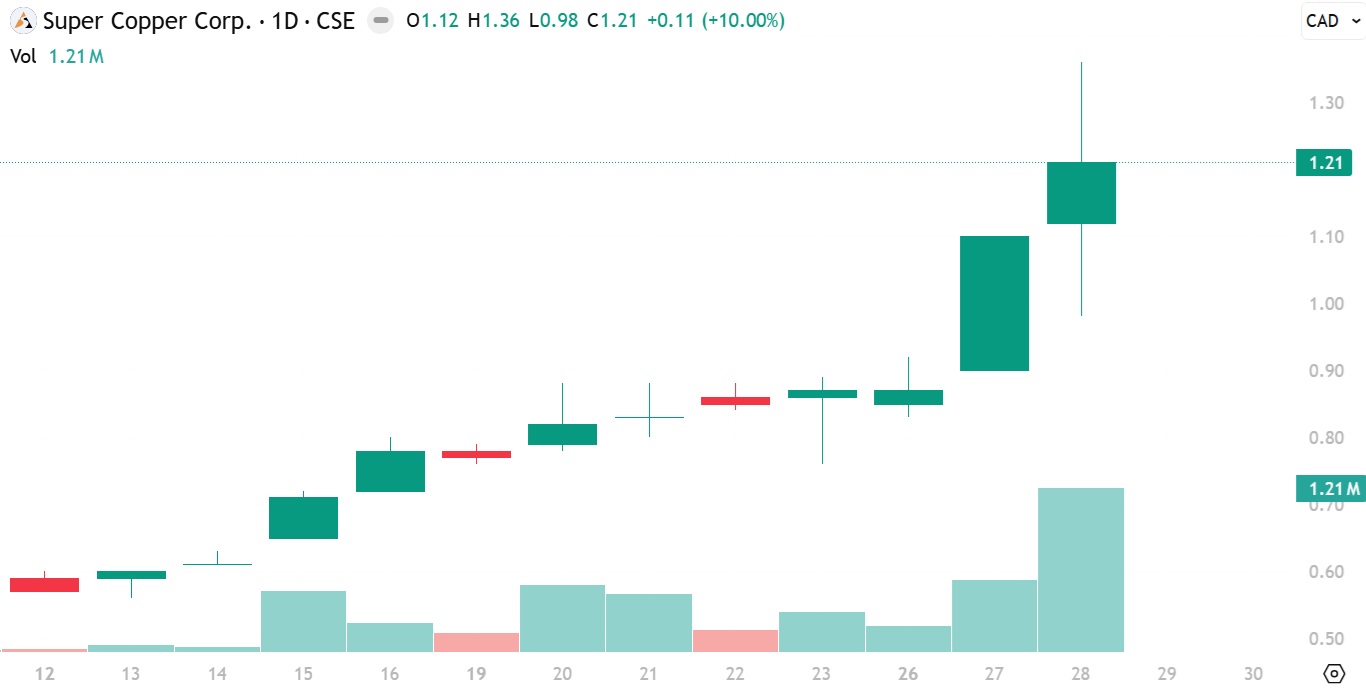

NIA’s latest brand-new stock suggestion, Super Copper (CSE: CUPR), surged by 10% today to a new all-time high of $1.21 per share… and the reason goes far deeper than a single day’s price move.

Super Copper is backed by Apeiron Investment Group, the investment firm led by billionaire Christian Angermayer and closely aligned with Peter Thiel. Apeiron is best known for early, private investments in biotech, crypto, and deep technology… including six companies that later became unicorns. By the time the public had access to those opportunities, valuations were already in the tens of billions of dollars.

Super Copper is different.

It represents one of the very few times public-market investors are able to participate at the ground floor of an Apeiron thesis… and notably, it is only the second natural-resource investment Apeiron has ever made.

That fact alone should get investors’ attention.

Apeiron’s Strategy: Owning the Physical Bottlenecks to AI

Christian Angermayer has been explicit about how Apeiron views the future. Artificial intelligence… especially when paired with robotics… is not just another technology cycle. It is a civilizational shift, one that will eliminate large portions of human labor while unleashing an unprecedented economic and infrastructure boom.

But Angermayer emphasizes a critical reality that most investors overlook: AI cannot exist without massive amounts of reliable energy… and the physical materials required to generate and deliver that energy.

This belief led Apeiron to create a new investment vertical called “Natural Resources (Tech)”, not mining for mining’s sake, but hard assets that become more valuable as AI scales.

Uranium is required to generate power.

Copper is required to deliver power.

Apeiron’s first investment in this new vertical was Uranium Digital, a privately held company modernizing the uranium market through a 24/7 transparent spot market for nuclear fuel. That investment addresses power generation.

Super Copper addresses the other half of the equation: power delivery.

No matter how much electricity is produced… nuclear or otherwise… it is useless without copper. Copper is the metal that physically moves power through transmission lines, substations, transformers, data centers, AI compute clusters, factories, and defense systems.

This is why Apeiron’s second natural-resource investment is copper… and specifically, Super Copper.

Apeiron does not invest in commodities for short-term price exposure. It invests in structural bottlenecks.

Copper demand is accelerating due to AI data centers, electrical grid upgrades, electrification of transport and industry, and national defense requirements… while new copper supply remains constrained by declining ore grades and 15+ year mine development timelines.

This imbalance creates a rare asymmetric opportunity… rising long-term demand versus structurally inelastic supply.

Super Copper gives public-market investors early exposure to the same AI infrastructure bottlenecks that elite private capital typically accesses behind closed doors.

Past performance is not indicative of future results. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received US$30,000 cash from CUPR for a three-month marketing contract. This communication is for informational and educational purposes only.