NIA Update on Gold & Silver ETF Ownership

If you assumed that iShares Silver Trust (SLV) ownership must have hit new all-time highs last week… you would be completely wrong. Surprisingly, SLV ownership hit a medium-term peak on December 22nd of 588.45 million shares outstanding and has since declined by 6.45% to only 550.50 million shares outstanding. SLV ownership reached an all-time high back on February 2, 2021, of 729.1 million shares outstanding, and has since declined by 24.50%.

If you assumed that SPDR Gold Shares (GLD) ownership must have hit new all-time highs last week… you would be completely wrong. Shockingly, GLD currently has 380.1 million shares outstanding, which remains slightly below its medium-term peak from back on April 19, 2022, of 381.3 million shares outstanding… approximately six weeks after gold hit a March 8, 2022, "double-top" of $2,070 per oz.

In fact, after gold initially topped out on August 7, 2020, at $2,075 per oz, GLD ownership peaked on September 21, 2020, at 437.8 million shares outstanding… slightly below GLD’s all-time high ownership of 449 million shares outstanding set on December 7, 2012. GLD ownership remains 13.18% below its 2020 high and 15.35% below its 2012 all-time high!

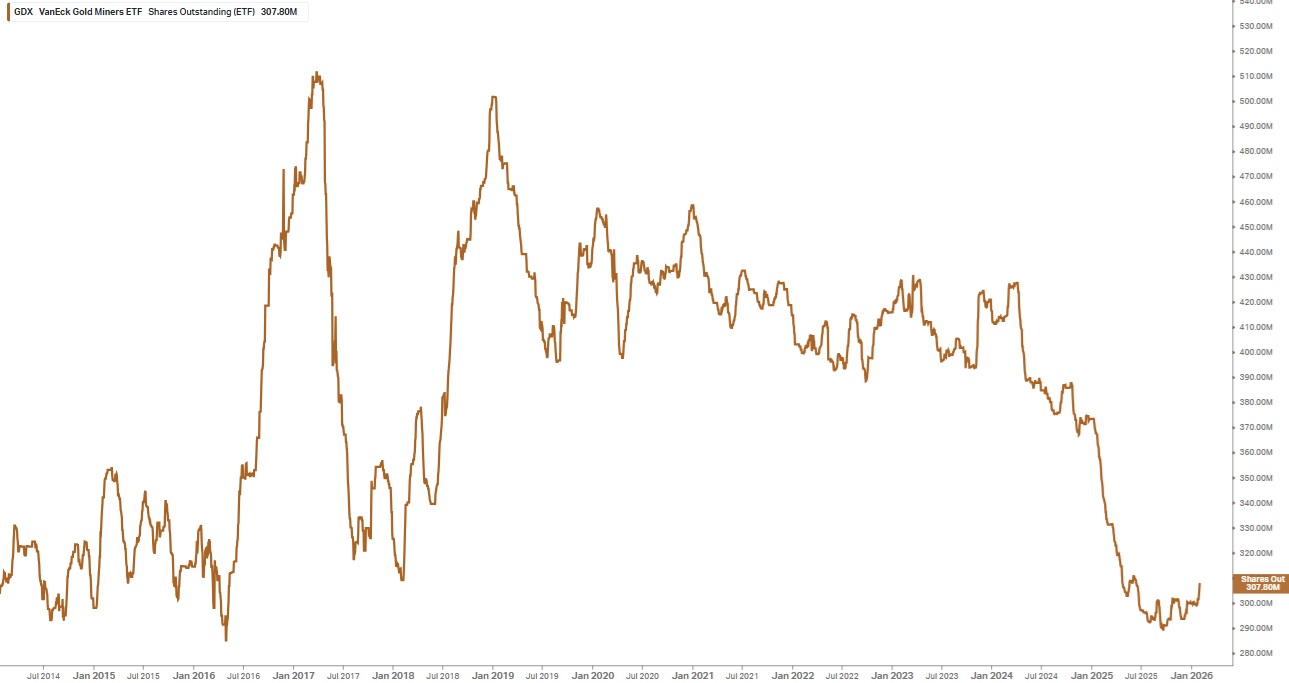

The largest gold miner ETF is VanEck Gold Miners (GDX) and its ownership currently sits near record lows with only 307.8 million shares outstanding!

On September 19th, GDX ownership hit a new 9-year low of 289.6 million shares outstanding and has since increased by 6.28%, but remains down by 14.13% from a year ago. From its April 4, 2024 level of 427.7 million shares, ownership has declined by 28.03% in just 22 months.

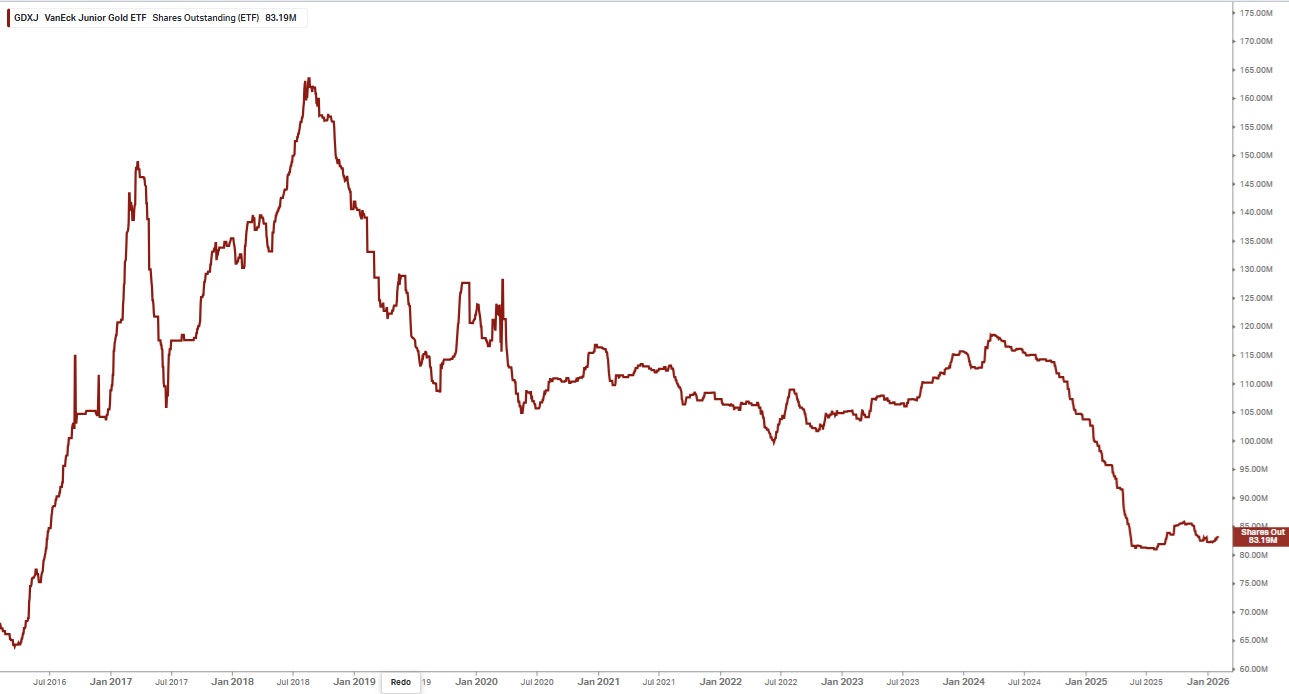

The second largest gold miner ETF is VanEck Junior Gold Miners (GDXJ), with ownership sitting near decade lows at just 83.19 million shares outstanding.

From its April 3, 2024 level of 118.59 million shares, GDXJ ownership has collapsed by 29.85% in 22 months and now sits 49.13% below its August 2018 all-time high of 163.54 million shares.