First Mining Intercepts 2.01 g/t Au over 29.8m

First Mining Reports Continued Drilling Success at its Miroir Discovery with 2.01 g/t Au over 29.8 m

First Mining Gold Corp. (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG)

Date: Nov 10, 2025, 07:00 ET

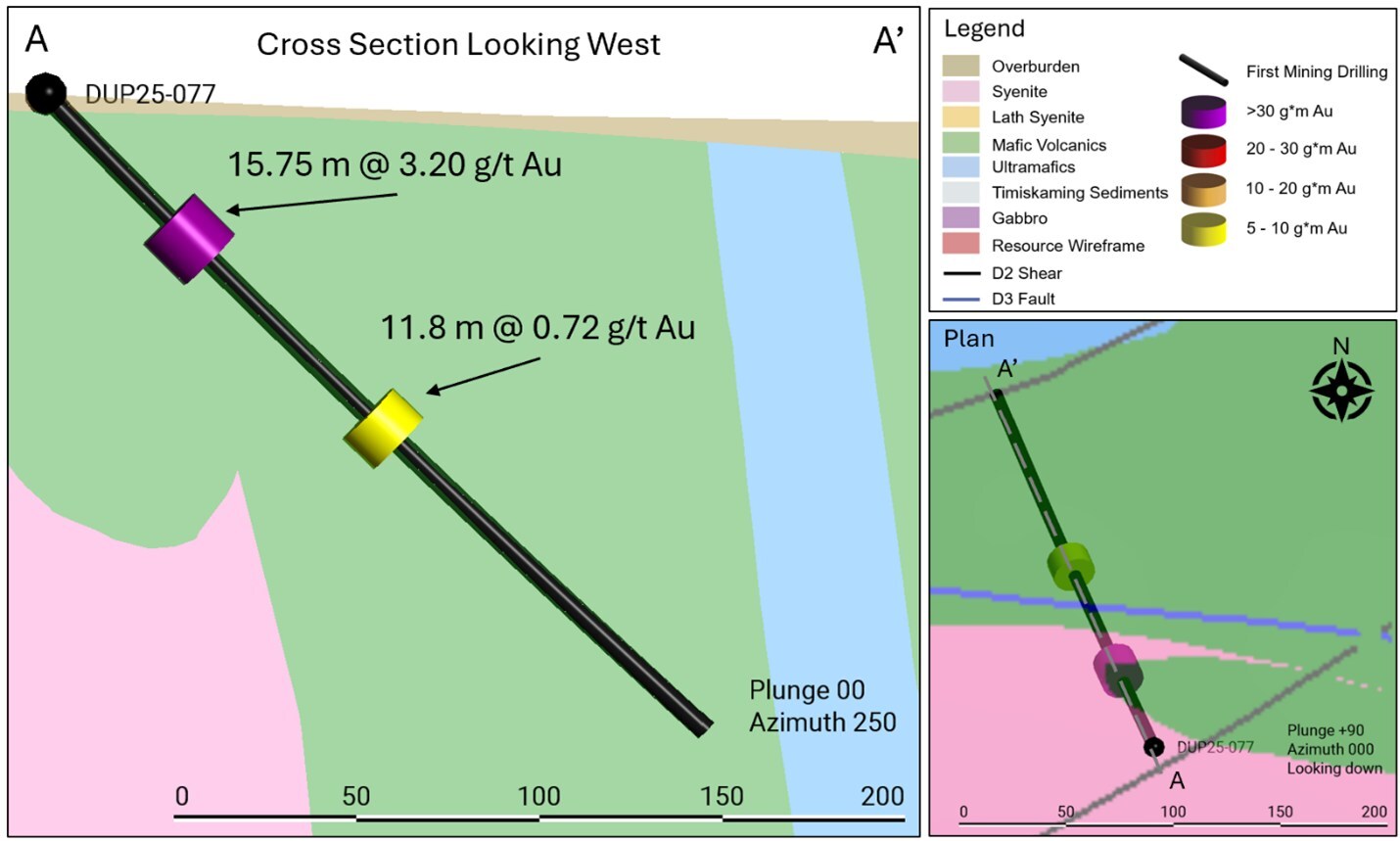

- DUP25-077 — 3.20 g/t Au over 15.75 m, including 5.21 g/t Au over 8.65 m and 22.50 g/t Au over 0.7 m

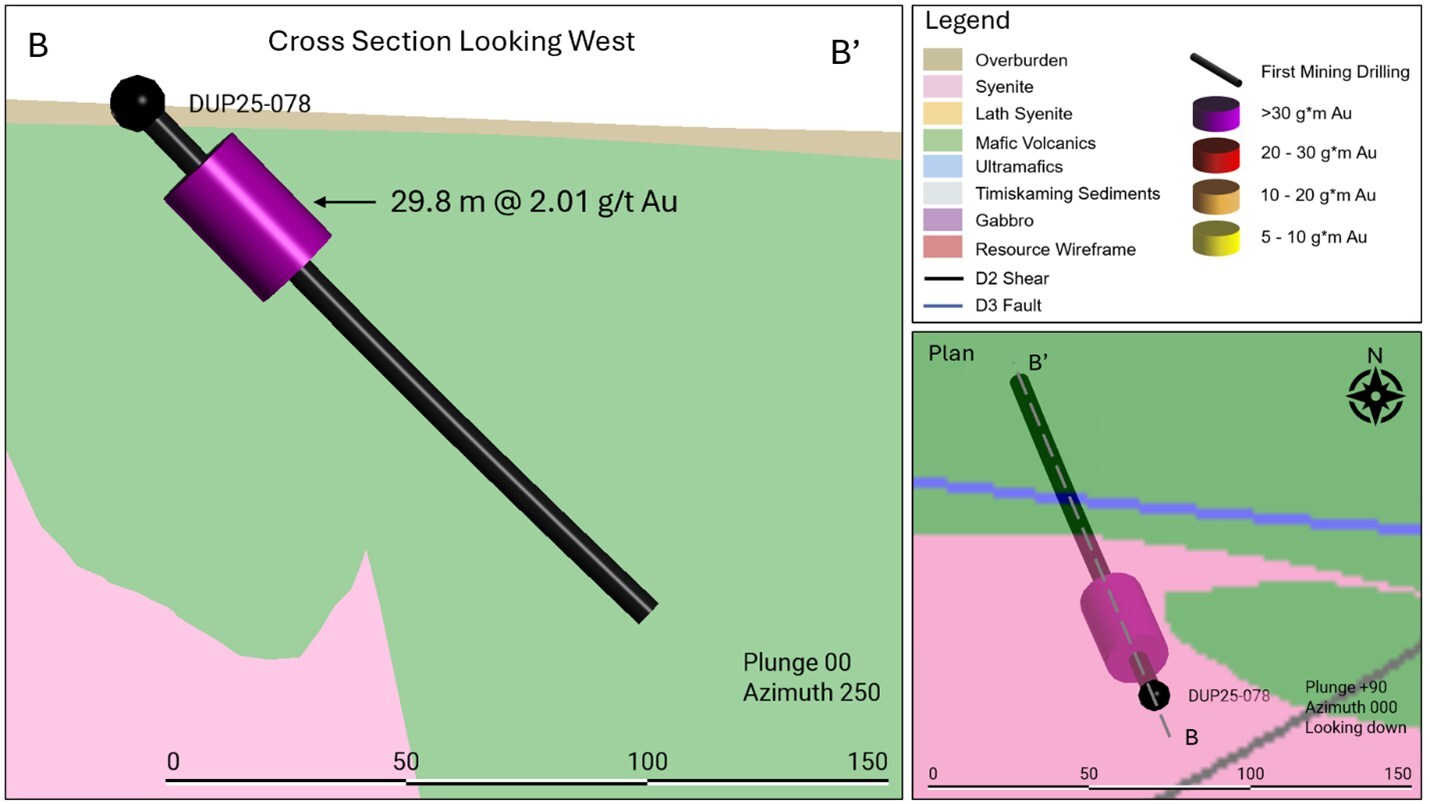

- DUP25-078 — 2.01 g/t Au over 29.80 m, including 15.70 g/t Au over 0.75 m and 18.20 g/t Au over 1.0 m

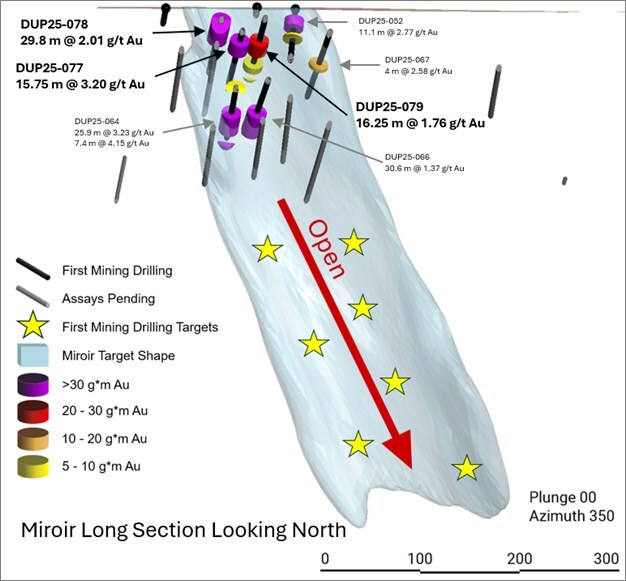

- Miroir target enhanced over 100 m strike & 100 m depth; remains open

VANCOUVER, BC, Nov. 10, 2025 /PRNewswire/ — First Mining Gold Corp. (“First Mining” or the “Company”) is pleased to announce additional results from the 2025 exploration drilling program at its Duparquet Gold Project (“Duparquet Project” or the “Project”) located in the Abitibi region of Quebec, Canada. The Company completed its 2025 drilling program at the Project in October, comprising 16,577 m of drilling. These latest drilling results are from the Miroir target, a high priority discovery zone first intersected in the 2024 drill program (hole DUP24-048) and further drill tested this year.

The latest results have enhanced the Miroir target over a strike length of ~100 m and a depth of ~100 m, where the target remains open. A total of 22 holes have been drilled at Miroir to date, with assay results from 14 of these holes now disclosed. Assay results from the remaining 8 holes drilled at Miroir during the 2025 program are pending and will be provided as results are received and interpreted.

Table 1: Latest Significant 2025 Drill Intercepts — Miroir Target

| Hole ID | From (m) | To (m) | Length (m) | Grade (Au g/t) | Notes |

|---|---|---|---|---|---|

| DUP25-077 | 48.2 | 63.95 | 15.75 | 3.20 | |

| DUP25-077 | 54.0 | 62.65 | 8.65 | 5.21 | inc. |

| DUP25-077 | 56.5 | 57.2 | 0.70 | 22.50 | and inc. |

| DUP25-077 | 124.7 | 136.5 | 11.80 | 0.72 | |

| DUP25-078 | 18.0 | 47.8 | 29.80 | 2.01 | |

| DUP25-078 | 21.55 | 22.30 | 0.75 | 15.70 | inc. |

| DUP25-078 | 46.80 | 47.80 | 1.00 | 18.20 | inc. |

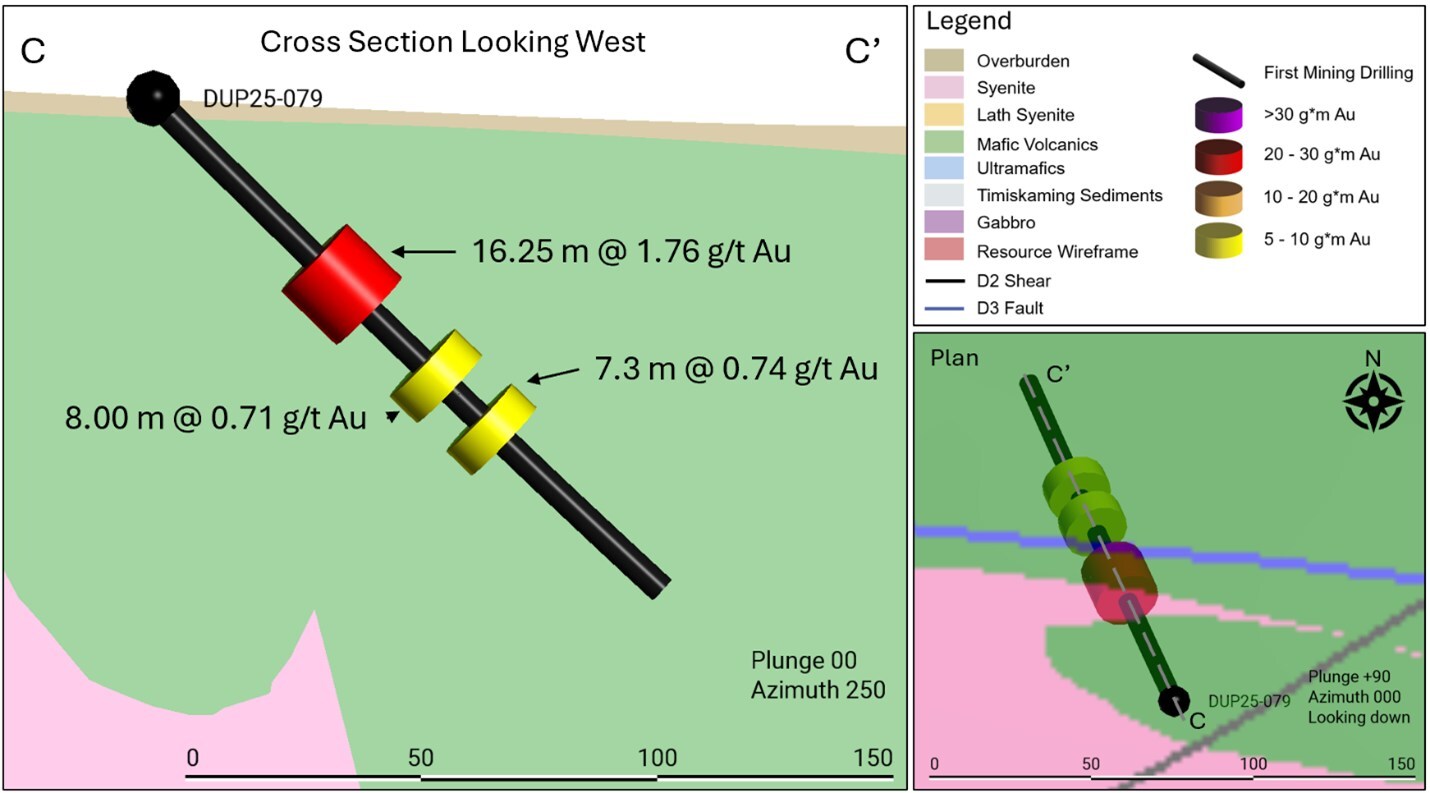

| DUP25-079 | 48.0 | 64.25 | 16.25 | 1.76 | |

| DUP25-079 | 58.05 | 64.25 | 6.20 | 3.02 | inc. |

| DUP25-079 | 80.0 | 88.0 | 8.00 | 0.71 | |

| DUP25-079 | 96.7 | 104.0 | 7.30 | 0.74 |

Reported intervals are drilled core lengths; true widths are estimated at 75–85% of the core length. Assay values uncut.

Table 2: Latest Assay Results from 2025 Drill Program — Miroir Target

| Hole ID | From (m) | To (m) | Length (m) | Grade (Au g/t) | Notes |

|---|---|---|---|---|---|

| DUP25-069 | 69.0 | 71.0 | 2.00 | 0.66 | |

| DUP25-069 | 107.25 | 108.80 | 1.55 | 2.94 | |

| DUP25-077 | 8.0 | 9.0 | 1.00 | 2.86 | |

| DUP25-077 | 12.0 | 13.0 | 1.00 | 0.96 | |

| DUP25-077 | 42.95 | 44.65 | 1.70 | 0.74 | |

| DUP25-077 | 48.2 | 63.95 | 15.75 | 3.20 | |

| DUP25-077 | 54.0 | 62.65 | 8.65 | 5.21 | inc. |

| DUP25-077 | 56.5 | 57.2 | 0.70 | 22.50 | and inc. |

| DUP25-077 | 91.1 | 92.9 | 1.80 | 0.60 | |

| DUP25-077 | 101.9 | 102.75 | 0.85 | 0.52 | |

| DUP25-077 | 108.0 | 109.45 | 1.45 | 1.91 | |

| DUP25-077 | 117.15 | 118.1 | 0.95 | 0.46 | |

| DUP25-077 | 124.7 | 136.5 | 11.80 | 0.72 | |

| DUP25-077 | 154.0 | 155.0 | 1.00 | 0.48 | |

| DUP25-077 | 196.0 | 198.0 | 2.00 | 0.80 | |

| DUP25-077 | 208.0 | 214.0 | 6.00 | — | assays pending |

| DUP25-078 | 10.0 | 13.0 | 3.00 | 0.48 | |

| DUP25-078 | 18.0 | 47.8 | 29.80 | 2.01 | |

| DUP25-078 | 21.55 | 22.30 | 0.75 | 15.70 | inc. |

| DUP25-078 | 46.80 | 47.80 | 1.00 | 18.20 | inc. |

| DUP25-078 | 54.0 | 54.7 | 0.70 | 0.82 | |

| DUP25-078 | 111.1 | 111.7 | 0.60 | 1.37 | |

| DUP25-078 | 132.7 | 134.1 | 1.40 | 0.57 | |

| DUP25-079 | 7.7 | 8.45 | 0.75 | 1.43 | |

| DUP25-079 | 43.0 | 45.0 | 2.00 | 0.54 | |

| DUP25-079 | 48.0 | 64.25 | 16.25 | 1.76 | |

| DUP25-079 | 58.05 | 64.25 | 6.20 | 3.02 | inc. |

| DUP25-079 | 80.0 | 88.0 | 8.00 | 0.71 | |

| DUP25-079 | 96.7 | 104.0 | 7.30 | 0.74 |

Reported intervals are drilled core lengths; true widths are estimated at 75–85% of the core length. Assay values uncut.

Table 3: Latest 2025 Drill Hole Locations — Miroir Target

| Hole ID | Azimuth (°) | Dip (°) | Length (m) | Easting | Northing |

|---|---|---|---|---|---|

| DUP25-069 | 0 | -46 | 114 | 633371 | 5374001 |

| DUP25-077 | 335 | -46 | 252 | 633593 | 5374064 |

| DUP25-078 | 336 | -46 | 150 | 633567 | 5374071 |

| DUP25-079 | 335 | -45 | 150 | 633610 | 5374080 |

Collar coordinates in UTM NAD83 Zone 17.

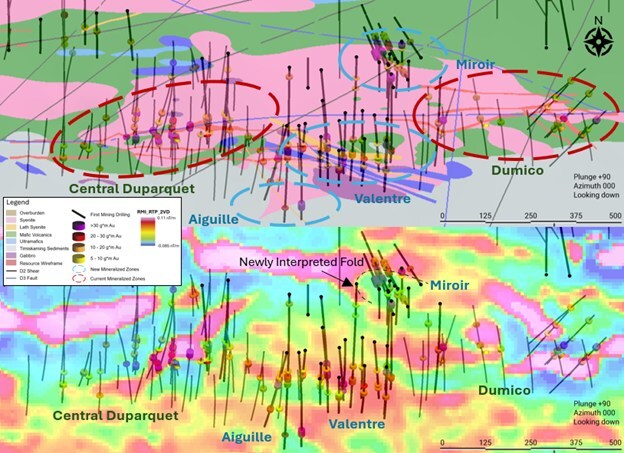

Duparquet 2025 Exploration Program Update and 2026 Outlook

Drilling activities at the Duparquet Project concluded for the year in October, with a total of 16,577 m drilled during the 2025 program. The 2025 field mapping campaign was also completed with a focused regional mapping consisting of 274 outcrops mapped and 308 grab samples including QA/QC. Pending assay results are being returned and the Company will provide further updates upon receipt and interpretation. The Company is reviewing and integrating all 2025 drill results into 3D geological and exploration target models while developing the 2026 exploration programs.

Additional Details on the Miroir Target

2025 drilling further delineated near-surface mineralization discovered in 2024 (e.g., DUP24-048: 3.12 g/t Au over 19.35 m; Jan 20, 2025 NR). Earlier 2025 drilling included DUP25-052: 2.77 g/t Au over 11.1 m (incl. 4.36 g/t Au over 6.5 m; May 28, 2025 NR), and DUP25-064: 3.23 g/t Au over 25.9 m (incl. 11.20 g/t Au over 2.0 m; incl. 10.16 g/t Au over 1.4 m; Sept 24, 2025 NR). The interpreted geophysical fold target continues to show continuity and growth potential.

Mineralization is typically associated with syenite–basalt contacts, hosted within brecciated silica-altered syenite and basalt, with ~2–5% very fine disseminated to fracture-controlled bronze pyrite and thin smoky dark quartz veinlets. Intercepts correlate with D2 deformation zones and a geophysically inferred folded basalt–syenite contact striking NE–SW and plunging east. Downhole intercepts tie to a grey porphyritic, silicified syenite with ~2–5% very fine pyrite, consistent with the Central Duparquet syenite unit south of the target (see Figures 3–5).

About the Duparquet Gold Project

The Duparquet Project is in the southern Abitibi Greenstone Belt, ~50 km north of Rouyn-Noranda, with excellent access to workforce and infrastructure (road, rail, hydroelectric power). It currently hosts an NI 43-101 compliant gold resource of 3.44 Moz Measured & Indicated (1.55 g/t Au) and 2.64 Moz Inferred (1.62 g/t Au). A Preliminary Economic Assessment (“PEA”) was completed in 2023.

Further details: “NI 43-101 Technical Report: Preliminary Economic Assessment, Duparquet Gold Project, Quebec, Canada” dated Oct 20, 2023 (G Mining Services Inc.), available on SEDAR+.

The Project totals ~5,800 ha over ~19 km of strike along the Destor–Porcupine Fault Zone, including the past-producing Beattie, Donchester and Duquesne mines, and the Central Duparquet, Dumico and Pitt Gold deposits.

Analytical Laboratory & QA/QC

All sampling follows First Mining’s QA/QC protocols, including certified reference materials, blanks and duplicates. 2025 core samples were prepared at AGAT Val-d’Or (QC) and analyzed in Thunder Bay (ON) for Au by 50 g fire assay with AAS finish; select holes received multi-element ICP (four-acid digest) at AGAT Calgary (AB). AGAT is ISO/IEC 17025 compliant and meets NI 43-101 assay requirements.

Qualified Person

James Maxwell, P.Geo., VP Exploration & Project Operations, is the “Qualified Person” under NI 43-101 and has reviewed and approved the technical disclosure herein.

About First Mining Gold Corp.

First Mining is a gold developer advancing two of the largest gold projects in Canada: the Springpole Gold Project (northwestern Ontario) — Feasibility Study in progress and EIS/EA submitted in Nov 2024 — and the Duparquet Gold Project (Quebec), a PEA-stage development project on the Destor–Porcupine Fault Zone. First Mining also owns the Cameron Gold Project (Ontario) and a 30% interest in the Pickle Crow Gold Project. First Mining was established in 2015 by Keith Neumeyer, founding President & CEO of First Majestic Silver Corp.

ON BEHALF OF FIRST MINING GOLD CORP.

Daniel W. Wilton, Chief Executive Officer & Director

Disclosure & Disclaimer: Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. This message is for informational and educational purposes only and does not provide investment advice.