Heliostar Announces PEA for Ana Paula Underground with Strong Economics and Sustainable Cash Generation

Heliostar Announces PEA for Ana Paula Underground with Strong Economics and Sustainable Cash Generation

Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF) (FSE: RGG1)

Date: November 6, 2025 – 6:30 AM EST

- Base Case: US$426M post-tax NPV₅, 28.1% IRR, 2.9-year payback at US$2,400/oz Au

- Upside Case: US$1.01B post-tax NPV₅, 51.3% IRR, 1.9-year payback at US$3,800/oz Au

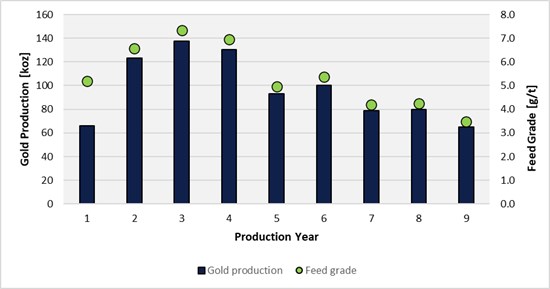

- 874,700 oz Au over 9-year mine life averaging 101 koz/yr after ramp-up

- Life-of-mine AISC: US$1,011/oz (lowest 13% globally) with US$300M CAPEX

- Average annual after-tax FCF: US$93.8M @ US$2,400/oz Au (US$168M @ US$3,800/oz)

- Plan to bring Ana Paula into production in 2028 following Feasibility Study

VANCOUVER, BC — Heliostar Metals Ltd. (“Heliostar” or the “Company”) is pleased to announce the results of a Preliminary Economic Assessment (“PEA”) evaluating the potential for underground mine development at the Ana Paula Project in Guerrero, Mexico.

Heliostar CEO Charles Funk commented: “Today’s PEA demonstrates Ana Paula can be a low-CAPEX, high-margin gold mine… we are excited at the prospect of bringing Ana Paula into production as a robust free-cash-flow-generating mine that will underpin Heliostar’s share price for the next decade.”

Ana Paula PEA Mineral Resource Estimate

| Classification | Kilotonnes (kt) | Gold Grade (g/t) | Contained Gold Ounces |

|---|---|---|---|

| Measured | 1,300 | 7.60 | 317,000 |

| Indicated | 2,970 | 4.44 | 424,000 |

| Measured & Indicated | 4,270 | 5.40 | 742,000 |

| Inferred | 4,040 | 3.96 | 514,000 |

Reported insitu using 2014 CIM standards; effective date July 30, 2025; cutoff 2.10 g/t Au. Not Mineral Reserves; economic viability not demonstrated.

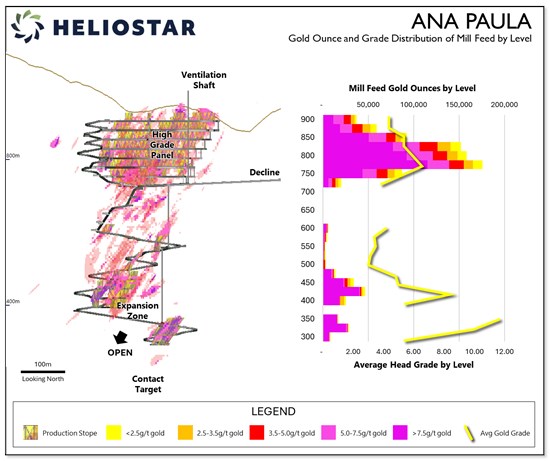

Ana Paula PEA Mill Feed Inventory

| Classification | Kilotonnes (kt) | Gold Grade (g/t) | Contained Gold Ounces | Contained Gold Ounces (%) |

|---|---|---|---|---|

| Measured | 1,103 | 8.12 | 288,000 | 30% |

| Indicated | 2,305 | 4.81 | 356,000 | 37% |

| Measured & Indicated | 3,408 | 5.88 | 644,000 | 66% |

| Inferred | 2,024 | 5.04 | 327,000 | 34% |

| Dilution | 193 | – | – | 0% |

| Total | 5,625 | 5.37 | 972,000 | 100% |

Forecast Production Highlights

| Parameter | Value | Units |

|---|---|---|

| Mill Feed (LOM) | 5,625 | kt |

| Gold Grade (LOM) | 5.37 | g/t Au |

| Gold Produced (LOM) | 875 | koz |

| Process Recovery | 90 | % |

| Life of Mine | 9 | years |

| Average Annual Production | 101 | koz/yr |

Forecast Financial Highlights

| Metric | Value | Units |

|---|---|---|

| Average Cash Cost | 923 | US$/oz |

| AISC | 1,011 | US$/oz |

| Initial Capital Cost | 300.1 | M |

| Total Sustaining Capital | 73.2 | M |

| Total LOM Capital | 376.3 | M |

Forecast Return Estimates (by Gold Price)

| Gold Price (US$/oz) | IRR | NPV₅ (US$M) | Payback (yrs) |

|---|---|---|---|

| 2,400 | 28.1% | 426 | 2.9 |

| 3,800 | 51.3% | 1,012 | 1.9 |

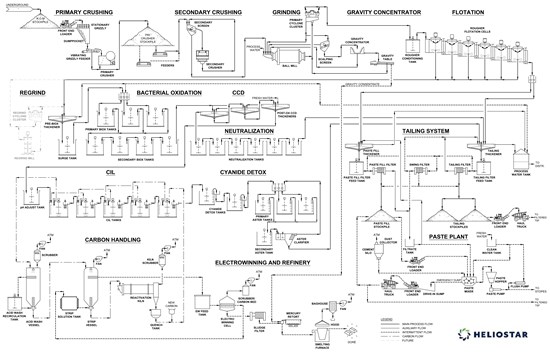

Total Operating Cost Summary

| Operating Costs | US$/oz Au | US$/t feed |

|---|---|---|

| Total Mining | 421 | 64.85 |

| Total Processing | 227 | 34.94 |

| BIOX Processing | 87 | 12.59 |

| G&A | 50 | 7.75 |

| Refinery & Transport | 11 | 1.63 |

| Cash Operating Costs | 709 | 109.17 |

| Production Taxes | 166 | 25.53 |

| Royalties | 48 | 7.36 |

| Total Cash Costs | 922 | 142.06 |

| Sustaining Capital | 84 | 13.01 |

| Total AISC | 1,011 | 155.07 |

Forecast Capital Cost Summary

| Capital Costs | Initial (US$M) | Sustaining (US$M) | Total LOM (US$M) |

|---|---|---|---|

| Underground Mining | 43.4 | 70.1 | 113.5 |

| Process Plant | 61.6 | – | 61.6 |

| BIOX Plant | 45.8 | – | 45.8 |

| Tailings Management | 26.9 | 3.1 | 30.0 |

| Infrastructure | 20.2 | – | 20.2 |

| Power/Substation | 6.2 | – | 6.2 |

| Camp Expansion | 6.8 | – | 6.8 |

| Total Direct Costs | 210.9 | 73.2 | 284.1 |

| Indirects + EPCM + Contingency | 89.2 | 3.0 | 92.2 |

| Total | 300.1 | 76.2 | 376.3 |

Summary Economic Results

| Metric | Units | After Tax | Before Tax |

|---|---|---|---|

| Total Cashflow | US$ M | 631.3 | 903.1 |

| Average Annual Cashflow | US$ M | 70.1 | 100.3 |

| NPV₅ (Base Case) | US$ M | 426.0 | 642.7 |

| IRR | % | 28.1 | 38.0 |

| Payback | Years | 2.9 | 2.4 |

Gold Price Sensitivity Analysis

| Gold Price (US$/oz) | Net Cash Flow (US$M) | NPV₅ (US$M) | IRR (%) | Payback (yrs) |

|---|---|---|---|---|

| 1,600 | 197 | 88 | 10.6 | 4.9 |

| 2,000 | 417 | 259 | 20.0 | 3.5 |

| 2,400 | 631 | 426 | 28.1 | 2.9 |

| 3,000 | 954 | 677 | 38.7 | 2.4 |

| 3,800 | 1,383 | 1,012 | 51.3 | 1.9 |

| 4,000 | 1,490 | 1,096 | 54.2 | 1.8 |

Next Steps

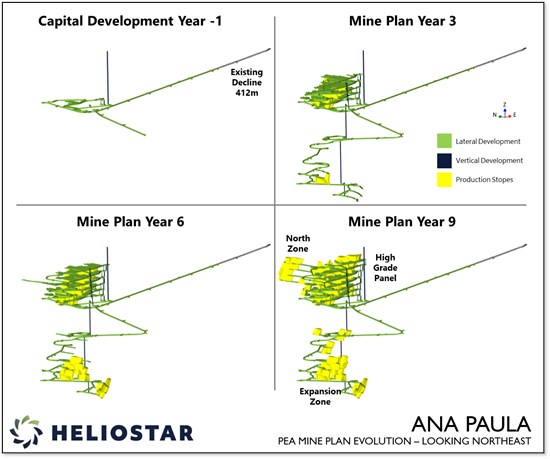

Heliostar has completed 10,909 m of its 15,000 m drill program with assays expected every 4–6 weeks. Objectives include converting Inferred ounces to higher confidence categories, supporting the Feasibility Study, and exploring targets north of the High Grade Panel. A permit amendment will be submitted in Q1 2026 to transition from open-pit to underground operations.

The Company plans to extend its existing 400 m decline by 1.2 km as part of an early works program (~US$15M), funded through free cash flow from its La Colorada and San Agustin mines. This will provide early access, facilitate a bulk sample, and establish underground drill platforms to test extensions down plunge.

About Heliostar Metals Ltd.

Heliostar is a gold mining company operating the La Colorada Mine (Sonora) and San Agustin Mine (Durango), Mexico, with development-stage assets including Ana Paula (Guerrero), Cerro del Gallo (Guanajuato), San Antonio (Baja Sur), and the Unga Project (Alaska, USA).

Contact:

Charles Funk, CEO — charles.funk@heliostarmetals.com — +1 844-753-0045

Rob Grey, IR Manager — rob.grey@heliostarmetals.com — +1 844-753-0045

Disclaimer: Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and could receive up to US$100,000 cash for twelve months. This content is for informational and educational purposes only and does not provide investment advice.