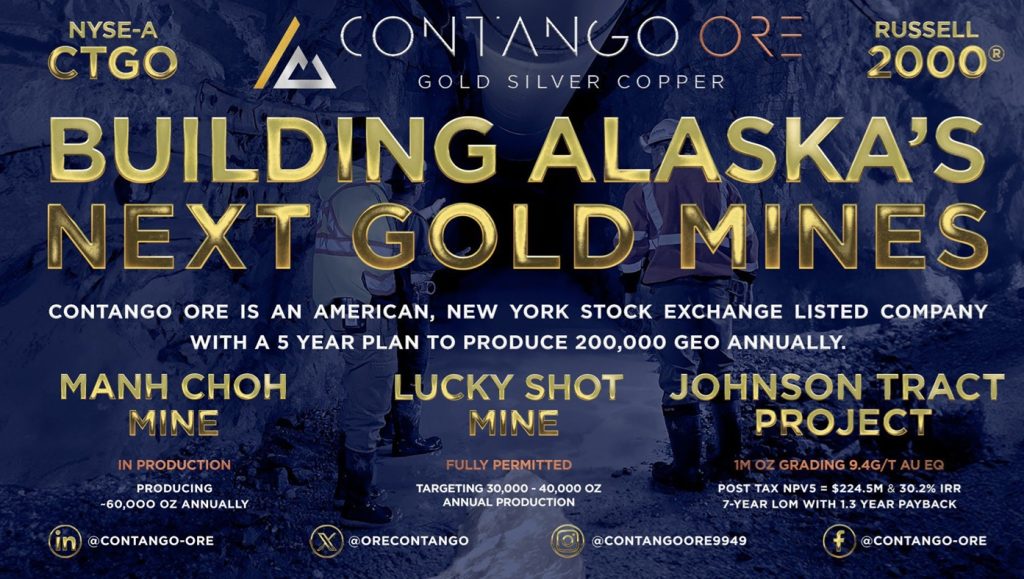

Contango ORE (CTGO) Likely to Generate $100M in 2025 Free Cash Flow

Contango ORE (CTGO) is likely to generate 2025 free cash flow of approximately $100 million up from current trailing twelve-month free cash flow of $44.49 million.

CTGO has a current enterprise value at $22.22 per share of $275.85 million or 6.20x trailing twelve-month free cash flow for the lowest enterprise value/free cash flow ratio in the industry, but just to remain at its current industry low multiple its share price will need to increase to $50.40 per share in the upcoming months. If CTGO remains at $22.22 per share it is likely to soon be trading with an enterprise value of 2.76x free cash flow.

CTGO reduced its net debt from $48.20 million down to $4.47 million in the first half of 2025 for a 90.73% reduction in net debt in the past two quarters! CTGO is on track to have net cash within three years that exceeds its current market cap!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.