Contango ORE (CTGO) Short Sellers Will Get Squeezed

If anybody has been selling Contango ORE (CTGO) short in recent days they will get squeezed.

CTGO has performed well since our initial suggestion, but it remains extremely undervalued:

The only recent CTGO dilution was for the 2024 acquisition of HighGold, owner of Johnson Tract.

CTGO’s last equity offering was over two years ago in July 2023 for 1.6 million shares priced at $19 per share so there has been very little dilution in recent years. CTGO has been rapidly repaying debt and is about to have a positive net cash position.

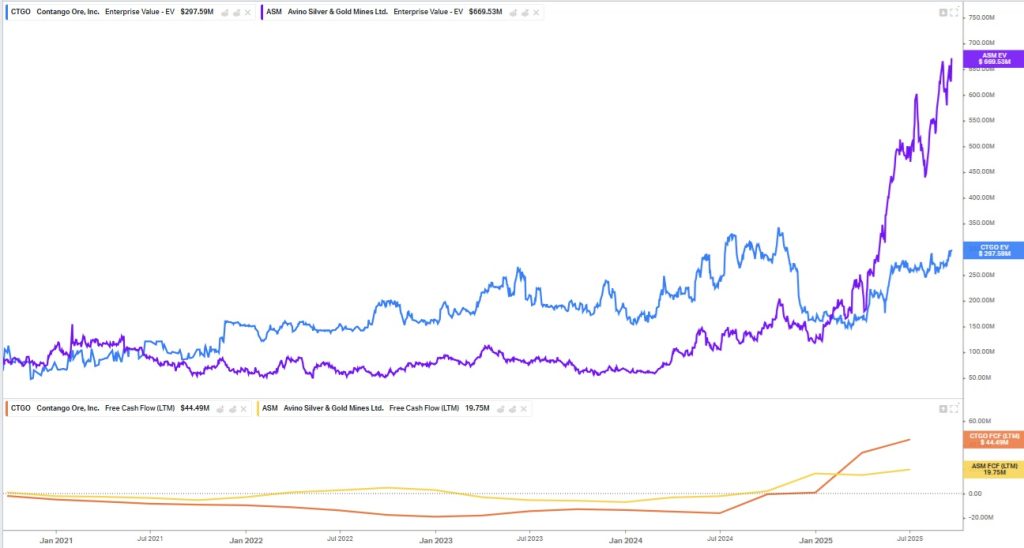

Avino Silver & Gold (ASM) was also added to GDXJ at the close yesterday. ASM has also performed well but moving forward CTGO has much more upside and much less downside risk.

ASM’s enterprise value of $669.53 million is more than double CTGO, but CTGO has more than double ASM’s free cash flow:

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.