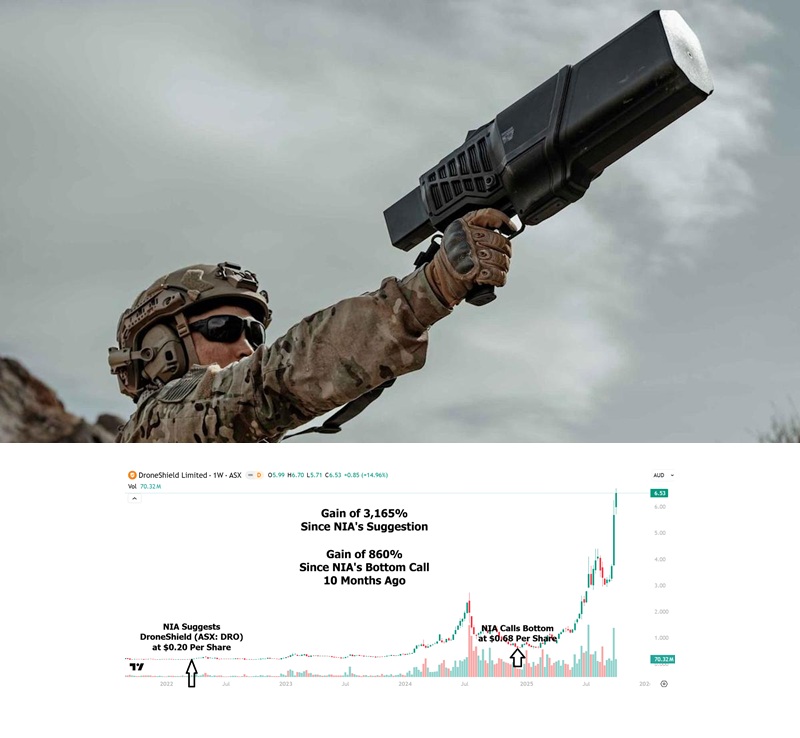

DroneShield (ASX: DRO) Gains 7.76% to $6.53 Up 3,165% Since NIA’s Suggestion

DroneShield (ASX: DRO) gained by 7.76% last night to a new all-time high of $6.53 per share for a gain of 3,165% since NIA's April 3, 2022, suggestion at $0.20 per share. Click here for NIA's initial DRO suggestion alert.

Ten months ago, with DRO at $0.68 per share, NIA sent out an alert saying, "Is DRO undervalued here at $0.68 per share? We much rather buy DRO at an enterprise value of 7.09X revenue than BigBear.ai (BBAI) at an enterprise value of 5.13X revenue or Apple (AAPL) at an enterprise value of 9.51X revenue or Nvidia (NVDA) at an enterprise value of 31.13X revenue. Yes, DRO is undervalued, but they have a lot of cash and want to remain independent." Click here to read NIA's December 5th alert.

Nine months ago, with DRO at $0.75 per share, NIA sent out an alert confirming that the bottom was in saying, "DroneShield (ASX: DRO) has bottomed and looks ready to go. An enterprise value of 7.82x revenue seems very low for a company with 100% growth." Click here to read NIA's December 29th alert.

All future 10-20 baggers will be junior gold, silver, and copper exploration & development stocks. People will chase them to outrageous bubble prices in 2026 that nobody believes possible today.

Over the next 12 months: Nvidia (NVDA) will decline by 50% and Trio-Tech International (TRT) will gain by 300%-500%

Titan Mining (TSX: TI) will be NIA's next 3,000%+ gainer

Contango ORE (CTGO) will be #1 largest gaining producing gold miner of 2026

Viva Gold (TSXV: VAU) will be next Nevada gold explorer to be acquired

Lahontan Gold (TSXV: LG) is the Nevada gold explorer with most upside potential

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA’s President has purchased 200,000 shares of LG in the open market and intends to buy more shares. NIA has received compensation from LG of US$30,000 cash for a three-month marketing contract. NIA’s President has purchased 100,000 shares of VAU in the open market and can buy or sell shares at any time. This message is meant for informational and educational purposes only and does not provide investment advice.