First Mining Gold (TSX: FF) Gains 17.12% to $0.325 (Full Analysis Inside)

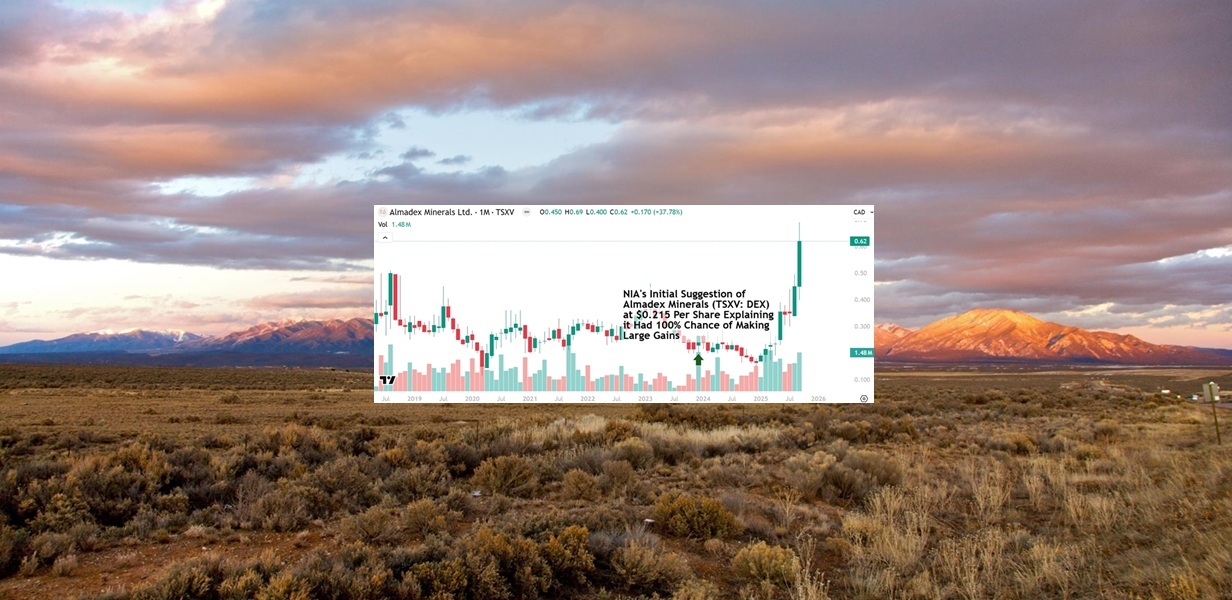

First Mining Gold (TSX: FF) gained by 17.12% today to a new 44-month high of $0.325 per share and has so far gained by 109.68% since NIA's June 1st suggestion at $0.155 per share!

First Mining Gold (TSX: FF)’s Springpole is likely to become Canada’s next major gold project to receive environmental approval, which would allow it to become fully permitted so that it can be developed into Canada’s next major gold mine. Springpole is a large-scale gold project with a long mine-life, which could make it the perfect target for Zijin Gold International after its September 29th IPO on the Hong Kong Stock Exchange (the largest gold IPO of all-time).

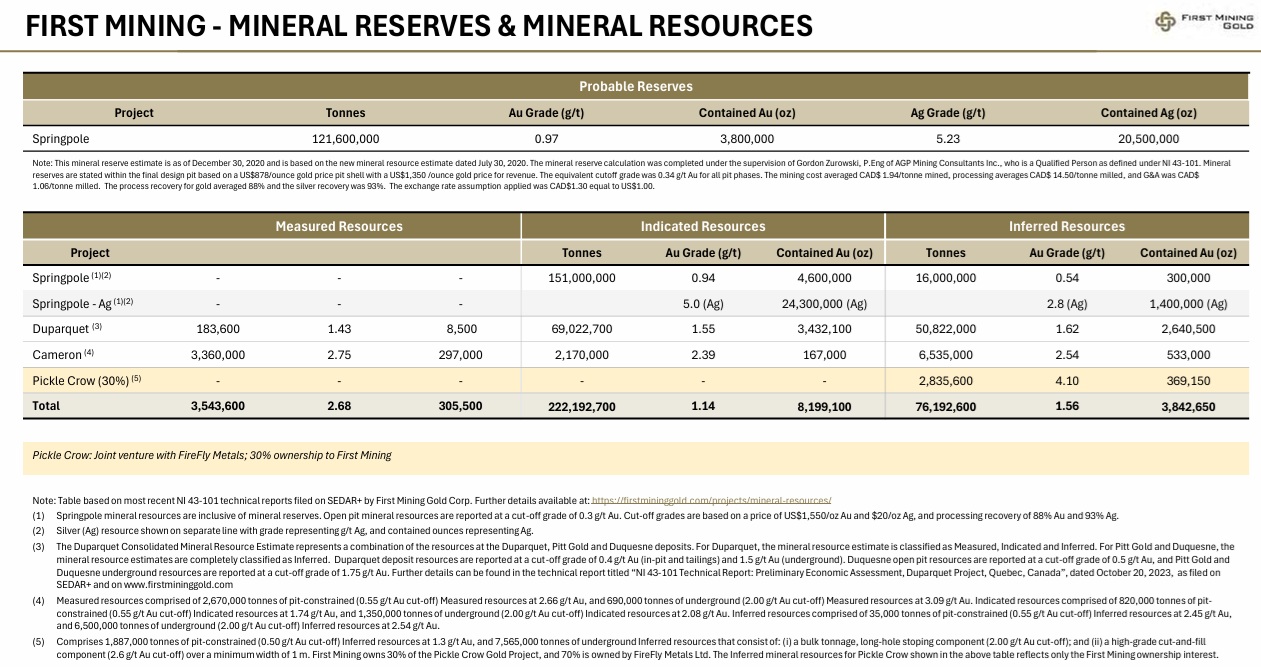

First Mining's Springpole has an indicated resource of 4,600,000 oz gold including a probable reserve of 3,800,000 oz gold plus an additional inferred resource of 300,000 oz gold. First Mining's Duparquet has a measured & indicated resource of 3,440,600 oz gold plus an additional inferred resource of 2,640,500 oz gold. First Mining's Cameron has a measured & indicated resource of 464,000 oz gold plus an additional inferred resource of 533,000 oz gold. First Mining's 30% owned Pickle Crow gives them an attributable inferred resource of 369,150 oz gold.

First Mining has total measured & indicated resources of 8,504,600 oz gold and total inferred resources of 3,842,650 oz gold.

First Mining's market cap here at $0.325 per share is only CAD$415.464 million or USD$301.61 million. First Mining is being valued at only USD$24.42 per oz of gold resources!

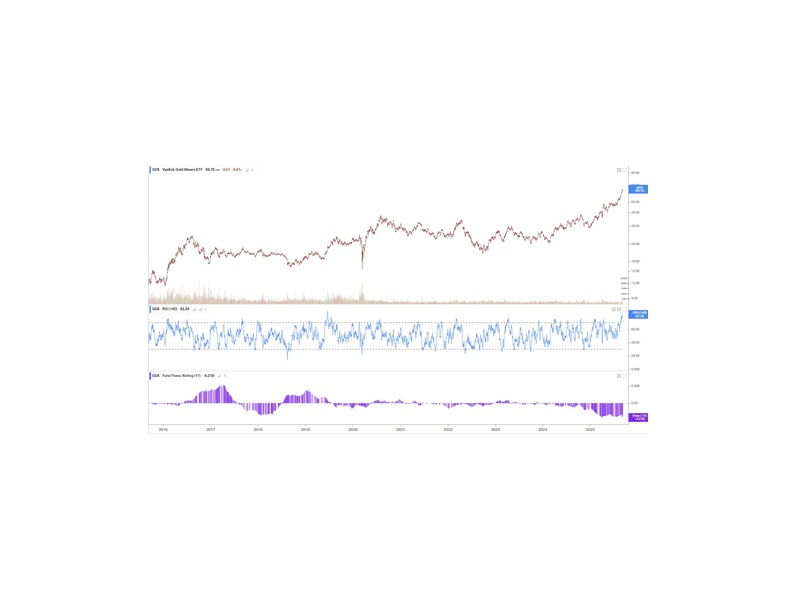

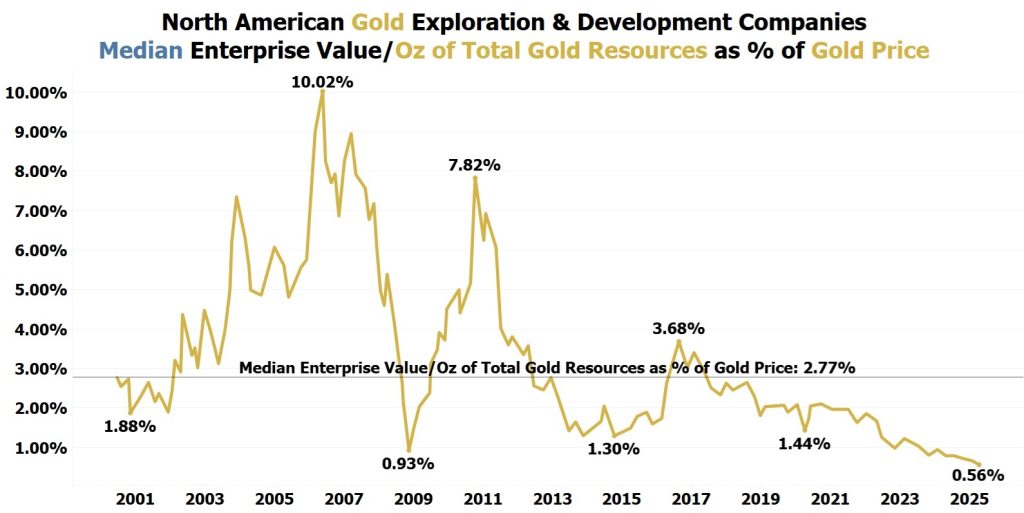

With gold at $3,680 per oz this is equal to 0.66% of the gold price. If you read NIA's September 10th alert by clicking here, you will see how in 2006 the average North American gold exploration & development company had total gold resources worth 10.02% of the gold price. If we return to 2006 levels, First Mining Gold (TSX: FF) could soon trade for US$368.74 per oz of gold resources, which would equal a valuation of US$4.553 billion or CAD$6.273 billion and would value First Mining Gold (TSX: FF) at $4.91 per share.

Do we think we head back to North American gold resources worth 10.02% of the gold price in the short-term? Probably not, but we most likely do within the next 5-6 years.

In the short-term, we most likely return to the long-term median of North American gold resources worth 2.77% of the gold price, which would equal US$101.94 per oz of gold resources. This would equal a valuation of US$1.259 billion or CAD$1.734 billion and would value First Mining Gold (TSX: FF) at $1.36 per share.

If we are considering an investment into a technology stock, we compare it first to First Mining Gold (TSX: FF) and ask ourselves:

Does it have as much upside as First Mining Gold?

Does it have less downside than First Mining Gold?

Is it as undervalued as First Mining Gold?

Does it have a catalyst ahead in the upcoming months as big as First Mining Gold?

If the answer is no, it is impossible for us to get excited about anything else!

We feel bad for the people still buying into Crypto IPOs like Bullish (BLSH) and Gemini (GEMI). They are sheep who will soon get slaughtered. Investors who own Strategy (MSTR) and/or MARA Holdings (MARA) are also about to get completely destroyed.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.