Gold Explorers Won’t Peak Until Bitcoin Collapses

In NIA’s opinion, Michael Saylor’s Strategy (MSTR) and Bitcoin miners like MARA Holdings (MARA) still have 90%+ downside ahead, and the final peak for our gold stock suggestions won’t occur until MSTR and MARA have fully capitulated. Historically, the most explosive gains in gold stocks come after the prior mania sector collapses, which is why several of our top gold selections could ultimately peak at levels 1,000%+ above today’s prices.

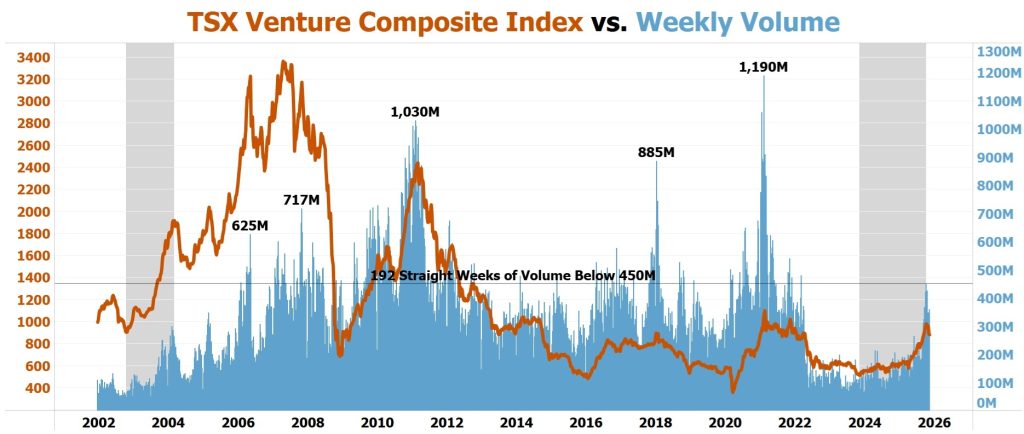

One of the most important signals of where we are in the cycle is trading volume of the TSX Venture Composite Index, which is the most reliable barometer for risk appetite in the junior mining sector.

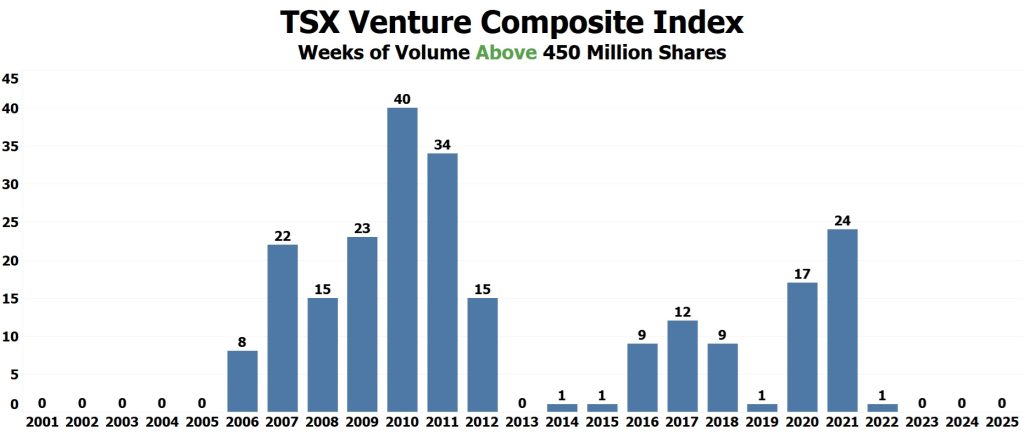

Despite the TSX Venture beginning a new bull market in 2023, it has not produced a single week of trading volume above 450 million shares.

Not one.

For comparison:

2016–2018 (the weakest bull market in TSXV history)

-

30 weeks above 450M

-

19.23% of all weeks

2020–2021 (pandemic stimulus boom)

-

41 weeks above 450M

-

39.42% of all weeks

2010–2011 (the last major gold mania)

-

74 weeks above 450M

-

71.15% of all weeks

Today’s volume levels are below all of these cycles… including the weakest one. This confirms that retail speculation has not yet entered the market, which is exactly what we expect during an early-stage accumulation phase.

The rally off the November 2023 low most closely resembles the low volume 2002–2004 setup, when:

-

The TSX Venture quietly doubled,

-

Pulled back ~25% from a short-term top,

-

And then erupted into a three-year mania that did not peak until 2007… producing some of the largest junior-mining gains of the past 30 years.

The current market environment matches that period almost perfectly.

A low volume doubling is not a late-stage signal… it is the defining characteristic of the early phase before the real money arrives.

Once the TSX Venture begins printing regular weeks above 450M in volume, it will signal the transition from accumulation to expansion… historically the window when:

-

Discoveries begin to gap higher,

-

M&A premiums surge,

-

And the top-performing juniors rise 5x–15x within 12–24 months.

We have not entered that phase yet.

But the setup is now in place.