How Is US Goldmining (USGO) Worth Even 50% of Contango ORE (CTGO)?

Contango ORE (CTGO) remains the world’s #1 most undervalued gold miner that we are extremely confident will be trading significantly higher in one year.

The fact US Goldmining (USGO) is worth even 50% of CTGO’s market cap makes no sense. USGO has no production or cash flow.

It is almost impossible to gain access to USGO’s Whistler Gold Project by road and their gold/copper grades aren’t very high. It will never be developed.

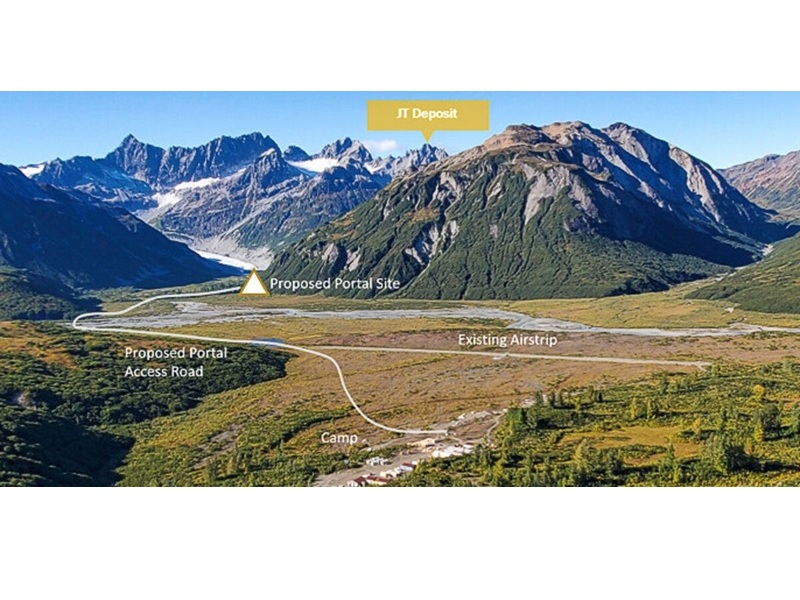

CTGO’s Johnson Tract is one of the highest-grade polymetallic gold projects in all of North America.

One year ago, CTGO received a 404 Permit from the US Army Corps of Engineers for construction of a 2.6-mile (4 km) access road from the camp to the proposed portal and laydown site at Johnson Tract.

Let’s compare the performance of CTGO vs. USGO over the next twelve months.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. This message is meant for informational and educational purposes only and does not provide investment advice.