Important NIA Monday Morning Update

First Mining Gold (TSX: FF) just announced this morning a significant new gold zone discovery at its Duparquet Gold Project in Quebec. Click here to read about it!

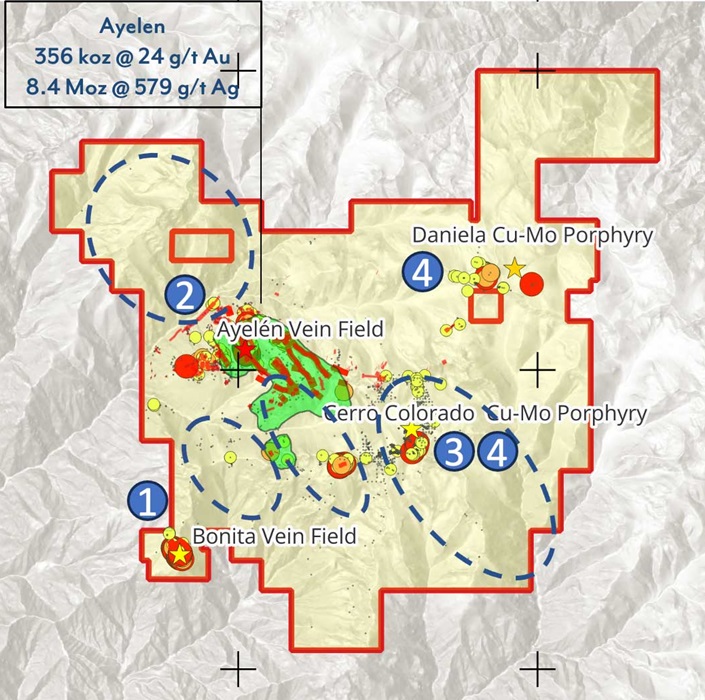

Silver is up another $0.476 this morning to $38.865 per oz! Click here to read NIA's report on our #1 favorite high-grade silver play Minaurum (TSXV: MGG).

NIA will be publishing a brand-new must-read report this week on NIA's latest brand-new stock suggestion that we announced this weekend Heliostar Metals (TSXV: HSTR). The company intends to ramp up production from 31,000-41,000 gold equivalent oz in 2025 to 500,000 oz in 2030 and recently intercepted 242m of 9.06 g/t gold!

Prior to NIA's announcement this weekend of HSTR we announced our last new gold producer stock suggestion Contango ORE (CTGO) on May 14th at $12.85 per share and it gained by 70% in one month to a June 18th high of $21.84 per share. We believe CTGO will soon surpass its all-time high from June 2023 of $33.67 per share.

Last year, NIA suggested gold development company Dakota Gold (DC) at $2.81 per share and it has so far gained by 47.33% to $4.14 per share. DC has a current market cap of US$463.22 million. DC has a heap leachable M&I resource of 3.65 million oz gold grading 0.463 g/t gold.

Augusta Gold (TSX: G) has a heap leachable M&I resource of 1.662 million oz gold with the Bullfrog portion grading 0.53 g/t gold and the Reward portion grading 0.75 g/t gold. Augusta's Reward includes a proven & probable reserve grading 0.86 g/t gold and ranks among the highest-grade fully permitted for construction heap leachable oxide gold reserves worldwide!

DC's market cap equals US$126.91 per oz of heap leachable M&I resources and would value Augusta Gold (TSX: G) at $2.88 per share (after repayment of debt owed to its largest shareholder and Executive Chairman Richard Warke and CEO Don Taylor). In a buyout, both G and DC would likely sell for US$300-$500 per oz. Skeena Resources (SKE) is already worth US$340 per oz, and Eskay Creek isn't heap leachable oxide gold!

The most likely company to acquire Augusta Gold (TSX: G) is $24B AngloGold Ashanti (AU). The most likely company to acquire Dakota Gold (DC) is $6B Coeur Mining (CDE). AU already acquired Sterling from CDE, which is directly adjacent to G's Reward at a valuation of US$165 per oz of inferred resources and gold has doubled since then! The odds are extremely high that AU acquires G in the future for a minimum of US$300 per oz of its total gold resources of 1.92 million oz, which would value G at $8.69 per share.

G is not relying on a buyout and intends to bring Reward into production next year… with construction to begin this year as soon as it announces the completion of financing including a high quality $50 million loan from President Trump's EXIM Bank. Augusta management also runs Titan Mining (TSX: TI) and was the first mining company under Trump's new executive order to successfully secure an EXIM Bank loan. Former House Speaker John Boehner is helping Augusta Gold (TSX: G) finalize and complete the EXIM Bank loan transaction so that construction of Reward can start immediately.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and could receive a total of up to US$100,000 cash for twelve months of coverage. NIA has received compensation from CTGO of US$30,000 cash for a three-month marketing contract. NIA previously received compensation from DC of US$30,000 cash for a marketing contract which has expired. NIA’s President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.