Michael Saylor’s Bitcoin Strategy Is Entering a Death Spiral

On February 26th, NIA issued an alert entitled, 'Michael Saylor Is Slowly Destroying Bitcoin'. Click here to read!

In this alert, NIA said, "Michael Saylor has brainwashed MicroStrategy (MSTR) investors into believing their outstanding convertible notes are risk free."

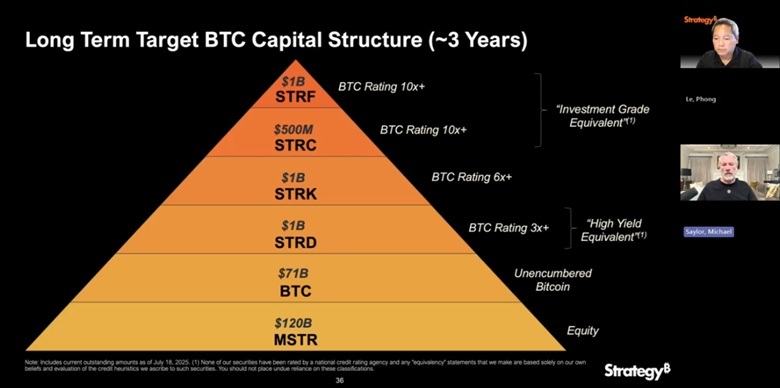

Since NIA's February alert, Michael Saylor has gone full ponzi mode… issuing four new types of preferred stock. This is from an actual Michael Saylor presentation… not only is his capital structure shaped like a pyramid, but if you look at the last letters of his four preferred stock symbols… Saylor is admitting the truth his investors are "FCKD":

The Most Disturbing Part Is the Labels:

"BTC Rating 10×+" and "Investment Grade Equivalent"

These labels are:

- not real ratings

- based on no credit agency

- invented entirely by Saylor

- designed to convince investors that higher layers are “safer”

This is the exact mechanism used by:

- structured products prior to 2008

- crypto lending desks prior to collapse

- high-yield REITs before bankruptcy

- Madoff-like capital waterfalls

They issue senior tranches, then more senior tranches, then “super senior” tranches… all referencing the same underlying assets!