Minaurum Gold (TSXV: MGG): Poised for Growth to 100M Ounces of Silver Resources

Minaurum Gold (TSXV: MGG) has the same co-founders as MAG Silver (MAG), a company acquired last month for US$2.1 billion. MAG's only producing asset was their 44%-owned Juanicipio mine in Mexico, a significant silver–gold–zinc–lead epithermal vein system discovered by Dr. Peter K.M. Megaw (co-founder of MAG and MGG). MGG's Alamos Silver Project is an earlier-stage epithermal vein system with recent holes averaging 220 g/t silver, 0.40% copper, 0.96% lead, and 2.05% zinc, or 365 g/t silver equivalent.

Ever since our success with Power Metallic Mines (TSXV: PNPN), which rose from $0.225 to a high of $1.97 for a gain of 775.56%—or 160 times more than the TSX Venture Composite Index—we have made it a top focus for us to research all high-grade polymetallic projects being advanced by small-cap publicly traded companies worldwide.

Contango ORE (CTGO)'s Johnson Tract is by far our #1 favorite U.S.-based high-grade polymetallic project. CTGO has so far gained 62.1% following the May 14 publication of NIA's CTGO report: click here to read it! Minaurum Gold (TSXV: MGG)'s Alamos Silver Project is by far our #1 favorite Mexican-based high-grade polymetallic project. The average pure silver portion of MGG's recent holes has been 8.18 times higher than PNPN's Lion Zone and 36.67 times higher than CTGO's Johnson Tract.

MGG's chart may not be quite as bullish as First Mining Gold (TSX: FF) at this exact moment, but give it a few days, and maybe it will be. Right now, we have a total of eight stock suggestions, and one of them is a technology stock: Hydreight (TSXV: NURS). It gained 7.30% yesterday to reach $1.91 per share and is up 63.25% since the April 8 publication of our NURS report. Click here to read it!

The rest of them are precious metals plays. We were able to successfully narrow down more than 1,500 metals and mining companies, including over 500 that we spent time researching, to only seven that we believe have the greatest upside potential.

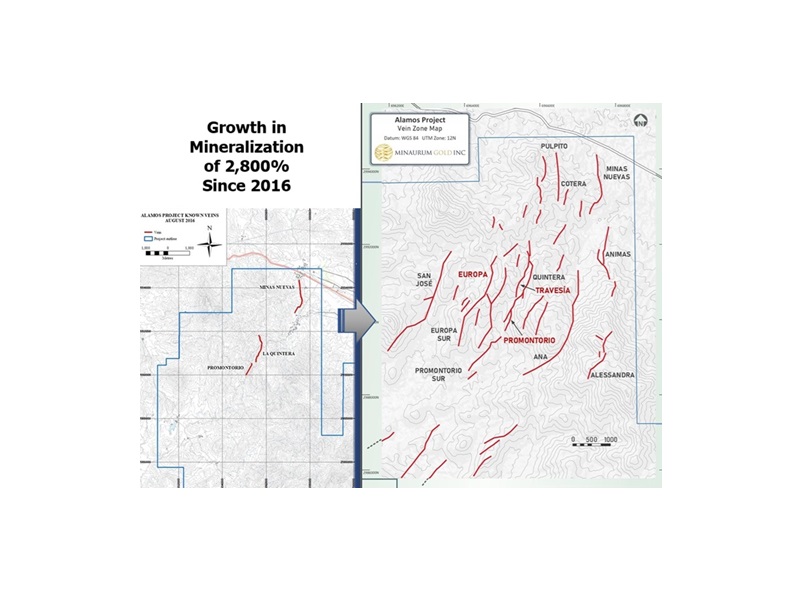

Minaurum Gold (TSXV: MGG) knew early on that the Alamos Silver Project would become big. During the COVID-19 pandemic, when the company was forced to temporarily stop exploration, they decided to launch the permitting process early. This means MGG is fully permitted for production today, unlike its higher-market-cap peers—Discovery Silver (TSX: DSV), Vizsla Silver (TSX: VZLA), GoGold Resources (TSX: GGD), Prime Mining (TSX: PRYM), and Silver Tiger Metals (TSXV: SLVR).

MGG's maiden 43-101 resource estimate will be published shortly, and the company is aiming for an initial 50 million ounces of silver equivalent, including 40 million ounces of pure silver. This is based on only two of 26 discovered veins. After MGG publishes its maiden resource estimate, they intend to grow it rapidly to 100 million ounces of silver equivalent.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract. NIA has received compensation from CTGO of US$30,000 cash for a three-month marketing contract. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. NIA has received compensation from NURS of US$30,000 cash for a three-month marketing contract. NIA previously received compensation from PNPN of US$50,000 cash for a six-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.