NIA’s Top 3 Silver Picks Exploding

On December 20th, NIA published its #1 most important alert of all-time entitled, “Silver’s Most Powerful Mining Family Just Revealed.” Click here to read!

In that alert, NIA explained exactly why Highlander Silver (TSX: HSLV), Contango ORE (NYSE: CTGO), and Minaurum Silver (TSXV: MGG) are the world’s top 3 most undervalued silver stocks with the greatest upside potential.

All three companies are closely connected to silver’s most powerful mining family — the McLeods:

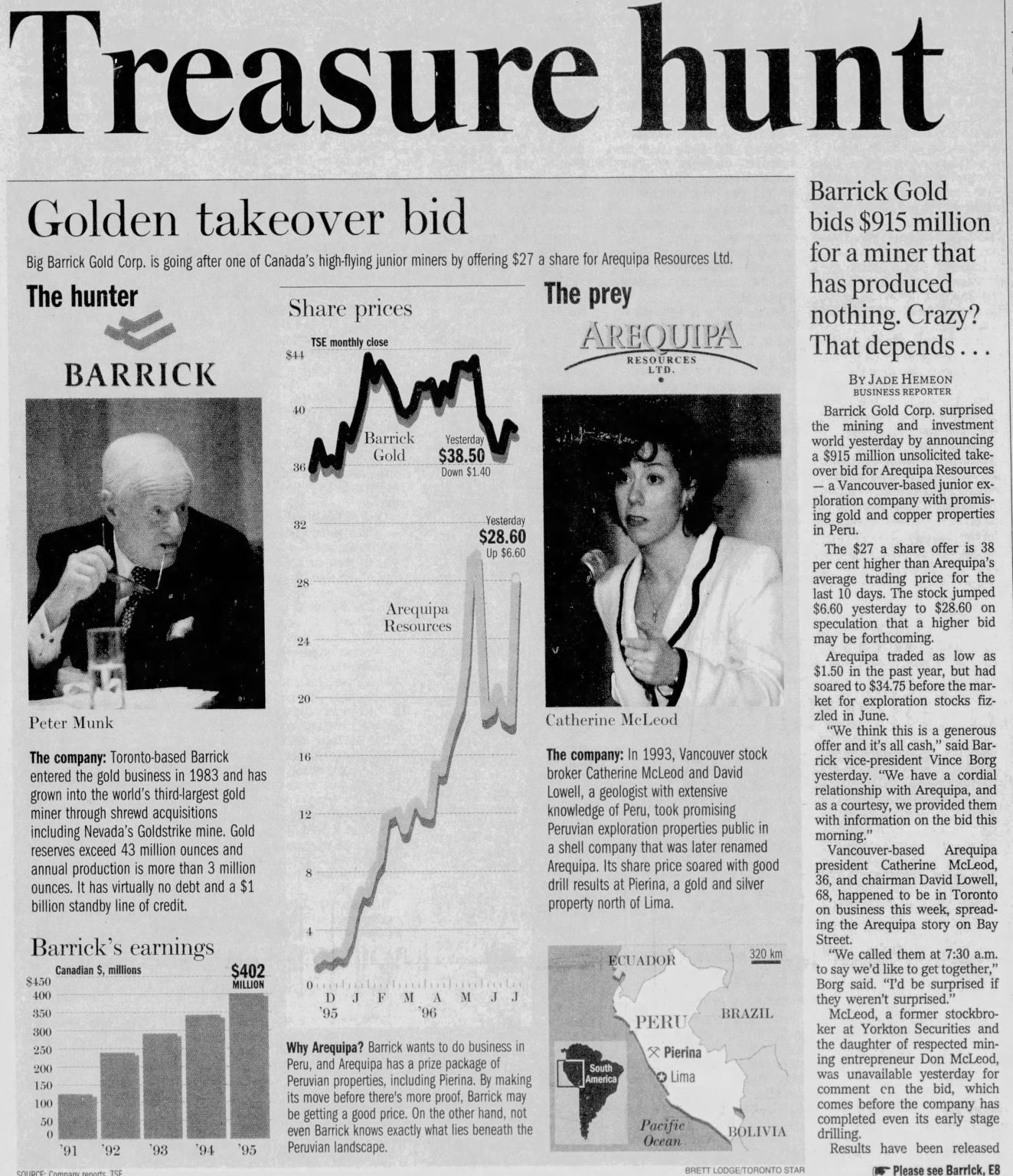

Highlander Silver (TSX: HSLV) is currently acquiring Bear Creek Mining for Corani, the world’s second-largest undeveloped silver project. Bear Creek’s Chairwoman, Catherine McLeod-Seltzer, previously co-founded Arequipa Resources alongside J. David Lowell, widely regarded as the Michael Jordan / Babe Ruth of geologists.

Since NIA’s initial HSLV suggestion at $1.40 per share, we have consistently highlighted the following article showing how Arequipa Resources rose from $1.40 to $30 before being acquired by Barrick:

HSLV is up 9.18% today to a new all-time high of $7.02 per share and we believe it will reach $20+ per share very soon. After Corani enters production, NIA expects HSLV to be acquired for $30+ per share, mirroring the Arequipa Resources outcome.

Contango ORE (NYSE: CTGO) is acquiring Dolly Varden Silver for Kitsault Valley, Canada’s largest and highest-grade undeveloped silver project. Dolly Varden was founded by Robert McLeod, first cousin of Catherine McLeod-Seltzer.

CTGO has the highest free cash flow yield of all publicly traded gold miners and plans to deploy this massive cash flow to develop Kitsault Valley into one of the world’s most profitable silver mines.

CTGO is up 7.78% today to $33.24 per share and is about to surpass its June 2023 all-time high of $33.67, which NIA believes could trigger a rapid move to $50+ per share. CTGO’s CEO previously founded NovaGold (NG) and Trilogy Metals (TMQ)… and President Trump recently invested big into Trilogy!

J. David Lowell’s final company was Lowell Copper, which today operates as Solaris Resources (TSX: SLS). Lowell Copper financially backed Minaurum in its early days.

Today, Minaurum Silver (TSXV: MGG) is advancing its Alamos Silver Project, with a maiden resource estimate expected shortly. Alamos is fully permitted for production with community agreements already in place and a major copper mine operating directly adjacent.

Alamos is a close analogue of Las Chispas, developed by Ruben Molina. During Molina’s tenure at SilverCrest, the stock rose over 10,000%, leading to a $1.7 billion buyout less than one year ago (they sold too early today it would be worth $5-$6 billion).

Ruben Molina now works for Minaurum Silver and is building Alamos into the next multi-billion-dollar silver project.

With almost no new silver mines permitted in Mexico in recent years and existing mines running out of ore, NIA believes the stage is set for a historic silver supply shock as the gold-to-silver ratio reverts toward 16.

MGG is up 7.55% today to $0.57 per share and owns 100% of what NIA believes is the only Mexican silver project likely to be developed in the coming years.

If MGG is acquired, its additional high-quality gold projects are likely to be spun off to shareholders as a new publicly traded company.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 125,000 shares of HSLV and may buy or sell shares at any time. NIA’s President has purchased 5,000 shares of CTGO and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 for a ten-month marketing contract. NIA is receiving compensation from MGG of US$100,000 for a twelve-month marketing contract and previously received US$60,000 for past marketing contracts which have expired. This message is for informational and educational purposes only.