NIA Warned About Blackrock Silver (TSXV: BRC)

NIA said this morning after Droneshield (ASX: DRO) closed at $5.74 per share for a gain of 2,770% from NIA's suggestion price of $0.20 per share: "All future 10-20 baggers will be junior gold, silver, and copper exploration & development stocks. People will chase them to outrageous bubble prices in 2026 that nobody believes possible today."

This doesn't mean you can recklessly buy any random junior gold, silver, or copper exploration & development stock because many are overvalued and not worth their current prices.

On September 22nd after NIA's Highlander Silver (TSX: HSLV) raised $75 million (was later upsized to $86.25 million) NIA warned, "As soon as the momentum for all of the "promotional" gold/silver stocks like Argenta Silver (TSXV: AGAG) and Blackrock Silver (TSXV: BRC) comes to an end… AGAG and BRC will collapse by 90% as HSLV plows forward to $15-$20 in 2026."

On September 21st NIA warned, "Despite a company like Blackrock Silver (TSXV: BRC) trading well below its mid-2020 high, BRC has had severe dilution from drilling 800m deep holes for 2m veins and paying for wasteful CNBC television ads during bear markets. BRC’s PEA showing estimated all-in silver equivalent production costs of $11.96 per oz is laughable. Even the majors can’t produce silver in the U.S. for less than $25 per oz. BRC’s market cap is already nearly double its mid-2020 high from all of the newly printed shares."

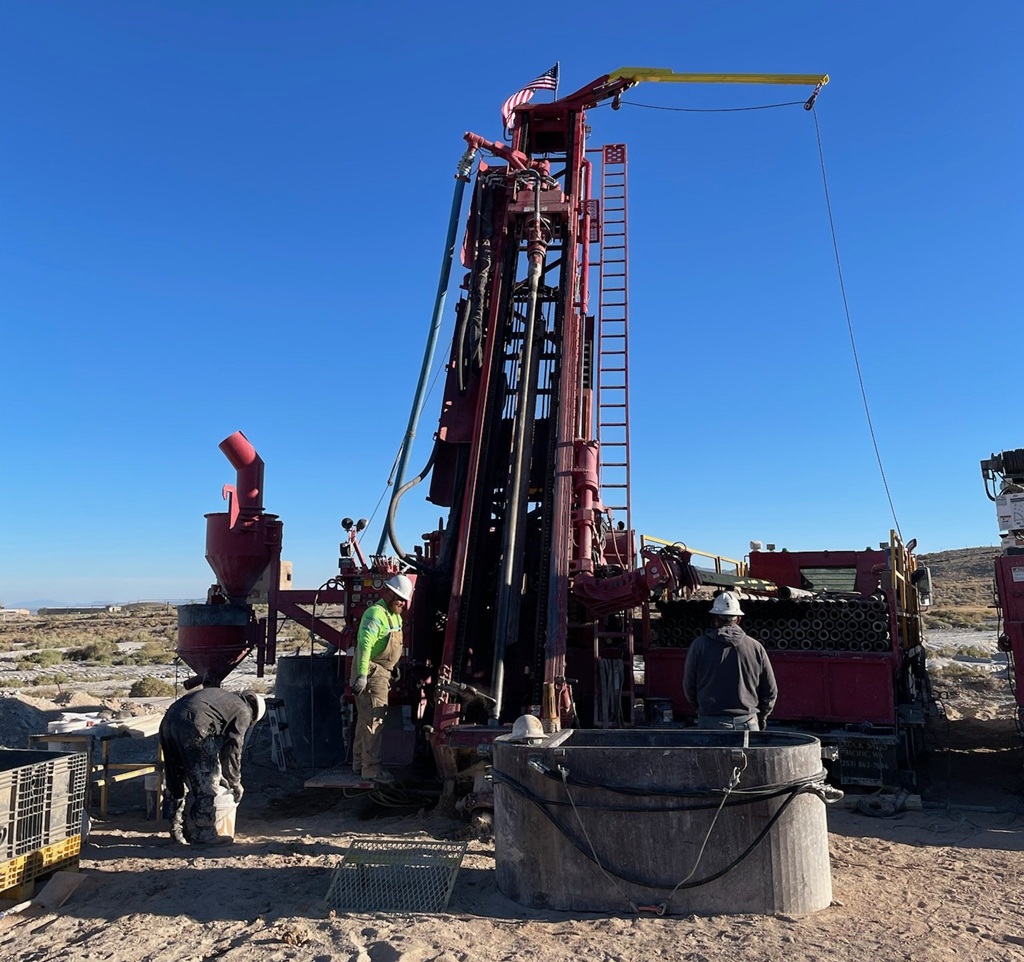

On September 2nd NIA warned, "Blackrock Silver (TSXV: BRC)’s Tonopah West project in Nevada is often promoted as a silver play, but in reality, about 52% of its resource value comes from gold and only 48% from silver. If an investor’s goal is exposure to Nevada gold, Viva Gold (TSXV: VAU)’s neighboring Tonopah Gold Project offers nearly the same amount of contained gold as Tonopah West yet trades at only a fraction of BRC’s market cap. The difference is fundamental: Viva’s ounces sit close to surface, well-suited for low-cost open pit, heap-leach mining, while BRC’s ounces are locked in deep underground veins that demand far higher mining costs."

Blackrock Silver (TSXV: BRC) is down by 16.67% today to $0.73 per share and is one of the only junior resource stocks to have already peaked for this cycle.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 125,000 shares of HSLV and may buy more shares or sell his shares at any time. NIA’s President has purchased 100,000 shares of VAU and may buy more shares or sell his shares at any time. This message is meant for informational and educational purposes only.