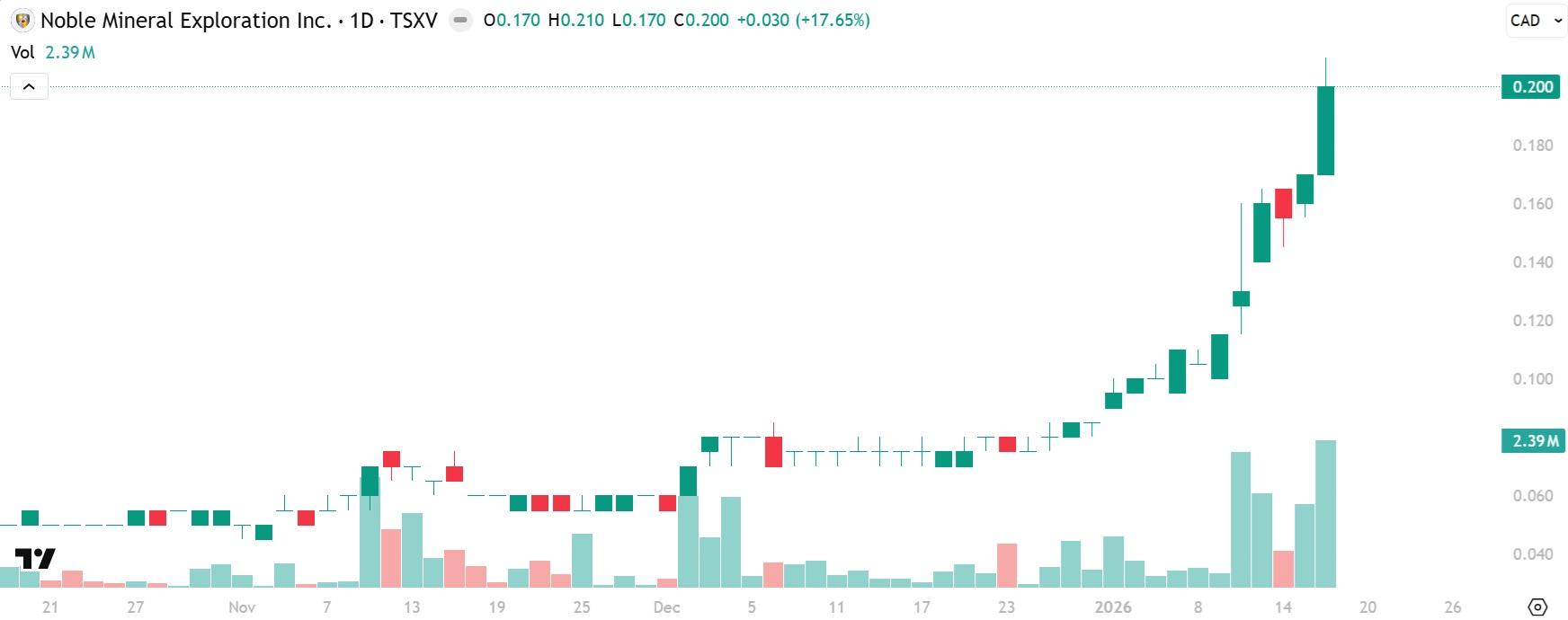

Noble Hits New 5-Year High After 17.65% Gain on Friday

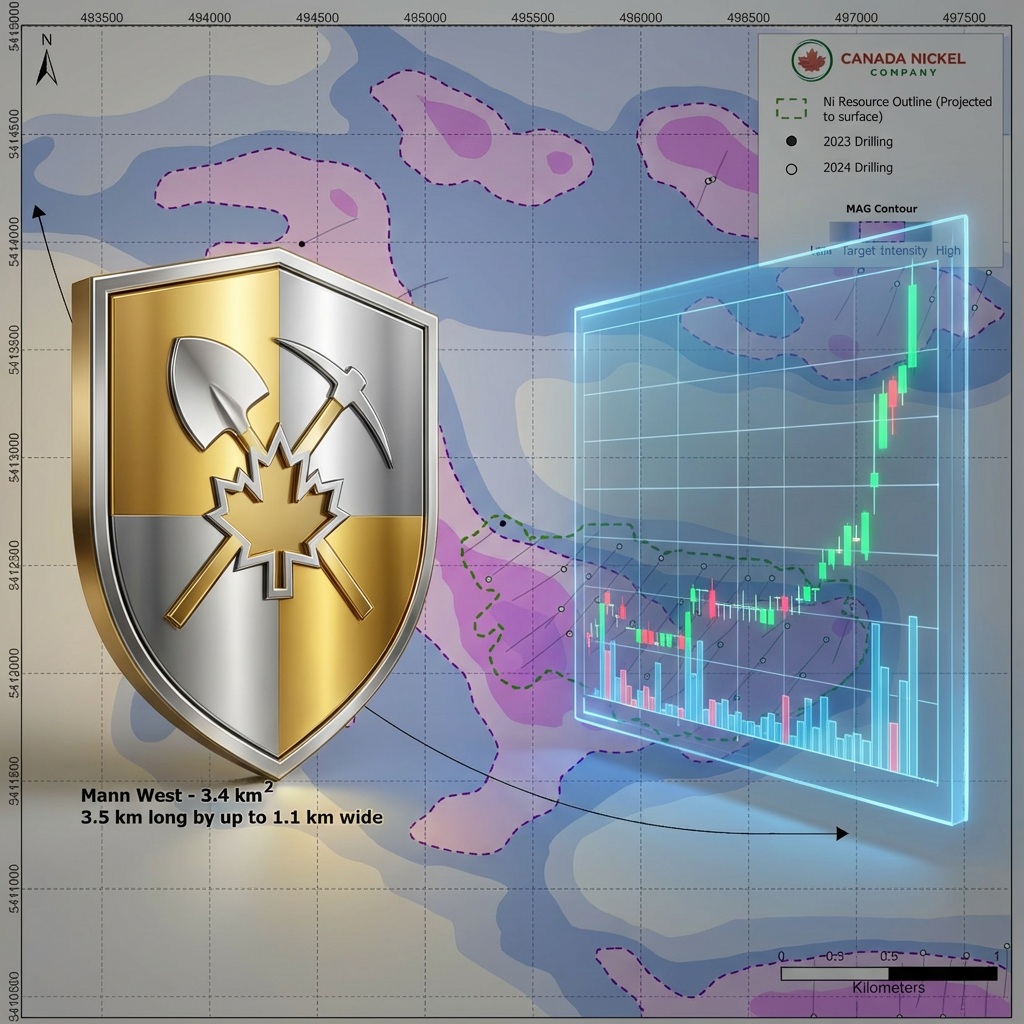

Noble Mineral Exploration (TSXV: NOB) gained by 17.65% on Friday to a new 5-year high of $0.20 per share! If Canada Nickel Company (TSXV: CNC) itself was a gold/silver company its market cap would be $3-$4 billion but nickel is out of favor right now. NOB owns a 20% stake in East Timmins Nickel owner of Mann West and Mann Central which already rival Crawford in size despite only ~40% of the geophysical footprint being drilled! NOB also owns huge stakes in CNC and Homeland Nickel (TSXV: SHL) the most promising U.S. nickel company, plus NOB owns NSRs in multiple CNC properties and NOB retains 5-year exploration rights for gold, copper, and VMS deposits on CNC properties and they are being explored right now!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA is receiving compensation from NOB of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. This message is for informational and educational purposes only and does not provide investment advice.