Silver Breaks $40 Per Oz for First Time in 14 Years

Silver has just surpassed $40 per oz for the first time in 14 years. Markets are closed tomorrow for Labor Day, but things should be very exciting on Tuesday.

Coeur Mining (CDE) closed Friday at a new 9-year high of $13.15 per share with a market cap of $8.45 billion. If you visit their website here, you will see they now consider Las Chispas to be their new flagship silver mine after CDE's $1.7 billion takeover of SilverCrest.

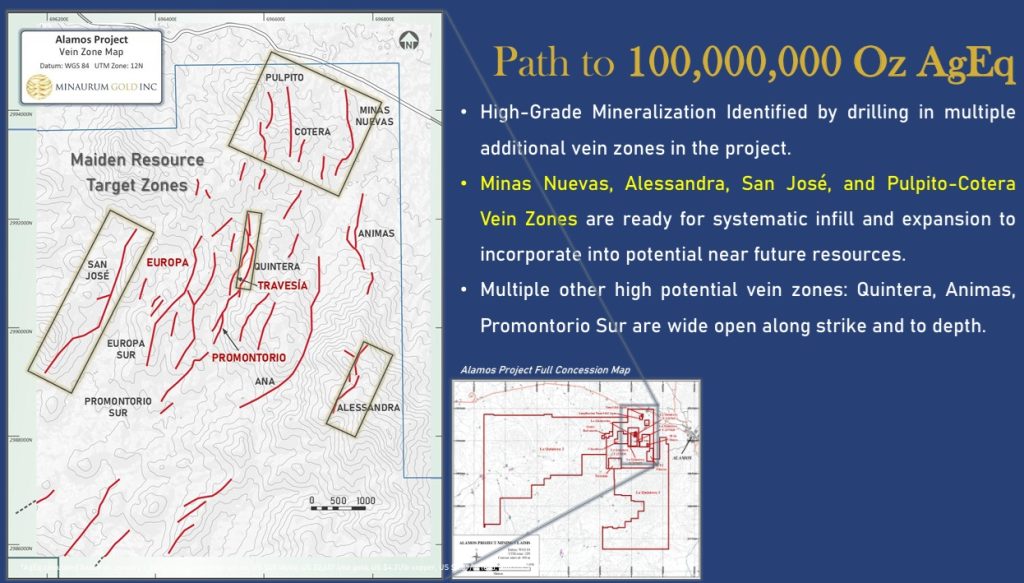

Minaurum Gold’s (TSXV: MGG) Alamos Silver Project shares many parallels with Las Chispas. Both are high-grade, epithermal vein systems located in Mexico with strong polymetallic credits that enhance project economics. SilverCrest was able to rapidly unlock value at Las Chispas by proving up a high-margin resource and attracting a major acquirer in Coeur. Minaurum is following a similar path at Alamos, where drilling has already outlined multiple robust veins returning grades on par with or exceeding those seen in Las Chispas’ early days. Importantly, Minaurum has strengthened its team by hiring key executives and technical leaders who previously worked on the discovery and development of Las Chispas, bringing direct experience in taking a world-class Mexican silver project from exploration to acquisition. With four rigs currently turning, Alamos has the potential to become the next generational Mexican silver discovery to capture the market’s imagination.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.