Viva Gold (TSXV: VAU) Is Likely Takeover Target

Viva Gold (TSXV: VAU)’s CEO James Hesketh did all of the work to get permitting at the Reward Gold Project which eventually resulted in our Augusta Gold being acquired by AngloGold Ashanti at a huge premium. Out of all the companies we cover it is pretty obvious Viva will be the next to be acquired.

On Viva’s Board is Christopher E. Herald who was CEO of Crown Resources Corporation a company acquired by Kinross Gold (KGC) in 2006 at a huge premium. Kinross paid US$157 per oz of gold resources for Crown Resources in 2006 despite gold trading for only $625 per oz. So, the resource valuation was 25.12% of the gold price.

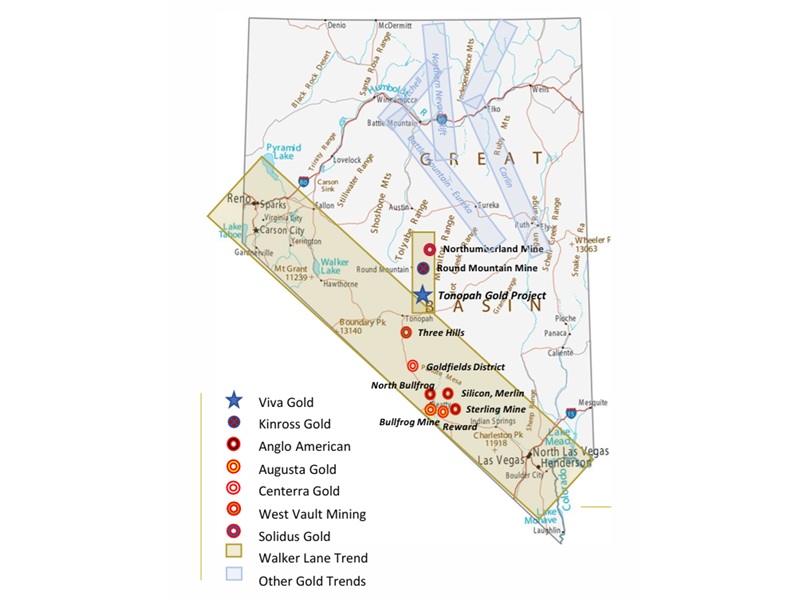

Viva Gold has 587,000 oz of gold resources located south of KGC’s Round Mountain. Viva’s current market cap at $0.16 per share? US$16.63 million or US$28.33 per oz equal to 0.68% of the gold price of $4,130 per oz.

Also on Viva’s Board is Ted Mahoney who was previously the Chief Geologist of KGC’s Round Mountain. Click here to see for yourself!

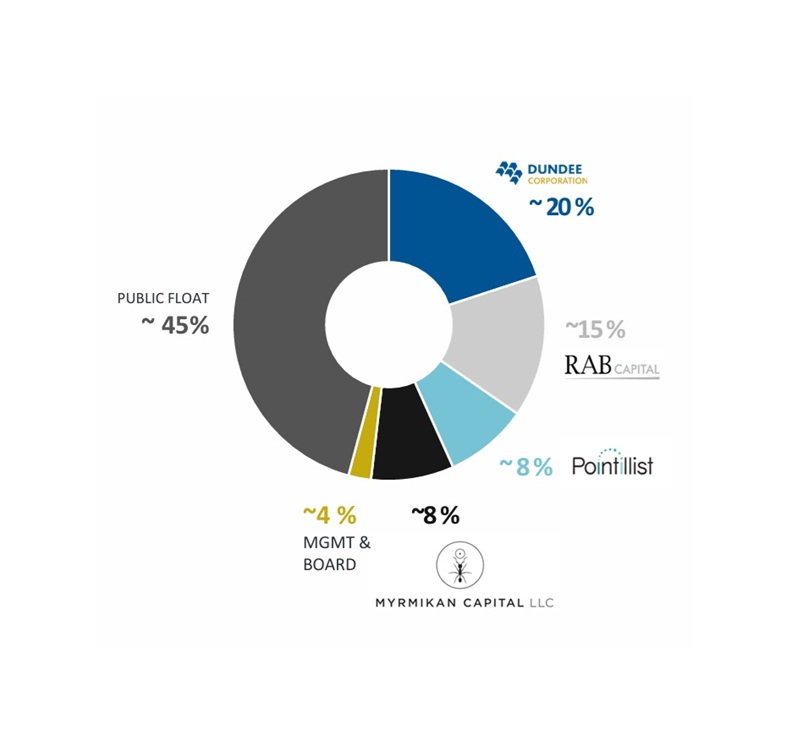

Viva’s largest shareholder with a 20% stake? Dundee!

Read the bio of Borealis Mining (TSXV: BOGO) Chairman Robert M. Buchan.

“In 1986, Mr. Buchan helped Ned Goodman start Dundee Capital, where he served as Vice Chair until his departure 1993 to found Kinross Gold.”

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 100,000 shares of VAU and may buy more shares or sell his shares at any time. NIA previously received compensation from BOGO of US$100,000 cash for a twelve-month marketing contract which has expired. This message is meant for informational and educational purposes only.