What Is Upside Potential of Total Metals (TSXV: TT)?

Prior to Total Metals (TSXV: TT) announcing its deal this week to acquire High Lake and West Hawk Lake, TT was already worth CAD$20 million from its high-grade polymetallic Electrolode property alone.

McFarlane Lake (CSE: MLM) declined in value this week when they announced their deal to sell High Lake and West Hawk Lake to Total Metals (TSXV: TT). MLM investors aren’t happy about losing these high-grade gold properties.

TT is paying a total of CAD$9.25 million for these high-grade gold projects and MLM will be focusing on a lower grade property it is acquiring from Aris Mining. MLM has share structure problems with over 61.5 million $0.07 per share warrants that will create severe dilution and drag its share price lower. TT is tightly held with only 29.7 million shares outstanding. Any financing TT does to complete the acquisition it should immediately be able to push through due to tremendous value creation similar to Discovery Silver (TSX: DSV) earlier this year.

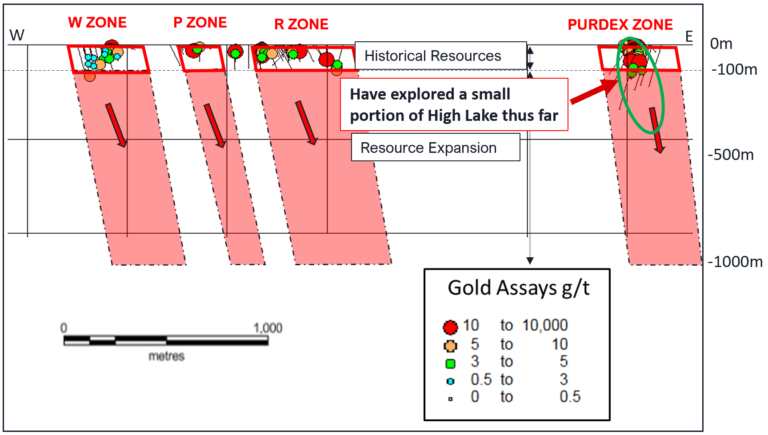

In November 2023, when the TSX Venture Composite Index was at a historical bottom… MLM was focused on exploring High Lake and West Hawk Lake and had a market cap of CAD$27.24 million with only a NEO exchange listing, which almost nobody has access to. High Lake caught Rob McEwen’s attention who invested into the company. McEwen said regarding MLM and its high-grade intercepts at High Lake, “I was attracted to McFarlane Lake because of its terrific high-grade intercepts and the fact that it is in Canada and located close to where Goldcorp Inc. enjoyed such phenomenal exploration success and profitability.” Frank Giustra also invested into MLM at the time it was focused on High Lake.

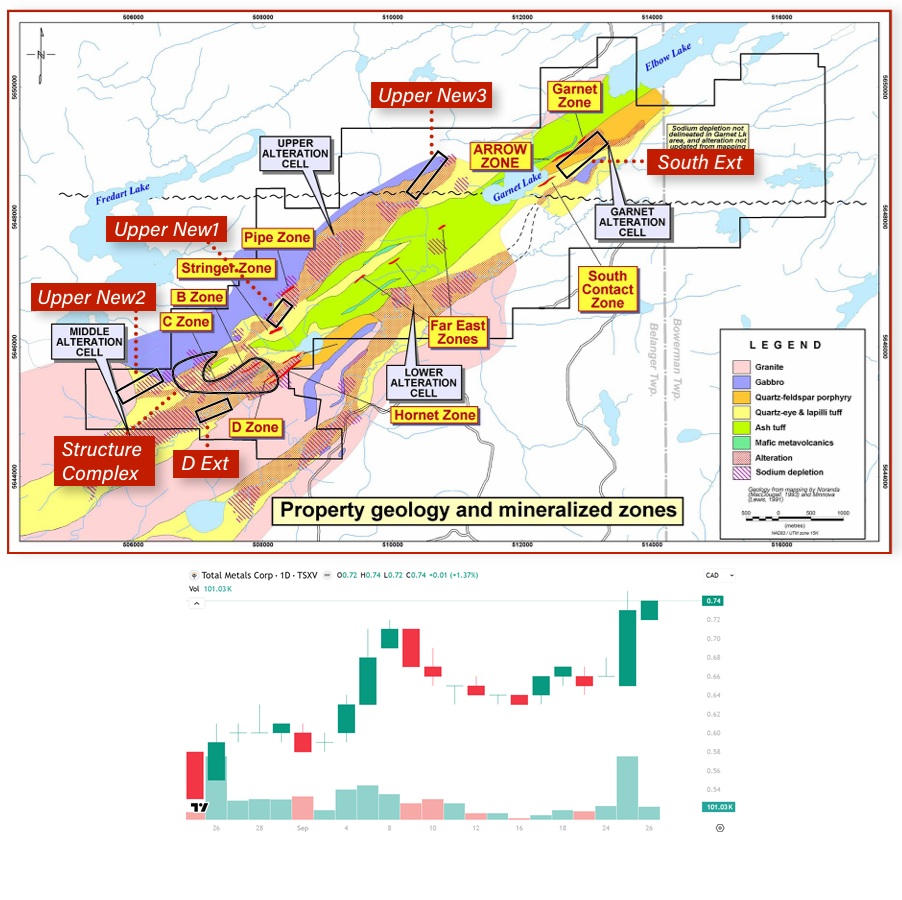

At Electrolode, TT’s Arrow Zone alone contains a 43-101 inferred resource of 2.1 million tonnes at 0.66% copper, 4.75% zinc, 0.66 g/t gold, 17.7 g/t silver. On the other side of the property, TT’s E-Zone has a smaller non-43-101 historical resource averaging 1.08% copper, 8.28% zinc, 0.39 oz/t silver. In the underexplored D-Zone on strike with the E-Zone an intercept was made of 10.0 g/t gold, 1.75% copper, 0.86% zinc, and 240.6 g/t silver over 3.4 meters.

Not only does High Lake have an indicated 45,800 oz gold grading 9.38 g/t and an inferred 96,200 oz gold grading 10.43 g/t, but West Hawk Lake has a high-grade non-43-101 historical resource of 204,292 oz gold grading 13.90 g/t.

What will all of these exceptional high-grade assets be worth combined in a new Total Metals (TSXV: TT) company with an experienced management team focused on them with better visibility along with strong market conditions and a TSX Venture Composite Index hitting new multi-year highs?

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from TT of US$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.