Where Will Gold Peak and How Much Upside Do Gold Stocks Have Left?

Unlike one year ago when NIA predicted the September 2025 gold price with greater accuracy than any other organization in the world, we have no reliable systems for forecasting the gold price based on today’s financial markets and economic conditions.

However, to put things into perspective:

-

The September 2011 gold peak, adjusted for growth in M2 Money Supply per capita, would equal $3,985.64 per oz today.

-

The January 1980 gold peak, adjusted for growth in M2 Money Supply per capita, would equal $8,369.74 per oz today.

Gold is likely headed significantly higher than $3,985.64 per oz over the next several years. But, even in a sideways or corrective phase, Contango ORE (CTGO) has such a low enterprise value/free cash flow ratio that it is likely to rise over the next twelve months under all conditions.

Why Today’s Market Is Different from 2011

On February 3, 2011, Newmont (NEM) announced a deal to acquire Fronteer Gold for $2.3 billion. Altogether, Fronteer owned 4.2 million oz measured & indicated and 1.7 million oz inferred resources. Newmont effectively paid $390 per oz at a time when gold traded at $1,350 per oz thereby valuing Fronteer’s gold resources at 28.9% of spot gold. Today, that would equate to paying $1,080 per oz of gold resources.

Contrast this with today’s valuations:

-

Lahontan Gold (TSXV: LG) owner of the Santa Fe Gold Project in Nevada (ranked the #2 best mining jurisdiction worldwide) trades at only ~$15 per oz.

-

First Mining Gold (TSX: FF) owner of the Springpole Gold Project in Ontario (ranked the #15 best mining jurisdiction worldwide) trades at only ~$25 per oz when Springpole is likely to be the next major Canadian gold project to secure EA approval for future development into a producing gold mine.

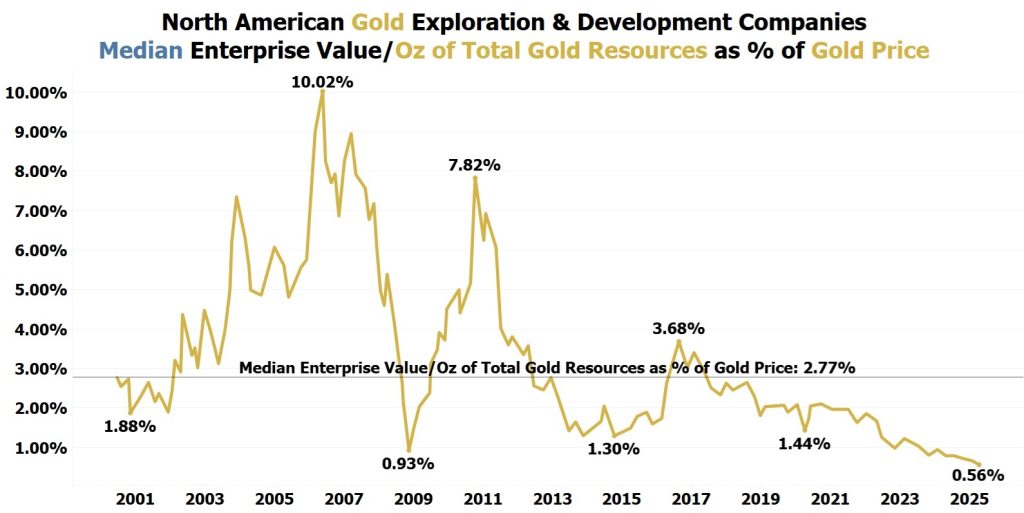

Back in February 2011, the median North American gold exploration & development company had gold resources valued at 7.82% of gold’s price, or $105.57 per oz. Newmont paid a premium for Fronteer because of Nevada’s jurisdictional quality and because over 50% of Fronteer’s gold resources were oxide gold suitable for low-cost heap leaching. Lahontan’s 44% oxide gold mix is lower, but still attractive.

Valuations Are at Historic Lows

Never before has gold peaked with explorers and developers valued this cheaply. In 2026, we will see another wave of aggressive acquisitions like Newmont’s Fronteer deal, as majors scramble for gold ounces in tier-one jurisdictions.

At an absolute minimum, the median valuation of North American explorers and developers should revert to its long-term median of 2.77% of the gold price. Notably:

-

In the run-up to 2011, companies traded above this median for 8 of 9 years.

-

Today, valuations have been below this median for 8 straight years (ever since the Bitcoin/Crypto boom began in 2017).

Supply Side Constraints

A decade of chronic underinvestment has left very few high-quality undeveloped gold resources for majors to acquire. At the same time, new gold discoveries are at record lows. This supply squeeze only amplifies the opportunity.

NIA’s Outlook

While we cannot predict exactly where gold will trade a year from now, NIA is confident that its highlighted gold exploration, development, and mining stock suggestions represent the highest-quality, most undiscovered opportunities with the greatest upside potential.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. NIA’s President has purchased 200,000 shares of LG in the open market and intends to buy more shares. NIA has received compensation from LG of US$30,000 cash for a three-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.