NIA Members Up 641.94% on SBSW Calls in 8.5 Months and 13 Months Left Before Expiration

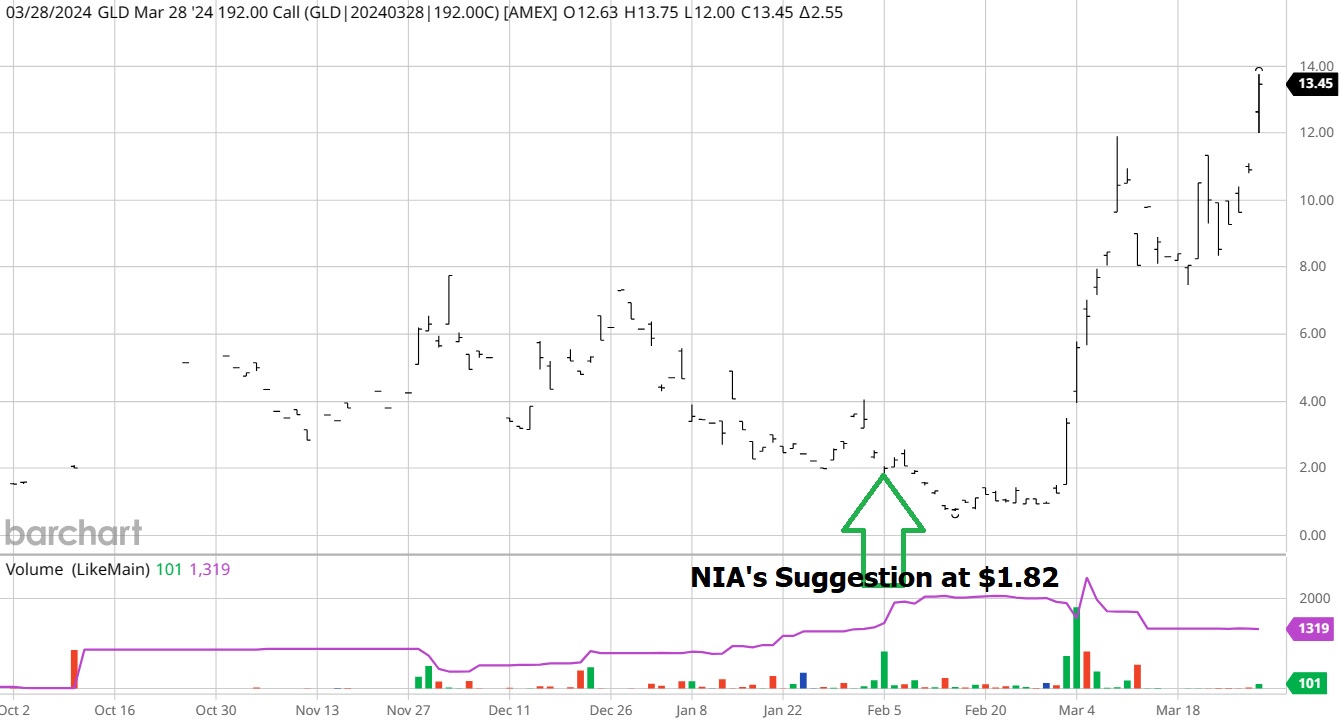

NIA's Sibanye Stillwater (SBSW) January 2027 $5 Call Option closed last week at a new high of $9.20 and has already gained by 641.94% in 8.5 months since NIA's March 27th suggestion at $1.24! We have 13 months left before expiration where our 7-figure profits will become 8-figure profits!

NIA said on March 27th, "Instead of chasing producing gold miners it is best to do the opposite of everybody else and invest into the world’s #1 highest quality producer of PGMs. SBSW’s Montana mine is the #1 highest grade PGM mine in the world!"

SBSW has significantly outperformed nearly all producing gold and silver miners since NIA first suggested SBSW call options. SBSW itself has gained 2.36x more than GDX, 2.08x more than GDXJ, 1.98x more than SIL, and 1.73x more than SILJ. Meanwhile, NIA's SBSW call options have delivered an additional 3.12x leverage over the gains in SBSW itself… while still maintaining a very safe margin with over one full year remaining until expiration.

Only Aris Mining (TSX: ARIS) which was NIA's #1 favorite producing gold miner prior to our recent discoveries of Contango ORE (CTGO) and Heliostar Metals (TSXV: HSTR) has performed better than SBSW, but ARIS had higher implied volatility than SBSW so the options wouldn't have gained nearly as much!

Click here to see NIA's initial SBSW call option suggestion alert!

Unfortunately, many ARIS shareholders got tricked by Frank Giustra into selling it and buying Argenta Silver (TSXV: AGAG). This is why we warned everyone on August 31st that Argenta has huge problems and Minaurum Gold (TSXV: MGG) is the superior silver company (click here to see!)

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 5,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA has received compensation from HSTR of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. NIA previously received compensation from ARIS of US$50,000 cash for a six-month marketing contract which has expired. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. This message is meant for informational and educational purposes only and does not provide investment advice.