The Next Approved Mine in Canada? First Mining Gold (TSX: FF)’s Springpole Is Almost There

NIA’s Initial Suggestion of FF: June 1, 2025 at 5:54 PM ET | Price: $0.155/share

Report Published: June 2, 2025 at 8:00 PM ET | FF Price at Publication: $0.17/share

First Mining Gold (TSX: FF) Owns Two of Canada's Largest Gold Projects

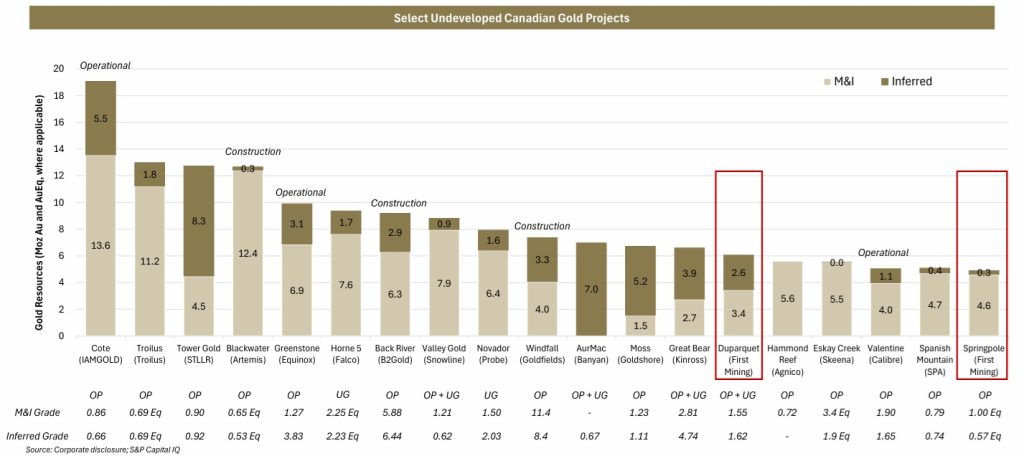

With two of the largest undeveloped gold projects in Canada — Springpole (Ontario) and Duparquet (Quebec) — First Mining Gold Corp. (TSX: FF) is poised for a massive re-rating in this new secular bull market for gold stocks.

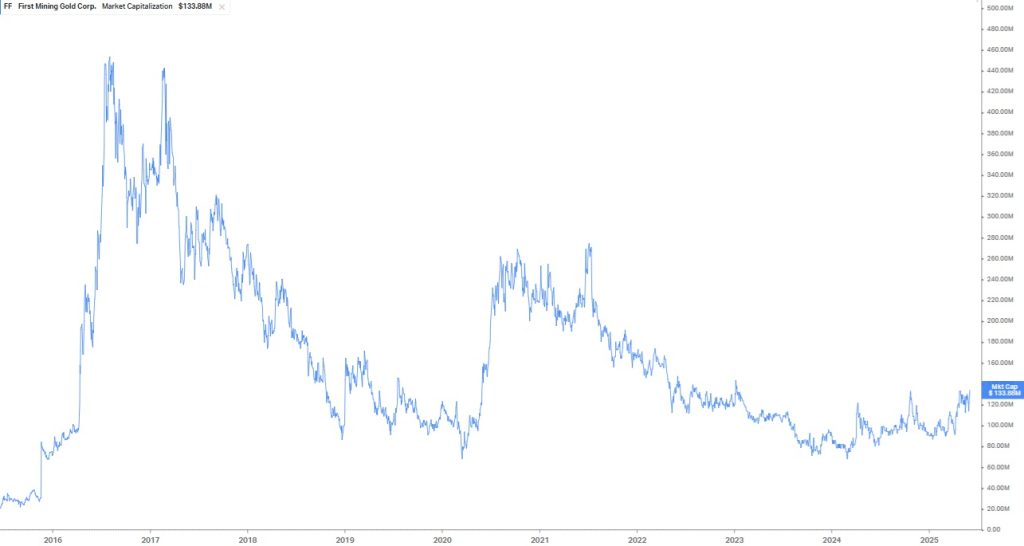

When Artemis Gold (TSXV: ARTG) received its Environmental Assessment Decision for Blackwater in 2019 the stock was only $1 per share. Today, ARTG closed at $25 per share with a US$4.13 billion market cap.

The second most advanced Canadian gold project currently in the environmental assessment process is Eskay Creek of Skeena Resources (SKE), which closed today at a new all-time high of $13.57 per share with a market cap of US$1.557 billion.

Today's #1 most advanced Canadian gold project in the environmental assessment process is First Mining Gold (TSX: FF)'s Springpole, with an Environmental Assessment Decision coming for Springpole before year-end 2025.

Although SKE's Eskay Creek has a measured & indicated resource of 5.5 million oz of gold, which is slightly larger than Springpole's measured & indicated resource of 4.6 million oz of gold, First Mining Gold (TSX: FF)'s market cap at $0.17 per share is only US$133.88 million or a tiny fraction of SKE's market cap of US$1.557 billion. First Mining expects to have its Environmental Assessment Decision within 6-7 months or well before Skeena.

If you include First Mining Gold (TSX: FF)'s Duparquet Gold Project in Quebec, First Mining's two flagship gold projects have a total measured & indicated resource of 8.04 million oz of gold, which is significantly larger than SKE's Eskay Creek.

While SKE closed today at a new all-time high, First Mining's market cap of US$133.88 million remains well below its all-time high market cap of US$453.18 million from August 2016 — 21 months ahead of First Mining launching its 7+ year environmental assessment process, which is about to be concluded in the upcoming months.

Springpole Gold Project: Near-Term Development Catalyst

Resource Overview

-

121.6 Mt @ 0.97 g/t Au & 5.23 g/t Ag Probable Reserve: 3.8 Moz Au, 20.5 Moz Ag

-

151 Mt @ 0.94 g/t Au & 5.00 g/t Ag Indicated Resource (including Probable Reserve): 4.6 Moz Au, 24.3 Moz Ag

-

16 Mt @ 0.54 g/t Au & 2.80 g/t Ag Inferred Resource: 0.3 Moz Au, 1.4 Moz Ag

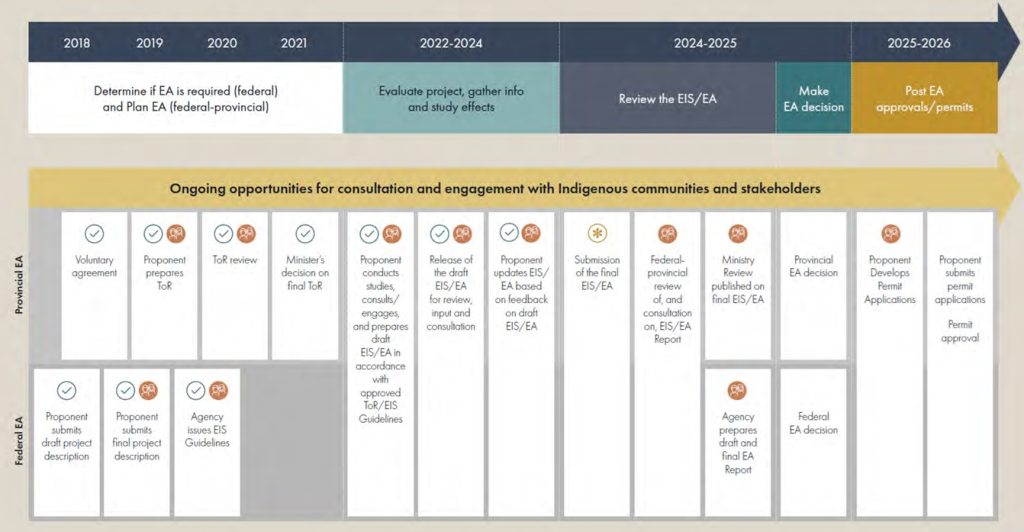

Permitting: Finish Line in Sight

-

Final EIS/EA submitted: November 2024

-

Decision expected: Late 2025

-

Time in process: 7+ years

-

Indigenous engagement: Deep collaboration with Cat Lake and Lac Seul First Nations

🗣 “We’re probably the most advanced mining project in Canada going through a federal EA. We’ve done the hard yards.” – First Mining CEO Dan Wilton

Re-Rating Opportunity

-

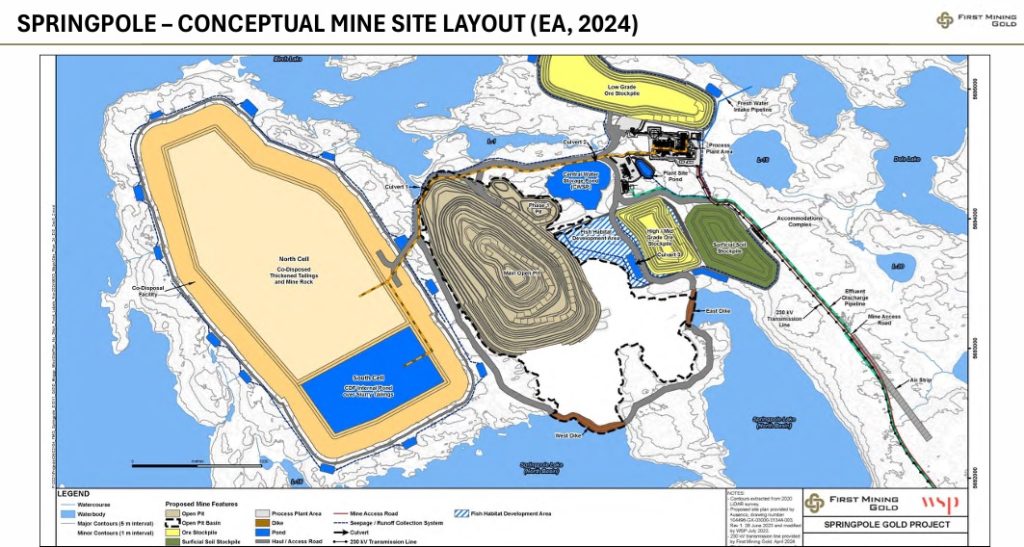

Perception hurdle: Springpole is partially under a bay; requires lake dewatering and dike construction.

-

Response: 15,500-page EA shows complete environmental viability.

🗣 “It’s impossible that a 5 million oz project with EA approval in Ontario will continue to be worth $10 an ounce.” – First Mining CEO Dan Wilton

Regulatory & Public Sentiment Shift

First Mining CEO Dan Wilton sees real progress in Canadian permitting attitudes:

-

Politicians are now “championing mining” post-elections

-

Ontario built 3 new gold mines in the last year (Côté, Greenstone, Minto), adding 1 Moz/year production

-

Indigenous economic participation growing through ownership and contracting

🗣 “Gold pays the bills in Ontario. They know it. And communities are benefiting economically like never before.” – First Mining CEO Dan Wilton

Duparquet Gold Project: Growth in the Abitibi Belt

Resource Overview

-

69.206 Mt @ 1.55 g/t Au Measured & Indicated Resource: 3.44 Moz Au

-

50.822 Mt @ 1.62 g/t Au Inferred Resource: 2.64 Moz Au

Exploration Upside

-

2025’s 18,000m drill program underway

-

Early success suggests resource growth potential, following a Hemlo-style phased expansion strategy

🗣 “We’re seeing amazing exploration success — Duparquet could be even bigger than we initially envisioned.” – First Mining CEO Dan Wilton

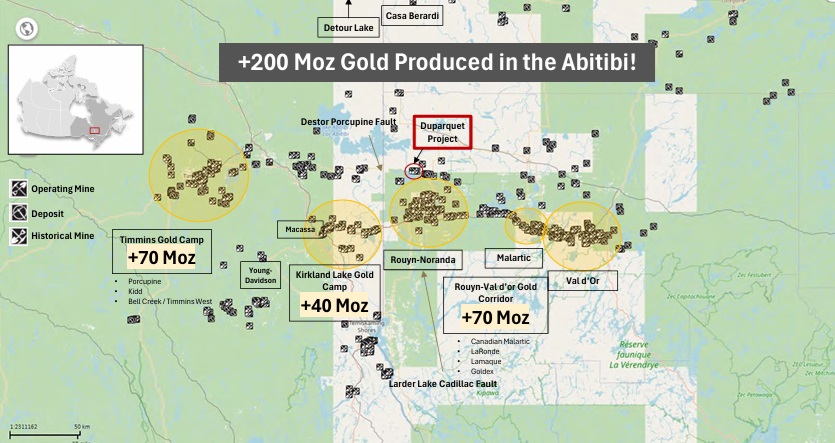

Strategic Location of Duparquet in the Heart of the Abitibi Gold Belt

The Duparquet Gold Project is ideally located within the Abitibi Greenstone Belt, one of the richest and most productive gold regions globally, with over 200 million ounces of historic gold production.

The map below illustrates how Duparquet is situated directly along the Destor-Porcupine Fault Zone, a prolific structural corridor that hosts many of Canada’s most significant gold deposits and producing gold mines.

Key Highlights:

-

📍 Centrally Positioned among Canada’s top gold camps:

-

Timmins Gold Camp – 70+ million ounces produced

-

Kirkland Lake Camp – 40+ million ounces produced

-

Rouyn-Noranda / Val-d'Or Corridor – 70+ million ounces produced

-

-

🛠️ Surrounded by operating mines, historic producers, and known deposits, providing a well-established mining ecosystem

-

🏗️ Access to regional infrastructure, skilled labor, and mining services, including proximity to Rouyn-Noranda, Val-d’Or, and major highways

Investment Significance:

Duparquet’s location in this tier-one gold jurisdiction offers substantial advantages:

-

De-risked development due to decades of permitting precedent and community engagement

-

Strong takeover appeal, with majors like Agnico Eagle and IAMGOLD already active in the region

-

Lower capex risk, thanks to existing infrastructure and regional processing capacity

This strategic positioning enhances Duparquet’s long-term value potential and strengthens First Mining Gold’s profile as a developer of truly world-class assets.

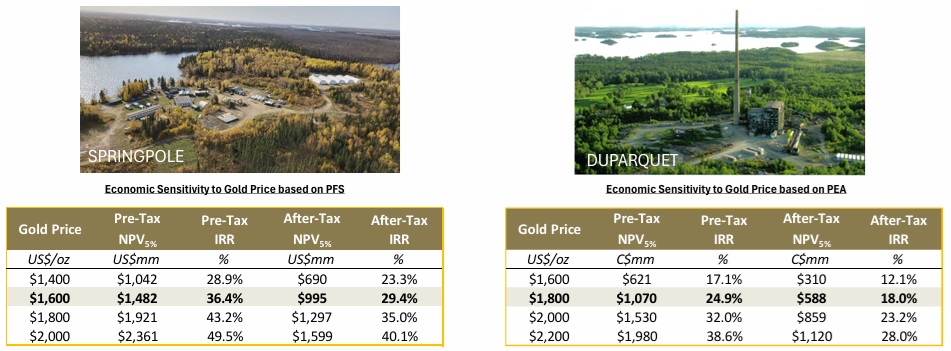

Fundamental Net Present Values

| Metric | Springpole + Duparquet |

|---|---|

| Total M&I Gold Resource | 8.04 Moz |

| Combined NPV (@ $1,600 and $1,800 gold) | ~US$1.6B |

| Current Market Cap at $0.17 per share | US$133.88M |

| Potential NPV @ $2,500 Au | ~$4+/share |

| Potential NPV @ $3,000 Au | ~$6+/share |

Each US$100/oz increase in gold adds ~US$250M in fundamental net asset value to First Mining Gold's projects!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from FF of US$100,000 cash for a twelve-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.