You Reach Full NPV By Developing a Mine

Companies that successfully develop a gold mine and bring it into production trade for the full net present value of the mine.

The biggest risk factors are always: 1) permitting and 2) financing.

Augusta Gold (TSX: G)’s Reward has current NPV at $3,390 per oz gold of US$308.07 million, which minus the outstanding debt values G at $4.42 per share.

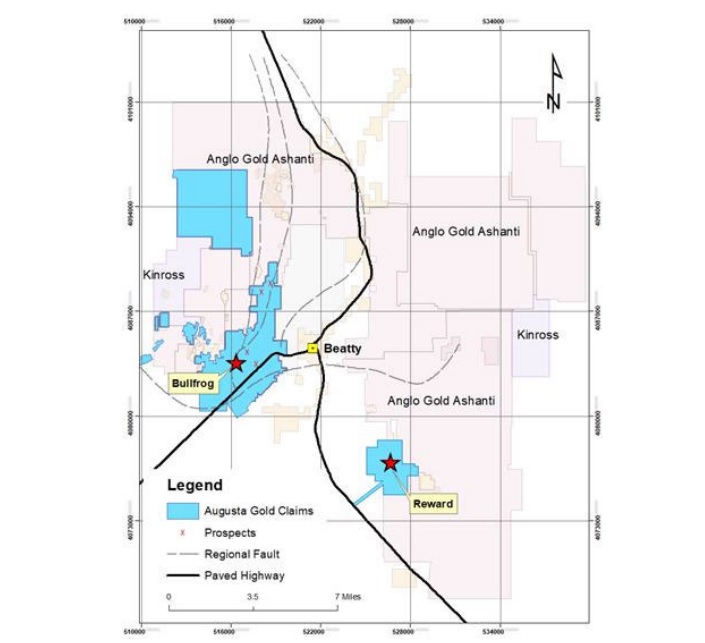

Reward is already fully permitted. If Augusta successfully completes the deal with the Trump Administration and the other non-dilutive financing they are working on it will be revalued to $4.42 per share not including any additional value for the Bullfrog Gold Project, which is 3.5x larger and located a few km away. Including Bullfrog, it will be worth $10-$15 per share.

AngloGold Ashanti (AU) desperately wants to acquire Augusta Gold (TSX: G) for both Reward and Bullfrog, but they can’t at current share prices because the premium will be too large and they will look bad to their shareholders. Getting the $50 million from Trump is exactly what is needed to get the ball rolling so share price is revalued to $3-$5 and buyout can then take place.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.