Viva Gold (TSXV: VAU) Up 64.70% in 31 Trading Days Since NIA’s Suggestion

On the morning of August 7th, NIA announced that its President purchased a small initial stake in Viva Gold (TSXV: VAU) on August 6th at $0.085 per share.

VAU gained by 33.33% on Friday to $0.14 per share its highest closing price since NIA's suggestion! VAU has so far gained by 64.70% in 31 trading days but this is nothing!

Contango ORE (CTGO) is about to become one of NIA's largest gainers in history due to its Direct Shipping Ore (DSO) method to rapidly develop its high-grade gold projects by mining, crushing, and shipping the ore to existing off-site processing facilities.

CTGO is currently processing its high-grade Manh Choh ore averaging 7 g/t gold at the existing Fort Knox Mill of Kinross Gold (KGC). We expect CTGO to sign similar DSO deals for the upcoming development of Lucky Shot and Johnson Tract, but for these new high-grade gold mines we expect CTGO to retain 100% ownership by funding the development costs entirely from the free cash flow of Manh Choh as CTGO ramps up its attributable gold production from 60,000 oz gold in 2025 to 200,000 oz gold per year once all three mines are operating together at the same time.

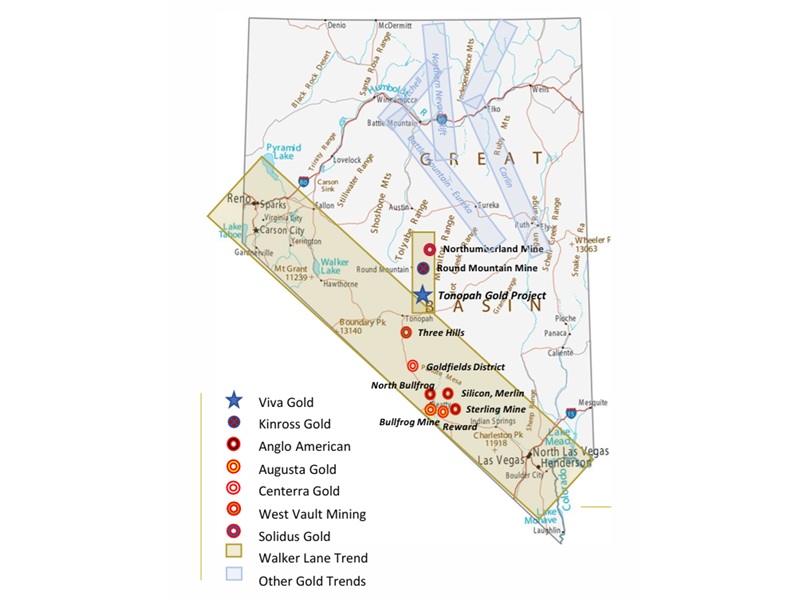

We see potential for VAU to work out a similar deal with Kinross in the future to utilize their Round Mountain mill.

Viva Gold's Tonopah is located directly south of Kinross Gold (KGC)'s Round Mountain, which is Nevada's #1 largest producing gold mine not owned by Newmont/Barrick's Nevada Gold Mines! However, Round Mountain is running out of ore and no longer operating at full capacity! By 2030, Round Mountain's gold reserves will be depleted! Dundee Corporation (TSX: DC.A) the original seed investor behind KGC knows this and that is why they own 20% of Viva Gold (TSXV: VAU)!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA’s President has purchased 100,000 shares of VAU in the open market and can buy or sell shares at any time. This message is meant for informational and educational purposes only and does not provide investment advice.