NIA Loves High-Grade Gold Projects

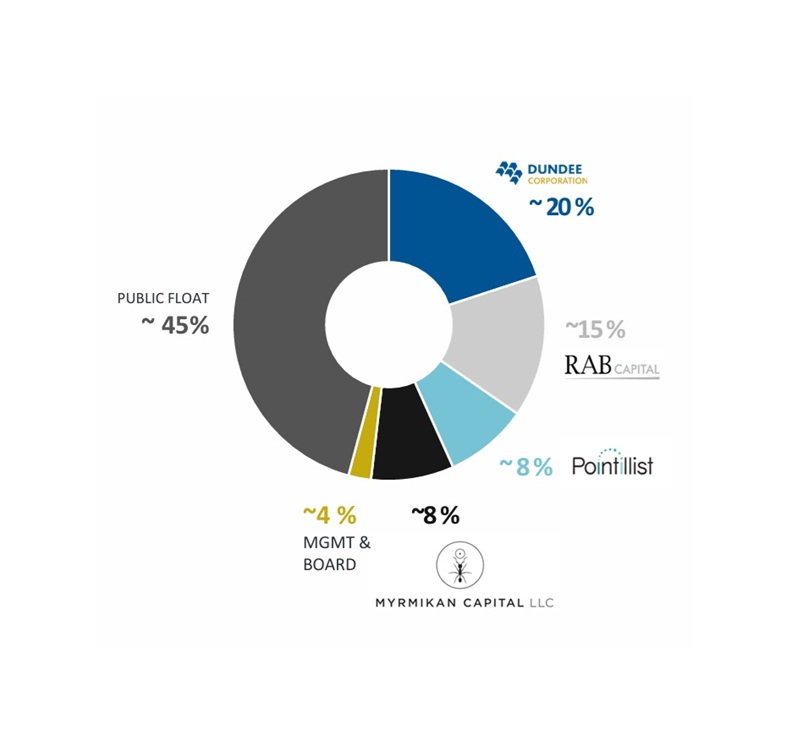

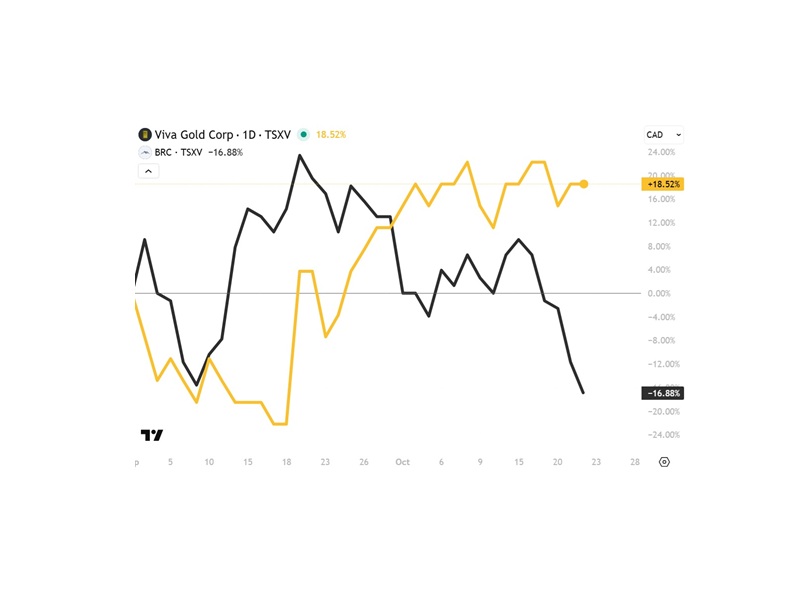

When NIA says Viva Gold (TSXV: VAU) is a takeover target it is 100% fact because Kinross Gold (KGC) needs Tonopah as a satellite deposit much more desperately than AngloGold Ashanti (AU) needed Augusta Gold. People who accumulate Viva Gold (TSXV: VAU) and are patient… will make money! Yes, it's a total conflict of interest because NIA's President owns 100,000 Viva Gold shares, but at least we disclose these facts unlike people on social media who disclose nothing.

Now, simply because Viva Gold (TSXV: VAU) is the #1 most likely takeover target of all publicly traded small-cap gold explorers, doesn't necessarily guarantee any certain return. Despite our Augusta Gold being acquired at a huge premium… it was our #3 favorite overall pick of mid-2023 Power Metallic Mines (TSXV: PNPN) that became the #1 largest percentage gainer of 2024 out of all TSX Venture resource stocks due to its extremely high grades of precious/base metals.

NIA loves high-grade gold projects and Total Metals (TSXV: TT) after raising $9.1 million yesterday is about to imminently close on the acquisition of High Lake and West Hawk Lake two of the highest-grade gold projects in all of Canada.

Total Metals (TSXV: TT) gained by 5.08% today to $1.24 per share and its market cap post-acquisition will be low compared to a company like Blue Lagoon Resources (CSE: BLLG) which has a lower grade high-grade gold resource in Canada, but its market cap is now $106.507 million. Total Metals (TSXV: TT) chart is setup perfectly:

In Nevada the only company with the potential to discover high grades of gold similar to Total Metals (TSXV: TT) is North Peak Resources (TSXV: NPR).

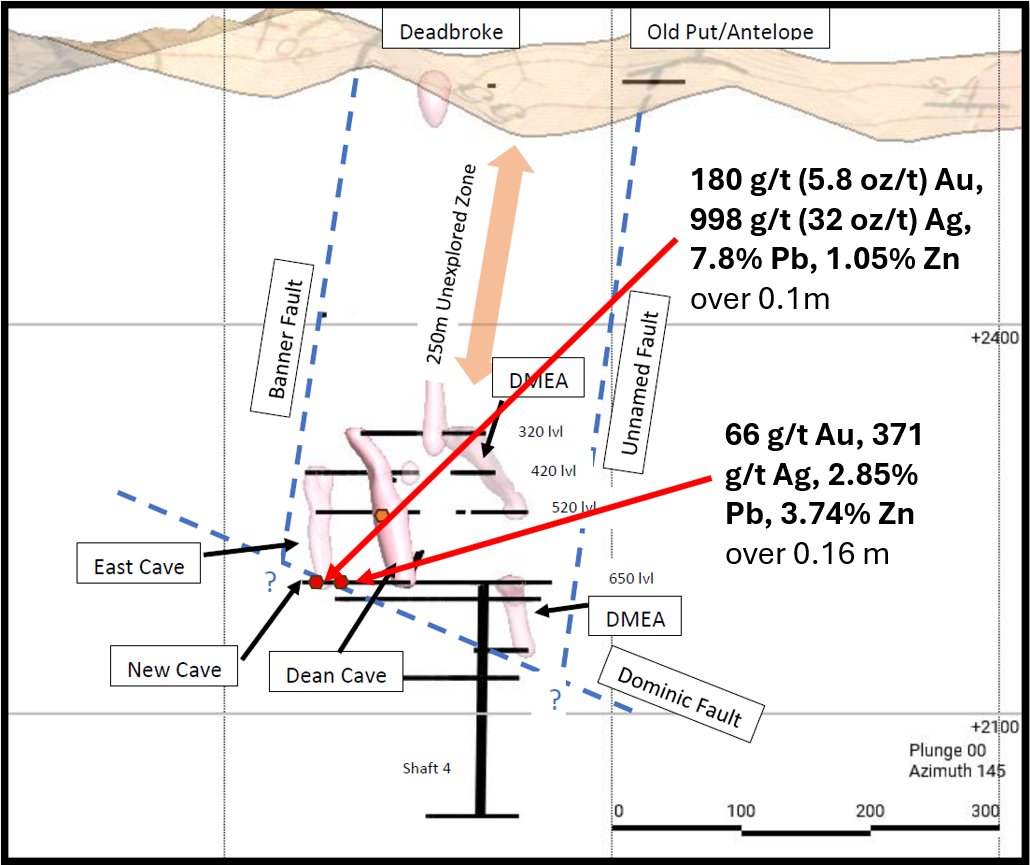

North Peak Resources (TSXV: NPR) gained by 7.53% today to $1 per share and any one of NPR's drill holes at the Prospect Mountain Mine Complex can change the fortunes of the company overnight:

Lookup NPR's Executive Chairman Harry Dobson and Manchester United! What a crazy story! Such a cool person!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 100,000 shares of VAU and may buy more shares or sell his shares at any time. NIA previously received compensation from PNPN of US$50,000 cash for a six-month marketing contract which has expired. NIA has received compensation from TT of US$100,000 cash for a twelve-month marketing contract. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 for a prior term. This message is meant for informational and educational purposes only.