The SIL/SLV Ratio Just Flashed a Major Buy Signal

When silver plunged by 26% to $85.31 per oz on January 30th, NIA highlighted the most important signal of that day… not the metal price itself, but what silver miners were doing beneath the surface.

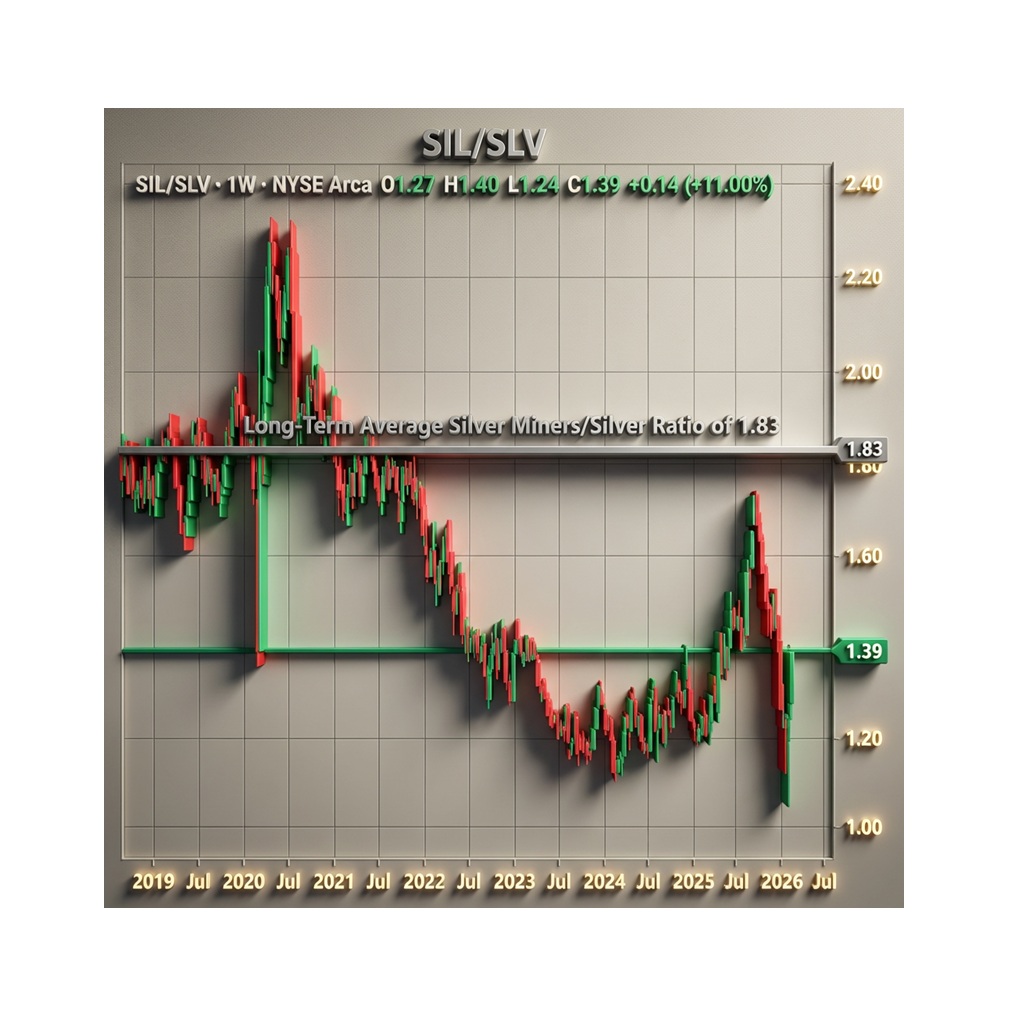

The Global X Silver Miners ETF (SIL)/iShares Silver Trust (SLV) Ratio surged by 19.25% to 1.25, just one day after bottoming at an all-time low of 1.05 on January 29th. At that point, NIA explained that silver miners were already pricing in $58.28 per oz silver… well below spot… signaling capitulation and a major disconnect.

That signal is now playing out exactly as expected.

Despite silver falling another 8.64% this week to $77.94 per oz, SIL gained 3.28%, while the SIL/SLV Ratio jumped 11% to 1.39… clear evidence that miners are decoupling from the metal and re-rating higher.

If silver can simply hold near $77.94 per oz, the average silver miner stands to gain approximately 31.65% as the SIL/SLV Ratio normalizes back toward its 16-year average of 1.83.

NIA’s top silver picks all gained big today:

Highlander Silver (TSX: HSLV): +6.07% to $7.34

Minaurum Silver (TSXV: MGG): +10.34% to $0.48

Contango ORE (NYSE: CTGO): +5.87% to $27.07

All three are positioned to reach new all-time highs in the weeks and months ahead, as capital rotates toward companies creating real, long-term value… not extremely overvalued names like Hycroft Mining (HYMC).

Meanwhile, Lahontan Gold (TSXV: LG) surged 15.56% to a new two-year weekly closing high of $0.26, after confirming that its newly acquired West Santa Fe Project is a silver-rich system… a catalyst the market is only beginning to price in.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA’s President has purchased 5,000 shares of CTGO in the open market and intends to buy more shares. NIA’s President has purchased 200,000 shares of LG in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. NIA has received compensation from LG of US$50,000 cash for a six-month marketing contract. This message is for informational and educational purposes only.