Investors Will Dump TLT for GLD

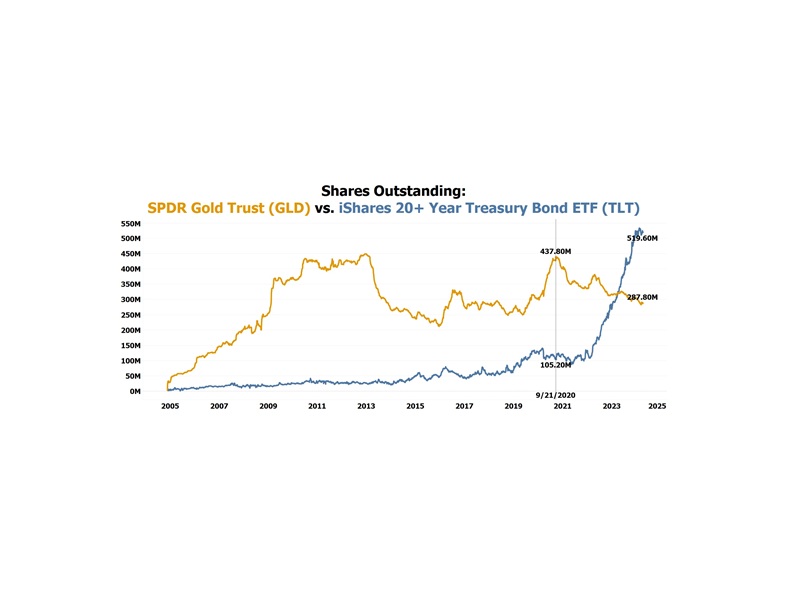

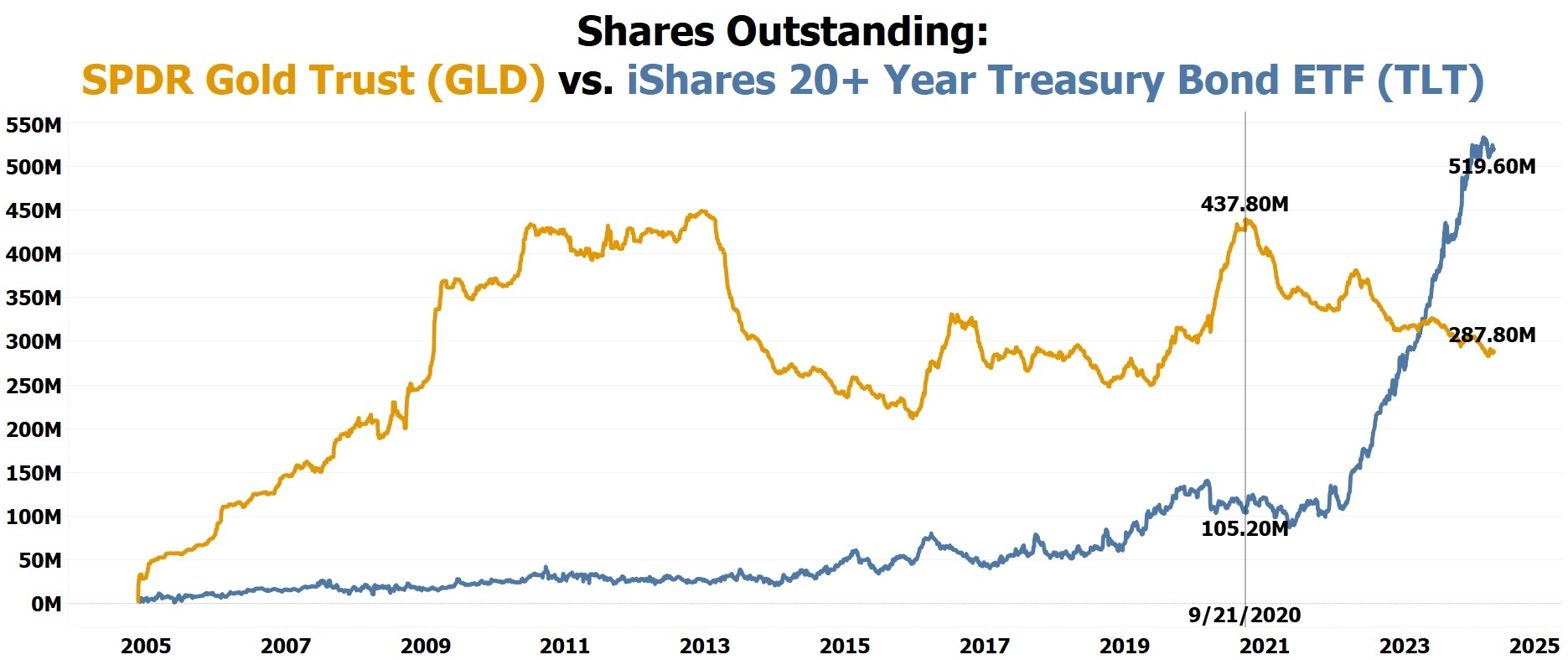

Since September 21, 2020, the shares outstanding of SPDR Gold Trust (GLD) have declined from 437.8 million down to 287.8 million, a 34.26% decline.

Over the same period, the shares outstanding of iShares 20+ Year Treasury Bond ETF (TLT) have surged from 105.2 million up to 519.6 million, a 393.92% increase.

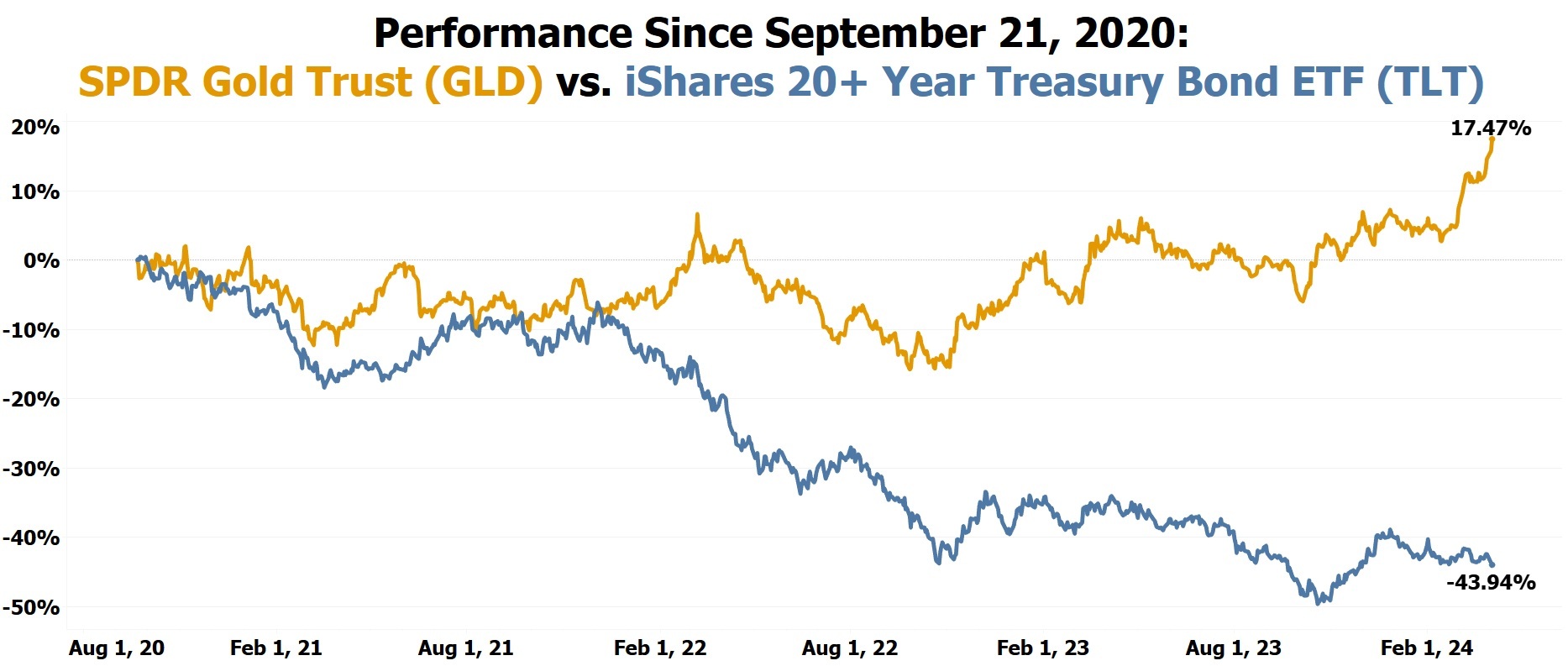

During this same time period, GLD gained 17.47% while TLT declined by 43.94%.

Where will gold be trading when investors dump TLT and begin rapidly loading up on GLD, sending the shares outstanding of GLD to new all-time highs?

GLD ownership is strongly correlated with interest in gold mining / exploration stocks.

Many gold mining / exploration stocks will be trading 1,000%+ higher when GLD ownership surpasses 437.8 million shares.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only.