Must See Cover of Barron’s This Week

The best possible sign for gold is the cover of Barron’s this week: “Time to Buy Bonds!”

Everybody already owns bonds. Nobody owns gold.

By the time Barron’s is saying “Time to Buy Gold!”, our top gold picks will already be 1,000%–10,000% higher than today, and we will be exiting gold stocks to buy bonds.

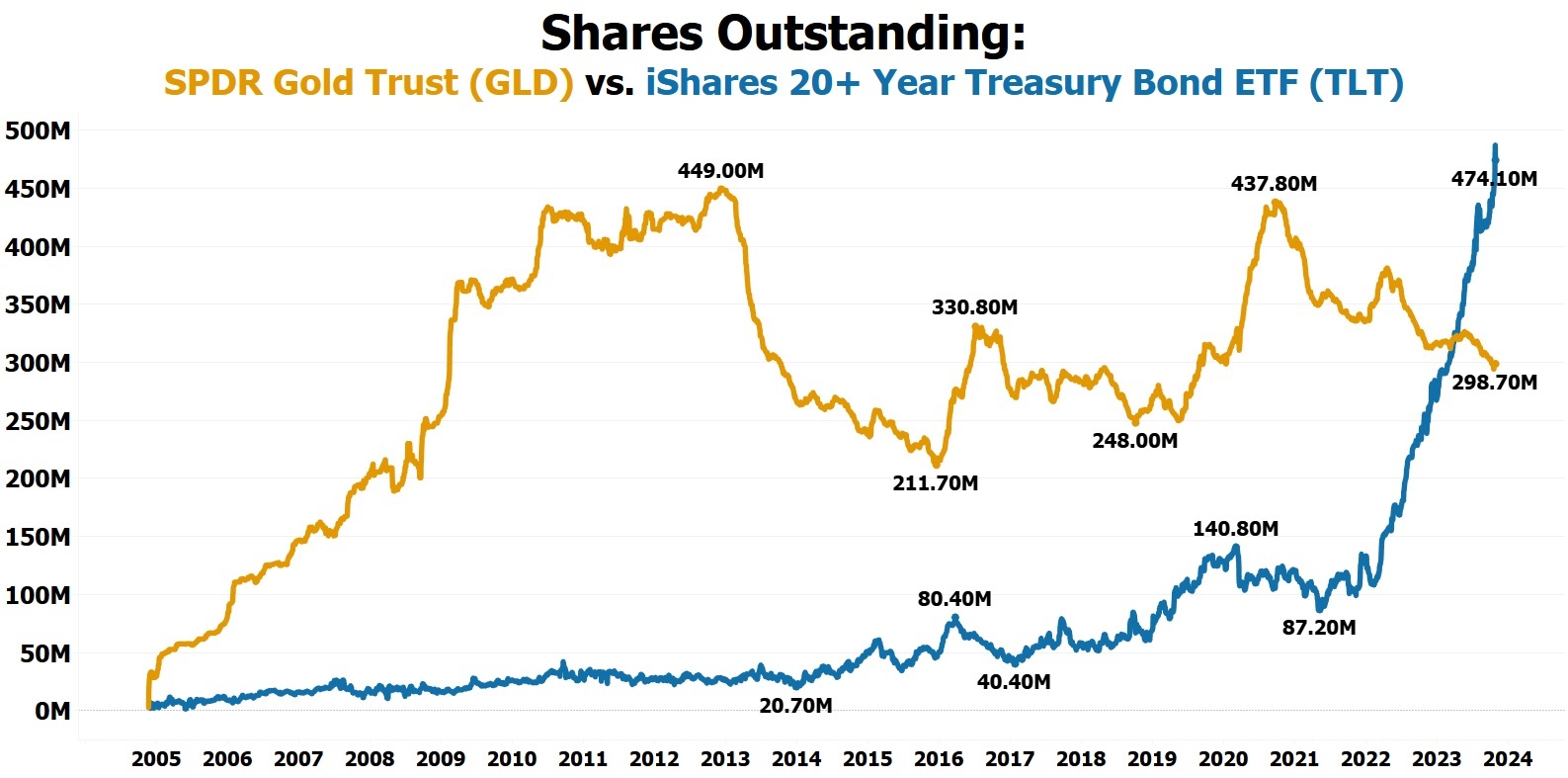

Here are the latest shares outstanding of SPDR Gold Trust (GLD) versus iShares 20+ Year Treasury Bond ETF (TLT):

GLD has seen $21.925 billion in outflows over the last 36 months, while TLT has seen $39.934 billion in inflows over the last 24 months.

This is getting ready to reverse and could send gold to $2,600+ per oz in the coming months.

The GLD/TLT Ratio is posting its largest up month since January 2009, yet nobody believes gold will continue higher—which is exactly why it will. A massive repricing to the upside for the highest-quality gold exploration stocks appears imminent.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. This message is for informational and educational purposes only.