NIA’s #1 Silver Pick MGG: 12th Largest Gainer of the Day

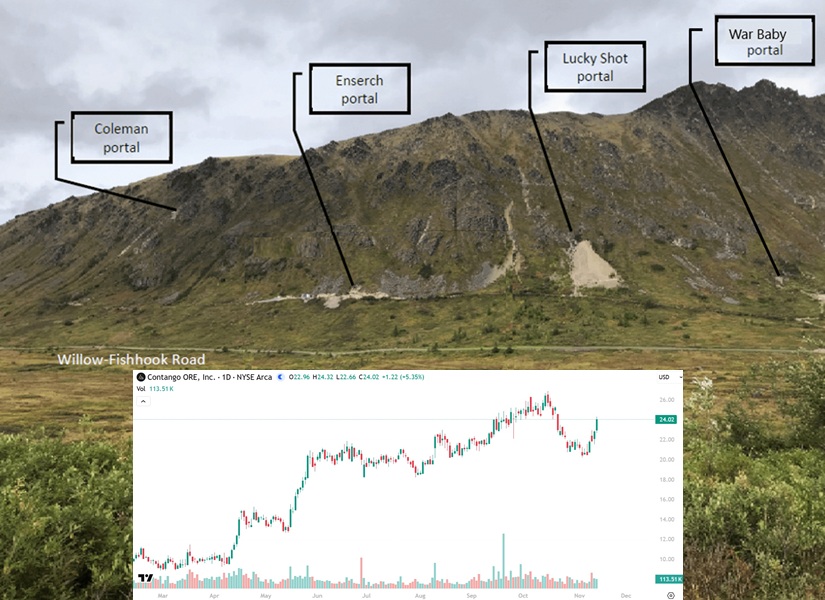

Similar to how Contango ORE (CTGO) is NIA’s #1 favorite producing gold miner and how NIA’s President is 1,000% confident that CTGO will be the #1 largest gaining gold miner of the next 12–36 months…

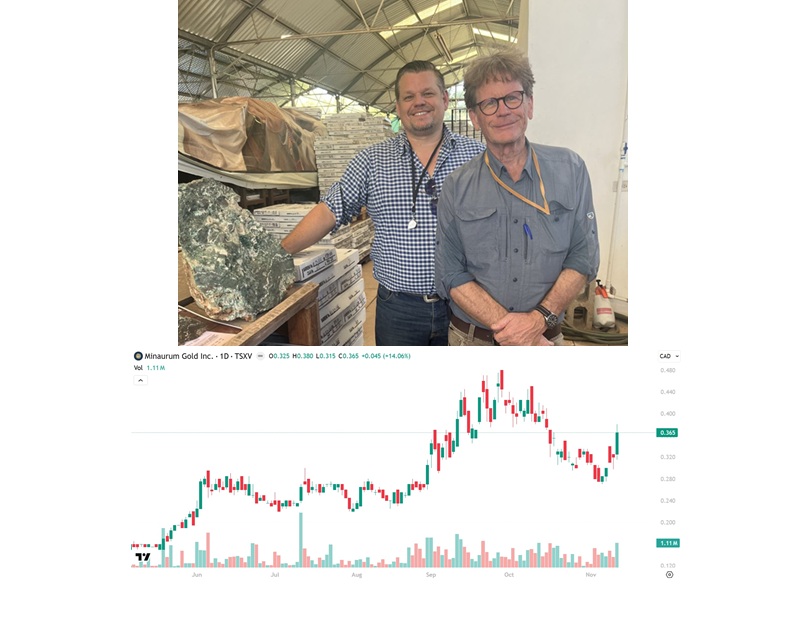

Minaurum Gold (TSXV: MGG) is NIA’s #1 favorite silver stock suggestion and today MGG finished as the 12th largest percentage gainer on the entire TSX Venture Exchange, surging by 14.06% to $0.365 per share.

What’s most important is this:

Since the beginning of MGG’s 2025 drilling program at its Alamos Silver Project, 100% of all reported drill holes have delivered strong intercepts of silver, copper, gold, lead, and zinc. There has not been a single miss.

This type of consistency is extremely rare in silver exploration, and it confirms that Alamos is evolving into one of North America’s most robust high-grade silver-polymetallic discovery stories.

Meanwhile…

CTGO remains on track to surpass $100 per share in early-to-mid 2026. The reasons are stacking up fast but one of the biggest catalysts is the company’s 100%-owned Johnson Tract, which stands out as America's #1 highest-quality polymetallic deposit, enriched with exceptionally high grades of gold, silver, copper, lead, and zinc.

Here is the most exciting part for MGG shareholders:

MGG’s Alamos Silver Project contains all five of these same high-value metals… the exact same “polymetallic basket” but with one key difference:

- Alamos is silver dominant

- Johnson Tract is gold dominant

This positions MGG as the silver analogue to CTGO’s gold growth story but at an earlier stage where the upside torque is significantly greater.

And unlike most exploration-stage juniors…

Alamos is already fully permitted for production. This means Minaurum isn’t fighting a permitting war, isn’t waiting years to “maybe” get a green light and isn’t stuck in the regulatory gridlock plaguing many Mexican projects.

CTGO = generating huge positive cash-flow today with massive growth ahead from America’s top gold-polymetallic asset and permits coming within months.

MGG = fully permitted high-grade silver district with massive expansion potential and a perfect exploration hit rate in 2025.

NIA is positioned for both sides of the coming precious-metals supercycle.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. NIA has received compensation from CTGO of US$80,000 cash for ten months of coverage. NIA’s President has purchased 2,000 shares of CTGO in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.