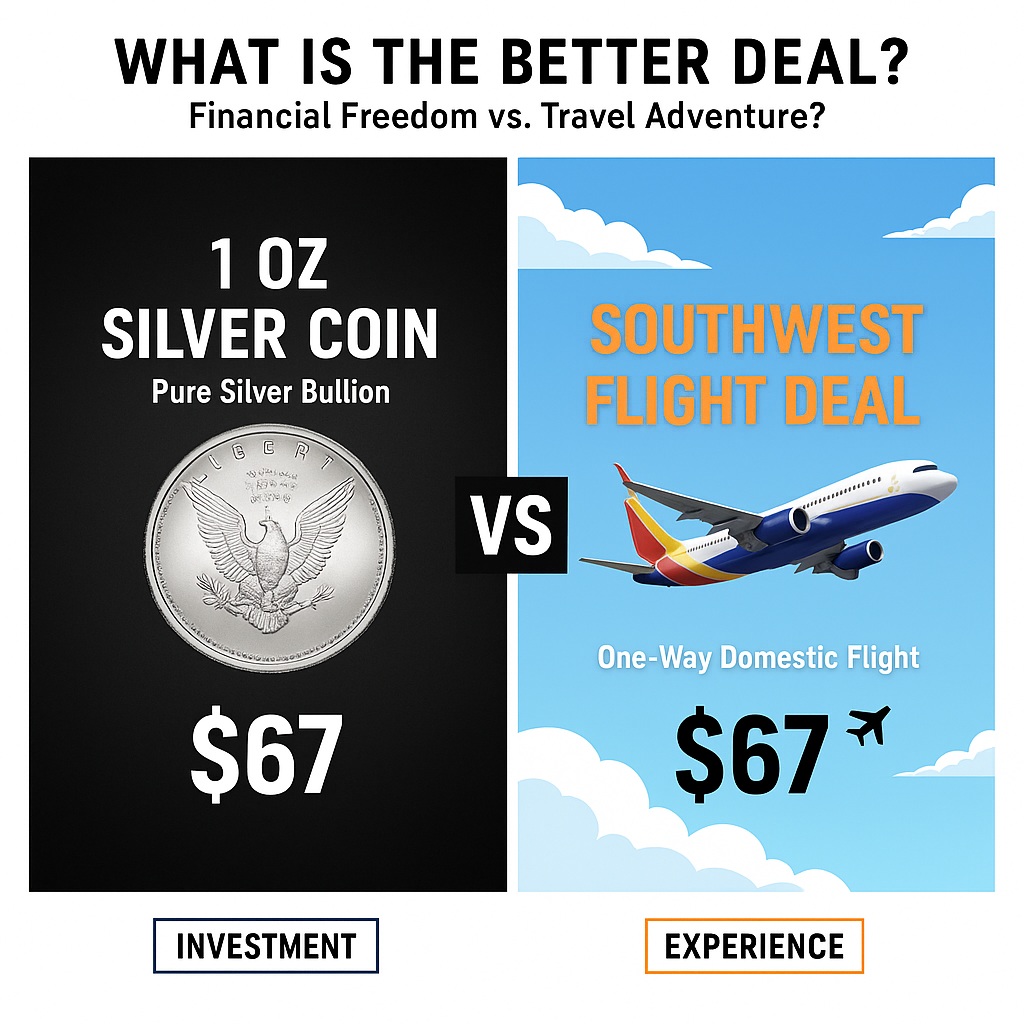

Southwest’s $67 Flights or Silver?

Anyone who thinks silver is expensive should compare its price to literally anything else in the economy.

For $67, Southwest Airlines is temporarily offering a one-way domestic flight. That same $67 also buys one ounce of physical silver.

The airline ticket gives you a few hours in the air. The silver gives you permanent ownership of a monetary metal that has preserved purchasing power for thousands of years. Silver at $66–$67 is just getting started.

In 2026, both Contango ORE (CTGO) soon to be renamed Contango Silver & Gold (CTGO) and Minaurum Gold (TSXV: MGG) have a realistic path to surpassing 100 million ounces of high-grade silver resources.

What separates CTGO and MGG from nearly every other silver company is quality, not just scale.

Minaurum controls the best fully permitted, high-grade new silver discovery in Mexico, a country that has produced more silver than any other in history. Permitted projects with genuine scale are becoming increasingly rare in Mexico, making Minaurum’s ounces far more valuable than headline resource numbers alone suggest.

At the same time, Contango is assembling what we believe are the highest-quality silver assets outside of Mexico, in safe, mining-friendly jurisdictions, giving it exposure to large, high-grade silver resources without the permitting and geopolitical risks that plague most global silver projects.

This matters because once a company crosses the 100-million-ounce threshold, it stops being viewed as a “small exploration story” and starts being valued as a strategic silver asset… the kind that major miners, institutions, and sovereign buyers pay attention to.

In past silver bull markets, companies that made this transition were often repriced multiple times higher, even before silver reached its ultimate peak, which in this cycle will be well above $100 per oz.

One of the biggest mistakes silver investors make is assuming that the best silver companies must have the word “silver” in their name.

In reality, what matters is how much silver can actually be recovered from the rock, not how much silver is listed in a headline resource estimate.

Some projects report large silver numbers, but the silver is metallurgically complex, meaning it is locked inside sulfides or refractory minerals that are difficult and expensive to process.

In these cases, a high “in-ground” silver resource does not translate into high recoveries, strong margins, or economic viability… especially at scale.

This is why companies like Frank Giustra’s Argenta Silver (TSXV: AGAG) face serious challenges despite the name. Much of Argenta’s silver is not free-milling, with recoveries constrained by the mineralogy of the deposit… effectively leaving a meaningful portion of the silver stuck in the rock.

By contrast, the most valuable silver projects tend to be those with clean metallurgy, high recoveries, and straightforward processing, even if “silver” isn’t yet in the company’s name.

Yes, CTGO and MGG both have a chance of outperforming Trio-Tech International (TRT) in 2026.

No, AGAG isn't going to outperform TRT. AGAG will decline by 90% as TRT rises by 1,000%.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 5,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. This message is for informational and educational purposes only.