Trio-Tech International (TRT) Gained 6.61% Yesterday New 2025 High

Trio-Tech International (TRT) gained by 6.61% yesterday to a new 2025 high of $6.70 per share. TRT is already up by 11.67% since NIA's Monday afternoon suggestion at $6 per share.

If the S&P 500 and/or NASDAQ were to collapse, there is a chance it could take Bitcoin down with it and gold is high enough now where it could also dip temporarily.

Historically, when the U.S. dollar weakens as it has over the last twelve months, U.S. technology companies see their growth disappear and all of the growth moves to Asia.

When Asian stocks were last in play between July 2005 and July 2007, TRT gained by 589.42% from $3.59 per share up to $24.75 per share.

Similar to how VanEck Gold Miners ETF (GDX) has blown past its 2011 highs we expect Trio-Tech International (TRT) to blow past its July 2007 high of $24.75 per share.

iShares MSCI Singapore ETF (EWS) has increased for ten straight months to a current price of $29.41 per share and is about to finally surpass its 2007 high of $31.94 per share.

When EWS hits a new all-time high before year-end for the first time in 18 years it will trigger a stampede of investors rushing to load up on Trio-Tech International (TRT), which is poised to capitalize on the imminent boom in AI datacenters, EVs, and industrial automation in hotels, restaurants, and factories across Asia.

Here is Trio-Tech International (TRT)'s Asia regional HQ in Singapore where they manufacture the semiconductor backend equipment used by AMD and other power-device and AI-chip leaders like Infineon and NXP Semiconductors:

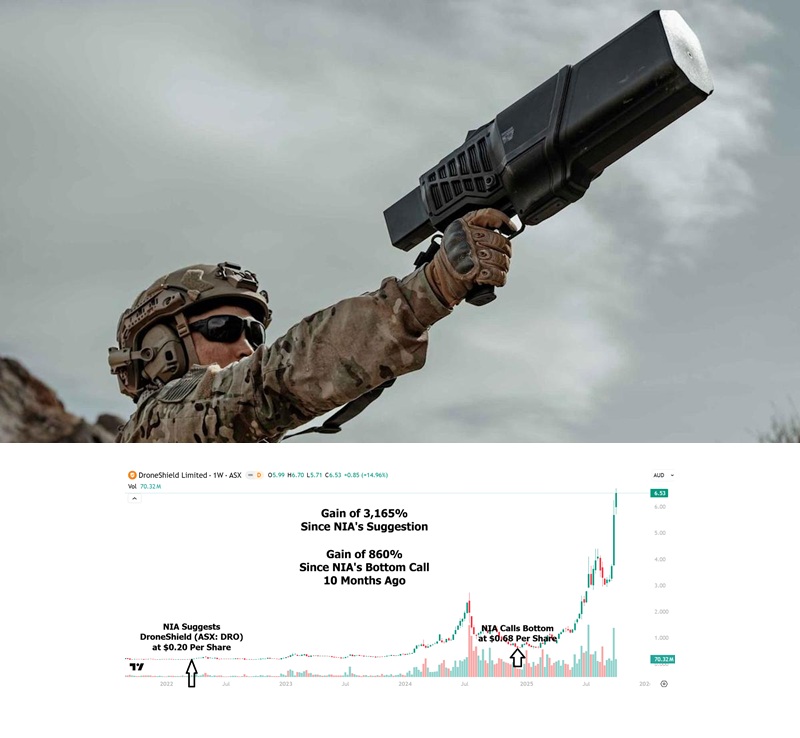

Nobody paid attention to gold, silver or gold/silver stocks until the mainstream media began talking about it in recent days. 99.99% of Americans have totally missed out on GDX rallying from $21.52 per share up to $79.15 per share over the last 37 months. The average American lives in a bubble where they follow their favorite influencers on YouTube and X and have no exposure to unbiased organizations like NIA who speak the truth and say maybe it's not such a good idea to buy Sol Strategies (CSE: HODL) at 20x NAV (HODL has crashed by 80.45% since NIA's HODL warning eight months ago):

Asia has little/no exposure to Solana meme coins they have been buying gold and Zijin Mining for years now and will prosper as America's tech bubble goes bust!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.