Valve Just Erased $1.7B Overnight, Could Crypto Be Next?

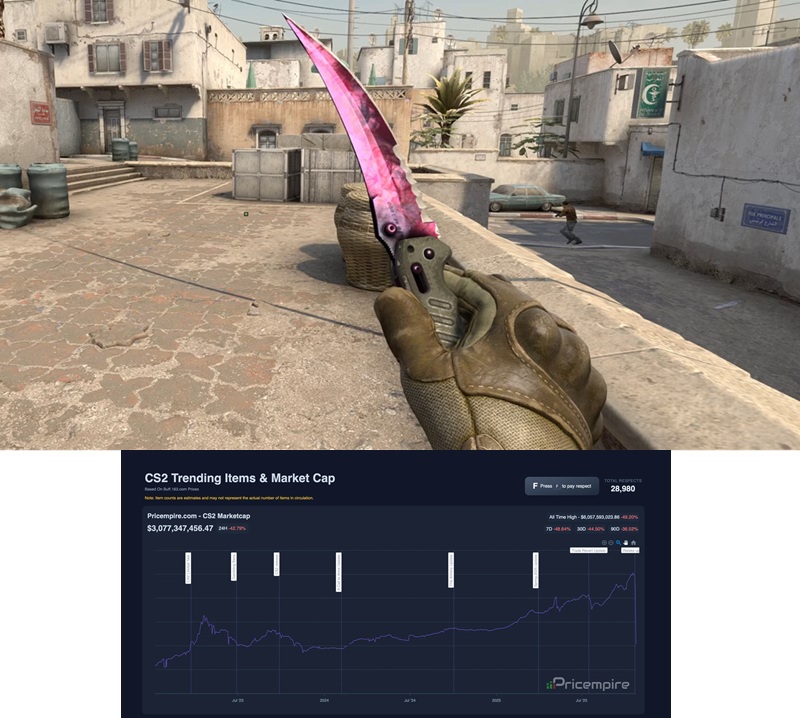

In the past 48 hours, one of the largest digital asset markets in the world collapsed almost instantly. Valve Corporation, the creator of Counter-Strike 2, quietly pushed a game update that allowed players to convert common in-game “skins” into ultra-rare knives and gloves. The change flooded the market with millions of new high-end items, and within a single day, over $1.7 billion in virtual-item market value evaporated. Some of the most coveted digital collectibles declined by 40% or more overnight.

This wasn’t a hack or scam it was a policy change. One company decision rewrote the rules of scarcity and instantly destroyed an entire class of digital wealth. The same psychology that fueled this speculative frenzy… faith in digital scarcity and endless price appreciation now drives Bitcoin and crypto markets worldwide. The Counter-Strike crash is a preview of how fast confidence can vanish when belief meets new reality.

Bitcoin depends on belief every bit as much as Counter-Strike depended on Valve. Even though Bitcoin is decentralized, both ecosystems rely on the same psychological foundation: faith in code-based scarcity. The CS2 event exposes how quickly that faith can reverse when users realize (a) they don’t actually control the underlying system, or (b) the rules that guarantee scarcity can be re-interpreted, upgraded, or bypassed.

Bitcoin’s defenders correctly argue that no single actor can change the rules. Yet that same decentralization makes collective action slow and brittle, not unchangeable. Every major network crisis from the 2017 Blocksize War to the 2022 Ordinals spam debate shows that social consensus, not math, ultimately governs outcomes. If a future economic shock makes miners unprofitable or security unsustainable, human governance will again be forced to intervene. The CS2 collapse illustrates how fragile markets become when “rule changes” suddenly test assumptions that users thought were permanent.

At some point in the future Bitcoin block rewards will approach negligible levels, and if transaction fees fail to increase sufficiently to provide adequate mining incentives, the network hash rate will begin to decline noticeably as marginal mining operations become unprofitable. Mining centralization will increase as only the most efficient, lowest-cost operations will maintain profitability. Network security metrics, including 51% attack resistance will deteriorate as the distributed hash rate becomes less abundant. At this point… the only choice to "save Bitcoin" will be to increase the monetary supply to maintain network security. After all, removing the 21 million supply limit would be preferable to allowing the network to become vulnerable to attack.

This is why we believe owning gold in the ground in places like Nevada is the best investment in the world. Companies like Viva Gold (TSXV: VAU) with resources adjacent to Round Mountain one of Nevada's largest producing gold mines that will soon run out of ore and will need to acquire satellite deposits like Viva's Tonopah to continue production… are likely to be revalued significantly higher in the months ahead as the digital asset economy collapses.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 100,000 shares of VAU and may buy more shares or sell his shares at any time. This message is meant for informational and educational purposes only.