Why President Trump Selected Augusta Gold (TSX: G)

In a bold move to jumpstart domestic gold production, the Trump administration has opened the federal loan window for Augusta Gold Corp. (TSX: G), which is now set to receive US$50 million in U.S. government-backed financing to advance its fully permitted Reward Gold Project in Nye County, Nevada.

The deal—enabled through newly expanded Defense Production Act (DPA) authorities and a national energy emergency declaration—marks a turning point for the U.S. junior mining sector, signaling that precious metals like gold are now considered strategic resources under national security policy.

Gold as a Strategic Asset

While previous administrations focused mainly on battery metals and rare earths, Trump’s March 20, 2025 executive order broadened the definition of “critical minerals” to explicitly include gold. This change allows the Department of Defense and the U.S. International Development Finance Corporation (DFC) to issue loans, guarantees, and offtake support to gold miners—especially those that can fast-track construction on U.S. soil.

🏗️ Why Augusta Gold’s Reward Project Was Chosen

-

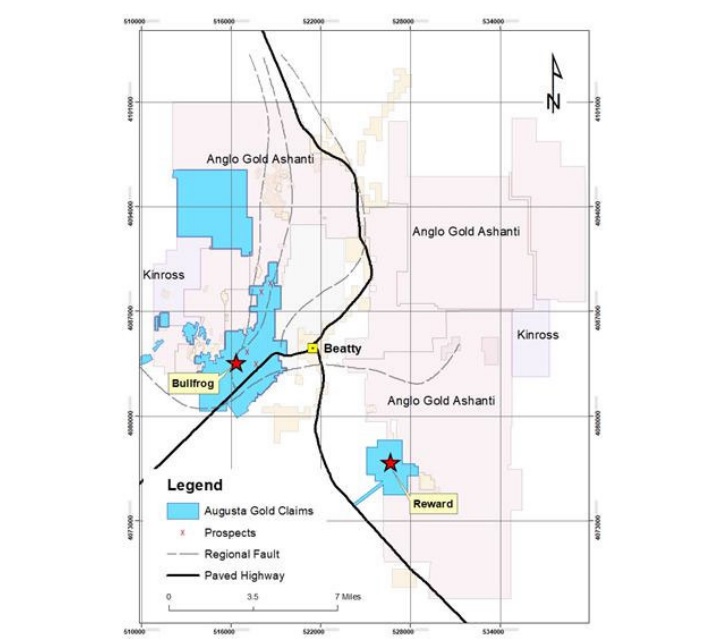

Fully permitted heap leach gold mine near Beatty, Nevada.

-

Backed by Augusta Group and mining financier Richard Warke.

-

Shovel-ready with low capex relative to peer-stage gold developers.

-

Located on federal lands now prioritized for mineral production under the executive order.

The $50M federal loan—expected to be disbursed under DFC’s newly delegated lending authority—will likely cover most or all of construction costs, dramatically reducing dilution risk for shareholders and accelerating the project’s timeline toward production.

🛡️ National Security Meets Gold Mining

Reward is viewed as a test case for Washington’s broader strategy to:

-

Secure domestic control over gold reserves.

-

Create jobs in rural America.

-

Cut reliance on foreign and adversarial nations for gold refining and reserves.

Augusta Gold (TSX: G) could become the first junior miner to reach production under Trump’s America first pro-mining government, setting a precedent for dozens of other domestic mining hopefuls.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.